Insider Sell: Director Terri Kelly Sells Shares of United Rentals Inc (URI)

United Rentals Inc (NYSE:URI), a leader in the equipment rental industry, has recently witnessed an insider sell that has caught the attention of investors and market analysts. On November 15, 2023, Director Terri Kelly sold 630 shares of the company, a transaction that prompts a closer look into the insider's trading behavior and the potential implications for the stock's performance.

Who is Terri Kelly of United Rentals Inc?

Terri Kelly is a member of the board of directors at United Rentals Inc. Directors play a crucial role in shaping the strategic direction of a company and are privy to in-depth knowledge about the firm's operations, financial health, and future prospects. Their trading activities are often scrutinized for insights into their confidence in the company's performance and valuation.

United Rentals Inc's Business Description

United Rentals Inc is the largest equipment rental company in the world, with an extensive network of locations across the United States and Canada. The company offers a broad range of equipment for rent, including construction and industrial equipment, tools, and supplies. United Rentals serves construction and industrial customers, utilities, municipalities, homeowners, and others, providing not just equipment but also services and solutions that support its clients' operational needs.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, such as buys and sells, can provide valuable clues about a stock's future direction. When insiders buy shares, it is often interpreted as a sign of confidence in the company's future prospects. Conversely, insider sells may raise questions about the insider's outlook on the stock's valuation or potential headwinds for the company.

According to the data, Terri Kelly has sold 630 shares over the past year and has not made any purchases. This could suggest a cautious stance from the insider regarding the company's valuation or future performance. However, it is important to consider the context of these transactions and the overall insider trading trend.

The insider transaction history for United Rentals Inc shows a pattern of more insider sells than buys over the past year, with 7 insider sells and only 1 insider buy. This trend could indicate that insiders, on balance, are taking the opportunity to realize gains or diversify their investments rather than accumulating more shares.

On the day of the insider's recent sell, shares of United Rentals Inc were trading at $480.02, giving the company a market cap of $32.601 billion. The price-earnings ratio stood at 13.95, lower than both the industry median of 16.44 and the company's historical median price-earnings ratio. This suggests that the stock was trading at a discount relative to its peers and its own historical valuation.

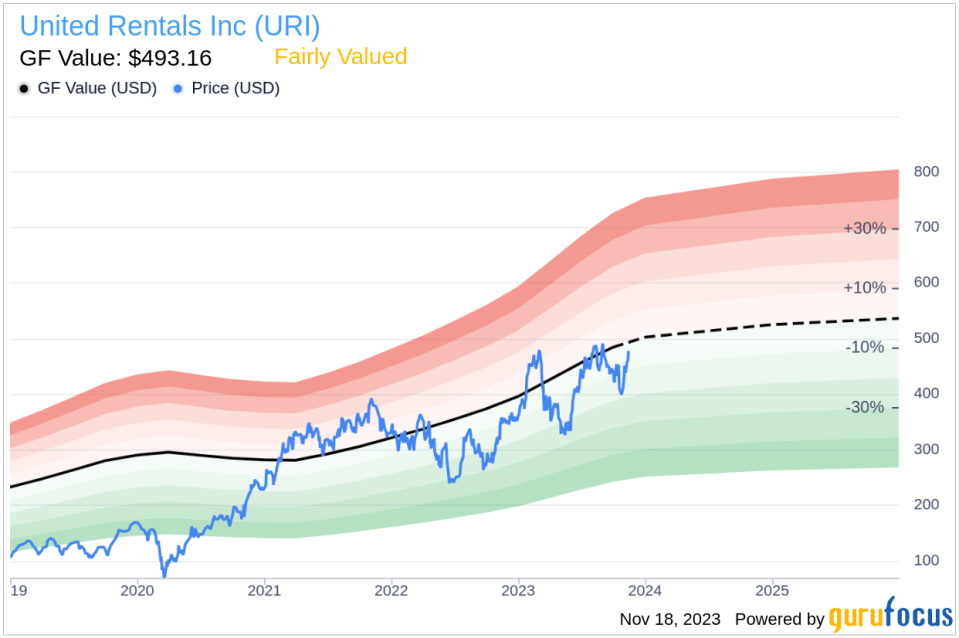

Furthermore, with a price of $480.02 and a GuruFocus Value (GF Value) of $493.16, United Rentals Inc had a price-to-GF-Value ratio of 0.97, indicating that the stock was Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

It is noteworthy that the insider's decision to sell occurred when the stock was deemed fairly valued, which could suggest that the insider believes the stock is fully priced or that there are limited upside opportunities at the current valuation.

The insider trend image above provides a visual representation of the insider trading activities, reinforcing the observation that sells have outnumbered buys in the recent period.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value estimate, supporting the notion that the stock is trading close to its fair value.

Conclusion

The recent insider sell by Director Terri Kelly at United Rentals Inc may raise questions among investors about the insider's perspective on the stock's valuation and future prospects. While the company's market cap and price-earnings ratio suggest a favorable comparison to industry peers, the insider trading trend and the stock's fair valuation based on the GF Value indicate that insiders may not see significant upside potential in the near term. Investors should consider these factors, along with broader market conditions and company-specific developments, when evaluating their investment decisions in United Rentals Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.