Insider Sell: Director Surya Mohapatra Offloads Shares of Leidos Holdings Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Leidos Holdings Inc (NYSE:LDOS), a prominent player in the defense, aviation, information technology, and biomedical research industries, witnessed a notable insider sell that has caught the attention of market watchers. On November 22, 2023, Director Surya Mohapatra sold 2,401 shares of the company, an event that merits a closer examination.

Who is Surya Mohapatra?

Surya Mohapatra is a distinguished figure at Leidos Holdings Inc, serving as a member of the company's board of directors. With a wealth of experience in the healthcare and technology sectors, Mohapatra's insights and leadership have been invaluable to the company. His tenure at Leidos Holdings Inc has been marked by a deep understanding of the company's operations and strategic direction, making his trading activities particularly noteworthy to investors and analysts alike.

Leidos Holdings Inc's Business Description

Leidos Holdings Inc is a powerhouse in providing scientific, engineering, systems integration, and technical services. The company operates through a variety of segments, including Defense & Intelligence, Civil, Health, and Advanced Solutions. Leidos' work spans from managing cybersecurity threats and modernizing IT infrastructure to providing solutions for public health and advancing biomedical research. With a commitment to innovation and solving complex challenges, Leidos Holdings Inc plays a critical role in supporting government and commercial clients worldwide.

Analysis of Insider Buy/Sell and Relationship with Stock Price

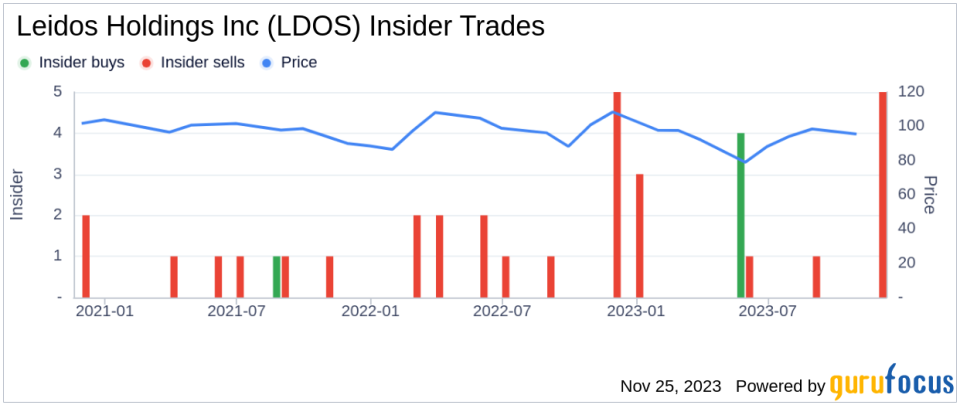

The insider trading history of Leidos Holdings Inc reveals a pattern of 4 insider buys and 11 insider sells over the past year. This trend can offer insights into the sentiment of those with the most intimate knowledge of the company's prospects. The recent sell by Surya Mohapatra, involving 2,401 shares, is a transaction that stands out due to the director's high-ranking position and potential access to sensitive company information.

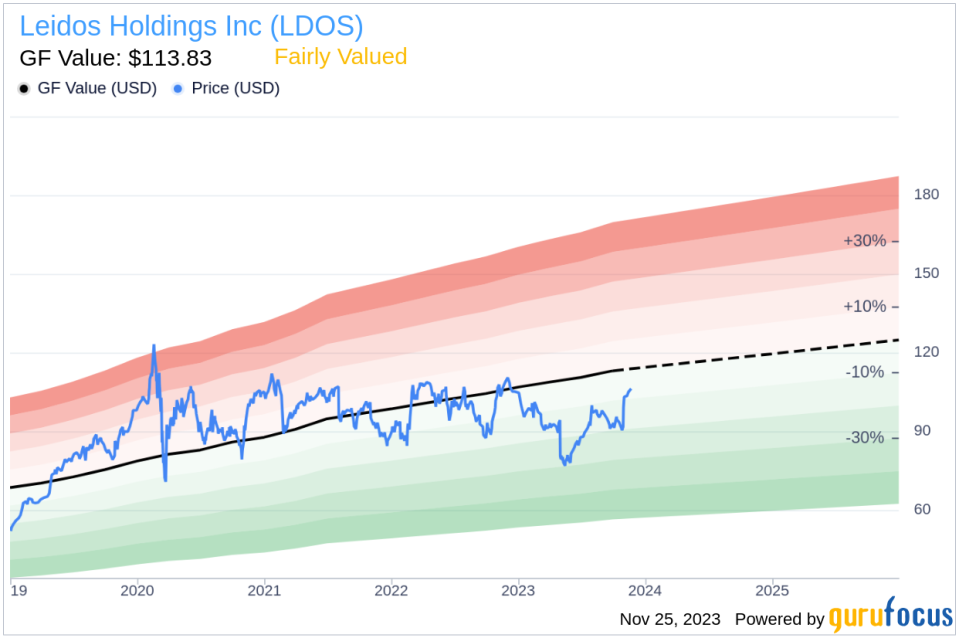

The timing and size of insider sells can sometimes correlate with the company's stock performance. In the case of Leidos Holdings Inc, the stock was trading at $105.83 on the day of the insider's sell, reflecting a market capitalization of $14.68 billion. This price point is significant as it hovers around the company's GF Value, suggesting that the stock is fairly valued.

The price-earnings ratio of Leidos Holdings Inc stands at 102.23, which is considerably higher than the industry median of 26.39 and the company's historical median. This elevated ratio could indicate that the stock is priced at a premium compared to its earnings, potentially influencing the insider's decision to sell.The GF Value, an intrinsic value estimate developed by GuruFocus, is calculated at $113.83 for Leidos Holdings Inc. With the stock trading at $105.83, the price-to-GF-Value ratio is 0.93, signifying that the stock is fairly valued. The GF Value takes into account historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business estimates from analysts.

Conclusion

The insider sell by Surya Mohapatra at Leidos Holdings Inc is a transaction that warrants attention due to the potential implications it may have on investor sentiment and the stock's future performance. While the company's stock appears to be fairly valued according to the GF Value, the high price-earnings ratio could be a factor in the insider's decision to reduce their holdings. As always, investors should consider insider trading as one of many factors in their investment decisions and conduct thorough research before making any financial commitments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.