Insider Sell: EVP Alwyn Dawkins Sells 1,200 Shares of Gartner Inc

Alwyn Dawkins, the Executive Vice President of Global Business Sales at Gartner Inc, has recently sold 1,200 shares of the company's stock. The transaction took place on November 27, 2023, and has caught the attention of investors and analysts alike. As a financial stock market writer for GuruFocus.com, we delve into the details of this insider sell and its implications for Gartner Inc and its shareholders.

Who is Alwyn Dawkins of Gartner Inc?

Alwyn Dawkins is a seasoned executive with a significant role at Gartner Inc, a leading research and advisory company. As the Executive Vice President of Global Business Sales, Dawkins is responsible for overseeing the sales strategies and operations across the company's global markets. His position puts him at the forefront of the company's business development and client engagement efforts.

Gartner Inc's Business Description

Gartner Inc, traded under the ticker symbol NYSE:IT, is a renowned entity in the world of business advisory and research. The company specializes in providing insights, advice, and tools for leaders in IT, finance, HR, legal and compliance, marketing, sales, and supply chain functions across the world. With a deep understanding of various industries and markets, Gartner equips executives with the necessary knowledge to make informed decisions and stay ahead in a competitive landscape.

Analysis of Insider Buy/Sell and Relationship with Stock Price

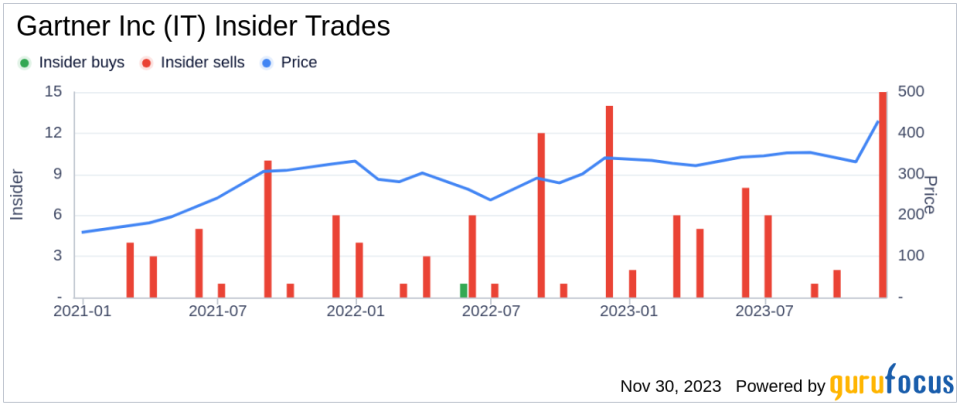

Insider transactions are often scrutinized by investors as they can provide valuable signals about a company's financial health and future prospects. In the case of Gartner Inc, the insider transaction history shows a notable pattern of insider sells over the past year, with 45 insider sells and no insider buys. This could suggest that insiders, including Alwyn Dawkins, may perceive the stock's current price as being on the higher side, prompting them to lock in profits.

Alwyn Dawkins's recent sale of 1,200 shares is part of a larger trend of his transactions over the past year, where he has sold a total of 11,123 shares and made no purchases. This consistent selling activity could be interpreted in various ways; however, without additional context, it is challenging to determine the exact motivation behind these sales.

On the day of the insider's recent sale, shares of Gartner Inc were trading at $428.91, giving the company a market cap of $33.527 billion. The stock's price-earnings ratio stands at 36.98, which is higher than the industry median of 26.48 but lower than the company's historical median price-earnings ratio. This indicates that while the stock may be trading at a premium compared to the industry, it is somewhat in line with its own historical valuation trends.

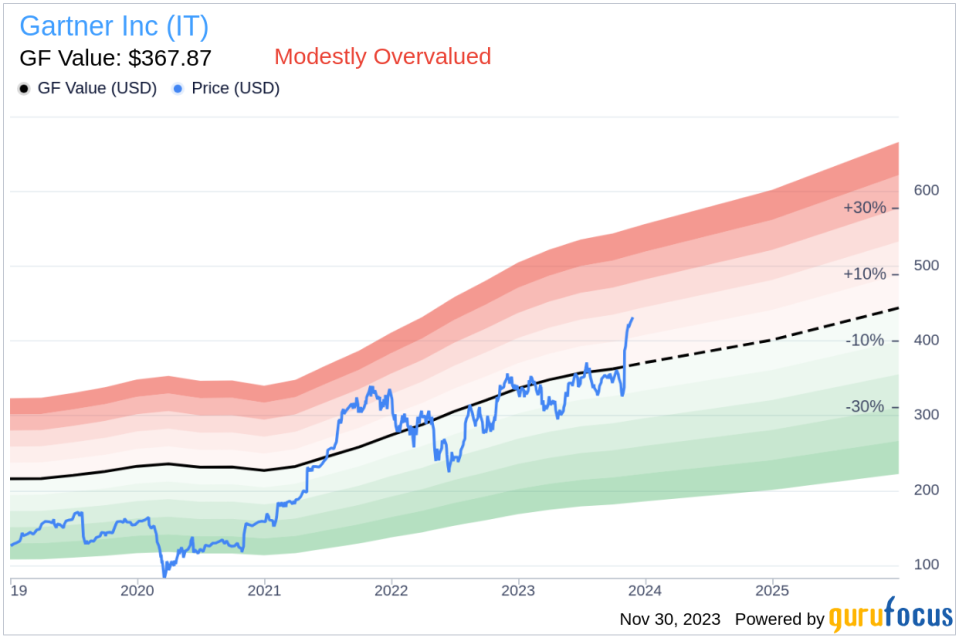

Considering the price-to-GF-Value ratio of 1.17, Gartner Inc is deemed to be Modestly Overvalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The current price-to-GF-Value ratio suggests that the stock is trading above its estimated intrinsic value, which could be another factor influencing the insider's decision to sell.

The insider trend image above provides a visual representation of the selling pattern among Gartner Inc's insiders. This trend could be a signal for investors to consider whether the stock's current valuation is sustainable in the long term.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. With the stock being labeled as Modestly Overvalued, investors may want to exercise caution and conduct further analysis before making investment decisions.

Conclusion

The recent insider sell by Alwyn Dawkins at Gartner Inc raises questions about the stock's current valuation and future performance. While insider sells are not always indicative of a stock's decline, the consistent pattern of sales by insiders at Gartner Inc, coupled with the stock's modest overvaluation based on the GF Value, suggests that potential investors should closely monitor the company's financials and market position. As always, insider transactions are just one piece of the puzzle, and a comprehensive investment strategy should consider a wide range of factors.

Investors are encouraged to keep an eye on further insider transactions and company announcements, as well as broader market trends, to make informed decisions regarding their investments in Gartner Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.