Insider Sell: Evan Roberts Sells 3,907 Shares of Phreesia Inc (PHR)

On September 13, 2023, Evan Roberts, the Chief Operating Officer (COO) of Phreesia Inc (NYSE:PHR), sold 3,907 shares of the company. This move is part of a series of insider sell transactions that have been occurring over the past year.

Phreesia Inc is a healthcare company that provides a patient intake management platform. The company's platform automates patient intake processes, including patient registration, insurance verification, medical history, and payments. Its aim is to improve the patient experience, increase administrative efficiency, and enhance clinical care.

Over the past year, the insider has sold a total of 14,159 shares and has not made any purchases. This trend of insider selling is not isolated to Roberts alone. The insider transaction history for Phreesia Inc shows that there have been 34 insider sells over the past year, with no insider buys.

The trend of insider selling can often be an indicator of the insiders' confidence in the company's future prospects. In this case, the consistent selling by the insider may suggest a less than optimistic outlook. However, it's important to note that insider selling can occur for a variety of reasons, and it does not necessarily indicate a negative outlook.

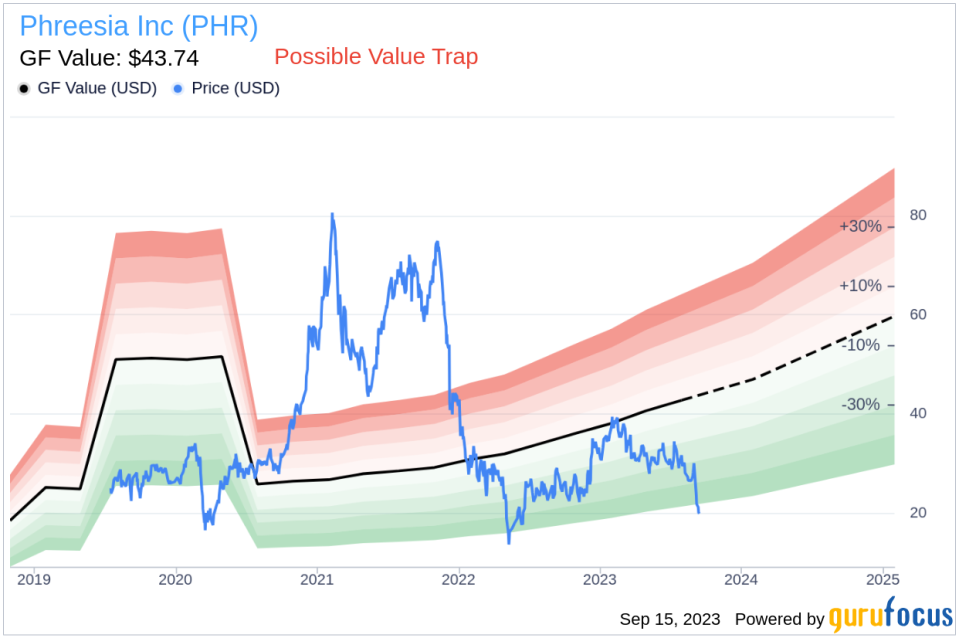

On the day of the insider's recent sell, shares of Phreesia Inc were trading for $20.34, giving the stock a market cap of $1.102 billion. This is a significant decrease from the company's GuruFocus Value of $43.74, resulting in a price-to-GF-Value ratio of 0.47. This suggests that the stock is currently undervalued and could be a possible value trap.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts. In the case of Phreesia Inc, the GF Value suggests that the stock may be undervalued, but investors should think twice before investing due to the possible value trap.

In conclusion, the recent insider sell by Evan Roberts, along with the trend of insider selling at Phreesia Inc, may raise some concerns for potential investors. However, the company's current undervaluation according to its GF Value suggests that there may still be potential for growth. As always, investors should conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.