Insider Sell: Director Steven Sarowitz Offloads Shares of Paylocity Holding Corp (PCTY)

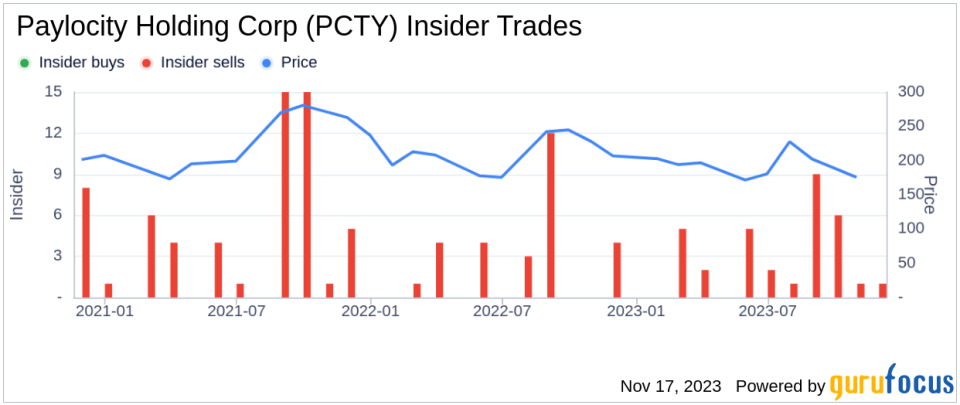

In a notable insider transaction, Director and 10% Owner Steven Sarowitz has sold 41,200 shares of Paylocity Holding Corp (NASDAQ:PCTY) on November 14, 2023. This move comes as part of a series of sales by the insider over the past year, with a total of 747,592 shares sold and no shares purchased during this period. The recent sale was executed at a price of $150.18 per share, resulting in a transaction value of approximately $6,187,416.Who is Steven Sarowitz?Steven Sarowitz is a prominent figure in the tech industry, known for his role as a Director and a significant shareholder of Paylocity Holding Corp. His involvement with the company extends beyond his directorial duties; as a 10% Owner, Sarowitz's actions in the market are closely watched for indications of his confidence in the company's future prospects.Paylocity Holding Corp's Business DescriptionPaylocity Holding Corp is a cloud-based provider of payroll and human capital management (HCM) software solutions for medium-sized organizations. The company's suite of products includes payroll processing, time and attendance, benefits administration, and talent management. Paylocity's platform is designed to improve the efficiency of HR operations, enhance employee engagement, and provide actionable insights into workforce data.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe insider transaction history for Paylocity Holding Corp reveals a pattern of insider selling, with 33 insider sells and no insider buys over the past year. This trend could be interpreted in various ways. On one hand, insiders might sell shares for personal financial planning reasons that do not necessarily reflect their outlook on the company's future. On the other hand, consistent selling by insiders, particularly without any offsetting buys, might raise questions about their long-term confidence in the company's stock.

The relationship between insider selling and stock price can be complex. While significant insider selling can sometimes lead to a decrease in stock price due to perceived lack of confidence, this is not always the case. For Paylocity Holding Corp, despite the insider selling, the stock remains significantly undervalued based on the GF Value.

Valuation and Market CapOn the day of the insider's recent sale, shares of Paylocity Holding Corp were trading at $150.18, giving the company a market cap of $8.370 billion. The price-earnings ratio stands at 57.98, which is higher than the industry median of 26.59 but lower than the company's historical median price-earnings ratio. This suggests that while the stock is trading at a premium compared to the industry, it may be trading at a discount relative to its own historical valuation.The GF Value, an intrinsic value estimate developed by GuruFocus, places Paylocity Holding Corp's value at $349.79 per share. This estimate is based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts. With the current price significantly below the GF Value, the stock appears to be significantly undervalued, indicating potential for upside.ConclusionThe recent insider selling by Steven Sarowitz at Paylocity Holding Corp warrants attention from investors. While the insider's actions may not necessarily predict future stock performance, they are an important piece of the puzzle when evaluating the company's prospects. Given the current valuation metrics and the stock's position relative to the GF Value, investors may find Paylocity Holding Corp an attractive opportunity, despite the recent insider selling activity. As always, investors should conduct their own due diligence and consider the broader market context when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.