Insider Sell: Director Stacy Smith Sells 15,000 Shares of Autodesk Inc (ADSK)

Autodesk Inc (NASDAQ:ADSK), a leader in 3D design, engineering, and entertainment software, has recently witnessed a significant insider sell that has caught the attention of investors and market analysts. On December 14, 2023, Director Stacy Smith sold 15,000 shares of Autodesk Inc, a transaction that has sparked discussions regarding insider activity and its potential implications on the company's stock performance.

Who is Stacy Smith of Autodesk Inc?

Stacy Smith is a prominent figure within Autodesk Inc, serving as a member of the company's board of directors. Smith's extensive experience in the technology sector, including a notable tenure at Intel Corporation where he held various leadership roles, has equipped him with a deep understanding of the industry's dynamics. His insights and strategic guidance have been valuable assets to Autodesk's board, where he contributes to steering the company through the ever-evolving landscape of design and engineering software.

Autodesk Inc's Business Description

Autodesk Inc is renowned for its sophisticated software solutions that cater to professionals in the architecture, engineering, construction, manufacturing, media, education, and entertainment industries. The company's flagship product, AutoCAD, has become synonymous with computer-aided design (CAD) and remains a staple tool for professionals worldwide. Autodesk's suite of software products enables users to conceptualize, design, and simulate their ideas with precision and efficiency, thereby enhancing productivity and fostering innovation across various sectors.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

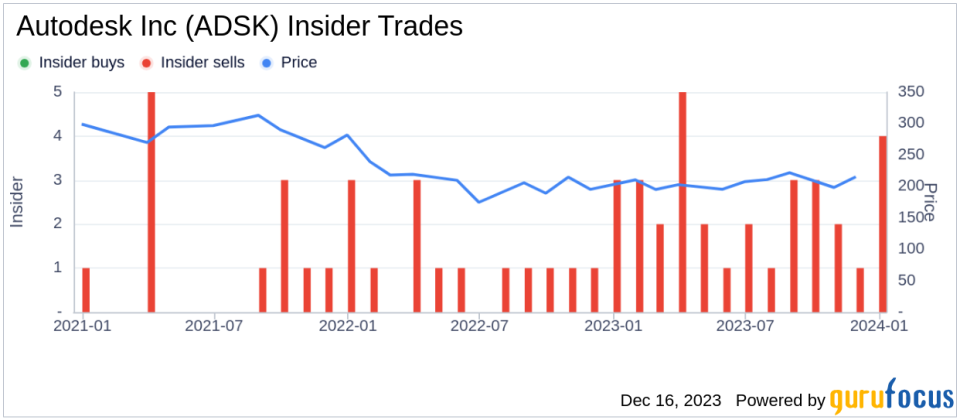

Insider transactions, particularly sells, can provide valuable clues about a company's internal perspective on its stock's valuation and future prospects. In the case of Autodesk Inc, the insider, Director Stacy Smith, has sold a total of 25,000 shares over the past year without any recorded insider purchases. This pattern of selling could suggest that insiders might perceive the stock as being fully valued or may be taking profits after a period of appreciation.

On the day of the insider's recent sell, Autodesk Inc's shares were trading at $238, giving the company a substantial market cap of $51.83 billion. The price-earnings ratio of 57.01, although higher than the industry median of 27.1, is lower than the company's historical median price-earnings ratio. This indicates that while the stock may be trading at a premium compared to its industry peers, it is somewhat in line with its own historical valuation trends.

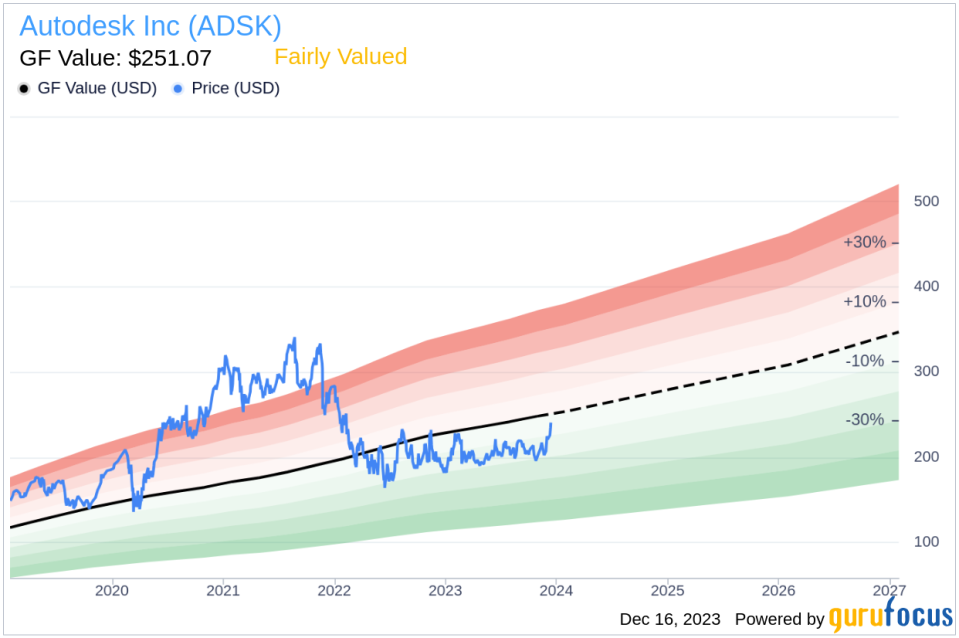

When considering the price-to-GF-Value ratio of 0.95, based on a GF Value of $251.07, Autodesk Inc appears to be Fairly Valued. The GF Value, an intrinsic value estimate from GuruFocus, suggests that the stock is reasonably priced when accounting for historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above illustrates the recent insider sell transactions, providing a visual representation of the insider's activity. Notably, the absence of insider buys over the past year, coupled with the 33 insider sells, could be interpreted as a lack of confidence from insiders about the stock's growth potential or simply a diversification of personal investment portfolios.

The GF Value image further supports the notion that Autodesk Inc's stock is trading close to its intrinsic value, as calculated by GuruFocus. This alignment with the GF Value may indicate that the stock is not significantly overvalued or undervalued at its current price level.

Conclusion

The recent insider sell by Director Stacy Smith of Autodesk Inc has prompted investors to scrutinize the transaction for potential implications on the stock's future performance. While insider sells can be motivated by various personal and financial considerations, they are often viewed as a signal to the market. In the context of Autodesk Inc, the consistent pattern of insider selling over the past year, despite the stock being fairly valued according to the GF Value, warrants attention from current and prospective shareholders.

Investors should consider the broader market conditions, Autodesk's competitive position, and the company's growth prospects when evaluating the impact of insider transactions on their investment decisions. As always, insider activity is just one piece of the puzzle, and a comprehensive analysis should encompass a range of financial and strategic factors.

For those closely monitoring Autodesk Inc, the insider sell by Stacy Smith serves as a reminder of the importance of staying informed about insider trends and their potential influence on stock valuation and investor sentiment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.