Insider Sell: Director VON SCHACK WESLEY W Sells 376 Shares of Teledyne Technologies Inc

On September 14, 2023, Director VON SCHACK WESLEY W sold 376 shares of Teledyne Technologies Inc (NYSE:TDY). This move comes amidst a year where the insider has sold a total of 1,835 shares and purchased none.

VON SCHACK WESLEY W is a key figure in the Teledyne Technologies Inc, a leading provider of sophisticated electronic components, instruments, and communication products. The company also provides engineering services and aerospace engines. It operates in four segments: Digital Imaging, Instrumentation, Engineered Systems, and Aerospace and Defense Electronics.

The insider's recent sell has raised eyebrows in the financial community, prompting a closer look at the relationship between insider trading and the stock's price.

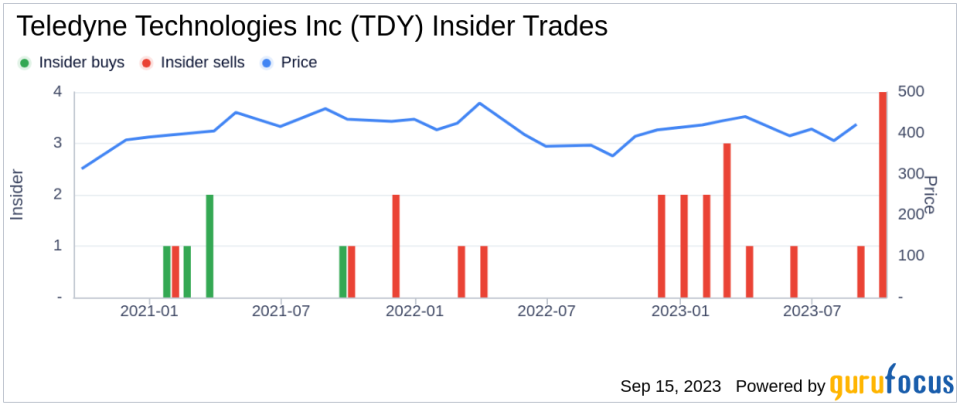

The insider transaction history for Teledyne Technologies Inc shows a trend of more sells than buys over the past year. There have been 16 insider sells and 0 insider buys in total. This could indicate that insiders believe the stock is overvalued, prompting them to sell their shares.

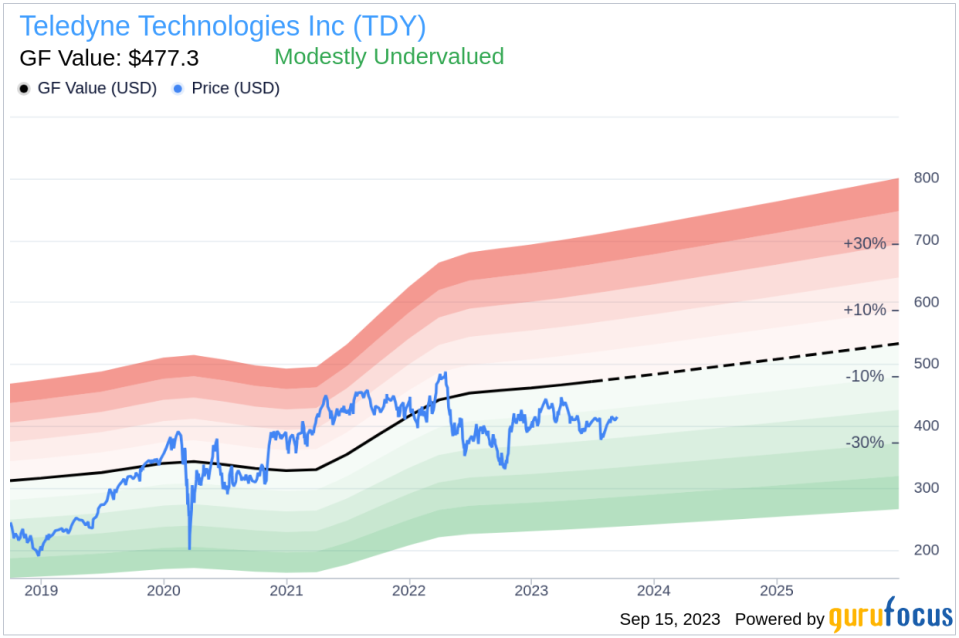

On the day of the insider's recent sell, shares of Teledyne Technologies Inc were trading for $412.3 apiece. This gives the stock a market cap of $19.53 billion. The price-earnings ratio is 25.81, which is higher than the industry median of 21.98 and higher than the companys historical median price-earnings ratio. This suggests that the stock is currently overvalued.

However, the GuruFocus Value of Teledyne Technologies Inc is $477.30, indicating that the stock is modestly undervalued. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent sell by the insider, coupled with the stock's high price-earnings ratio and the trend of more insider sells than buys, could indicate that the stock is overvalued. However, the GF Value suggests that the stock is modestly undervalued. Investors should keep a close eye on Teledyne Technologies Inc and consider these factors when making their investment decisions.

This article first appeared on GuruFocus.