Insider Sell: Dustin Combs Sells 1,900 Shares of Weyco Group Inc

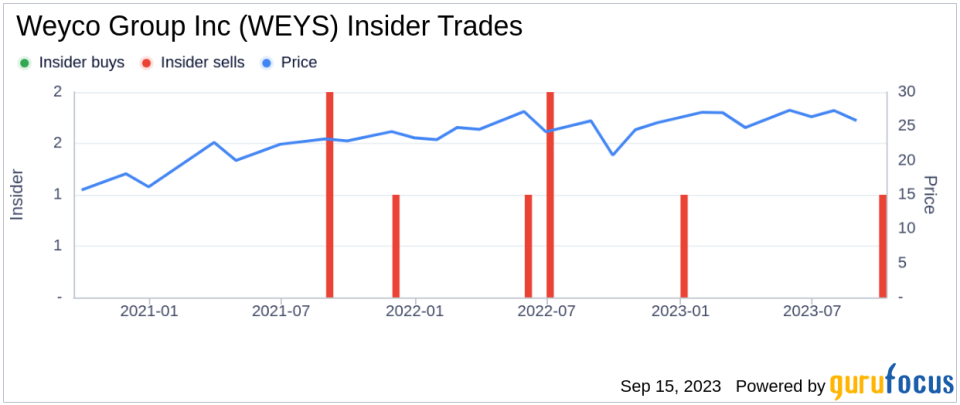

On September 14, 2023, Dustin Combs, VP, President - Bogs & Rafters of Weyco Group Inc (NASDAQ:WEYS), sold 1,900 shares of the company. This move comes as part of a series of insider transactions that have taken place over the past year.

Dustin Combs is a key figure in Weyco Group Inc, a company that designs and markets quality and innovative footwear for men, women, and children under a portfolio of well-recognized brand names including Florsheim, Nunn Bush, Stacy Adams, BOGS, Rafters and Umi. The company's products are available in department stores, specialty stores, and online retailers across the United States and internationally.

Over the past year, the insider has sold a total of 1,900 shares and has not made any purchases. This trend is mirrored in the company's overall insider transactions, with 2 insider sells and 0 insider buys over the same timeframe.

The relationship between insider transactions and stock price is often closely watched by investors. In the case of Weyco Group Inc, the stock was trading at $27.12 per share on the day of the insider's recent sell, giving the company a market cap of $253.731 million.

The company's price-earnings ratio stands at 7.70, which is lower than both the industry median of 17.85 and the companys historical median price-earnings ratio. This could suggest that the stock is undervalued, a sentiment echoed by the GuruFocus Value of $30.91.

The price-to-GF-Value ratio of 0.88 indicates that the stock is modestly undervalued. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

While the insider's sell may raise eyebrows, it's important to consider the broader context. The stock's current valuation and the company's performance should also be taken into account when making investment decisions.

As always, investors are advised to do their own due diligence and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.