Insider Sell: EverQuote Inc's CTO David Brainard Disposes of 26,221 Shares

EverQuote Inc (NASDAQ:EVER), a leading online insurance marketplace, has witnessed a significant insider sell by its Chief Technology Officer, David Brainard. On November 30, 2023, David Brainard sold 26,221 shares of the company, a transaction that has caught the attention of investors and market analysts alike. This article delves into the details of the sale, the insider's history, and the potential implications for EverQuote's stock performance.

Who is David Brainard of EverQuote Inc?

David Brainard serves as the Chief Technology Officer at EverQuote Inc. He is a key figure in the company's leadership, responsible for overseeing the technological advancements and innovations that drive EverQuote's platform. Brainard's role is crucial in maintaining the company's competitive edge in the fast-paced online insurance marketplace. His decisions and actions, particularly in the realm of stock transactions, are closely monitored for insights into the company's internal dynamics and future prospects.

EverQuote Inc's Business Description

EverQuote Inc operates as a data-driven online marketplace connecting consumers with insurance providers. The platform facilitates the shopping experience for insurance across various categories, including auto, home, life, and health insurance. EverQuote's technology leverages a massive amount of data to optimize the match between consumers and insurers, aiming to make the insurance shopping process more efficient and personalized. The company's business model is built on generating revenue through referrals and advertising, providing value to both insurance seekers and providers.

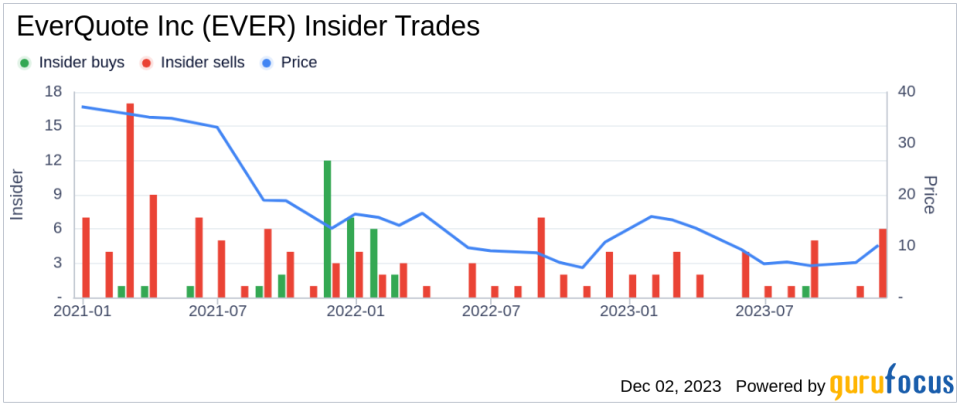

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, such as buys and sells, can provide valuable clues about a company's financial health and future performance. In the case of EverQuote Inc, the insider transaction history shows a pattern that may raise questions among investors. Over the past year, there has been only 1 insider buy compared to 28 insider sells. This could be interpreted as a lack of confidence among insiders about the company's future growth or valuation.

David Brainard's recent sell of 26,221 shares is part of a larger trend of his transactions over the past year, where he has sold a total of 58,215 shares and made no purchases. This consistent selling activity might suggest that the insider is taking advantage of the current stock price or possibly diversifying his personal portfolio.

On the day of Brainard's recent sell, EverQuote Inc's shares were trading at $10.24, giving the company a market cap of $356.686 million. This price point is above the GuruFocus Value (GF Value) of $9.20, indicating that the stock is modestly overvalued with a price-to-GF-Value ratio of 1.11.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. When a stock trades above its GF Value, it suggests that the market may be pricing in future growth expectations or that the stock is overvalued relative to its intrinsic value.

Considering the modest overvaluation and the insider selling trend, investors might be cautious about the stock's potential for near-term growth. However, it is also important to consider that insider sells can be motivated by various personal factors and may not always reflect a bearish view on the company's prospects.

The insider trend image above provides a visual representation of the buying and selling activities of EverQuote's insiders. The predominance of sell transactions could be a signal for investors to investigate further or to approach the stock with caution.

The GF Value image offers additional context to the valuation discussion, illustrating the stock's current price in relation to its estimated intrinsic value. The modest overvaluation highlighted by the GF Value may be a factor for investors to consider when evaluating the stock's investment potential.

Conclusion

David Brainard's recent insider sell of 26,221 shares of EverQuote Inc is part of a broader pattern of insider selling at the company. While the stock is currently trading above its GF Value, suggesting modest overvaluation, the insider selling trend could be a red flag for potential investors. It is essential for investors to conduct thorough due diligence, considering both the insider activity and the company's valuation, before making any investment decisions. As EverQuote continues to navigate the competitive landscape of online insurance marketplaces, the actions of its insiders will remain a key area of interest for market participants.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.