Insider Sell: EVP, CFO and Assistant Sec. ...

On August 7, 2023, John Guthrie, the Executive Vice President, Chief Financial Officer, and Assistant Secretary of SiteOne Landscape Supply Inc (NYSE:SITE), sold 1,028 shares of the company. This move is part of a series of insider transactions that have been taking place over the past year.

SiteOne Landscape Supply Inc is the largest and only national wholesale distributor of landscape supplies in the United States. The company provides a comprehensive range of products including irrigation supplies, fertilizer and control products, landscape accessories, nursery goods, outdoor lighting, and ice melt products. The company also offers value-added consultative services to its customers.

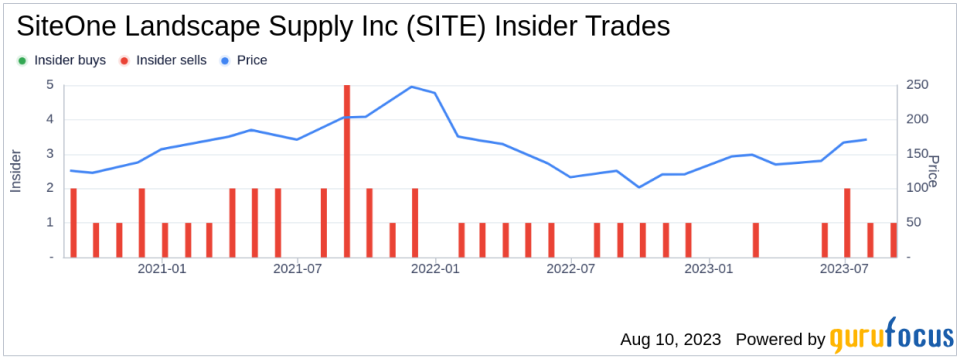

Over the past year, John Guthrie has sold a total of 1,028 shares and has not made any purchases. This trend is consistent with the overall insider transaction history for SiteOne Landscape Supply Inc, which shows zero insider buys and ten insider sells over the same timeframe.

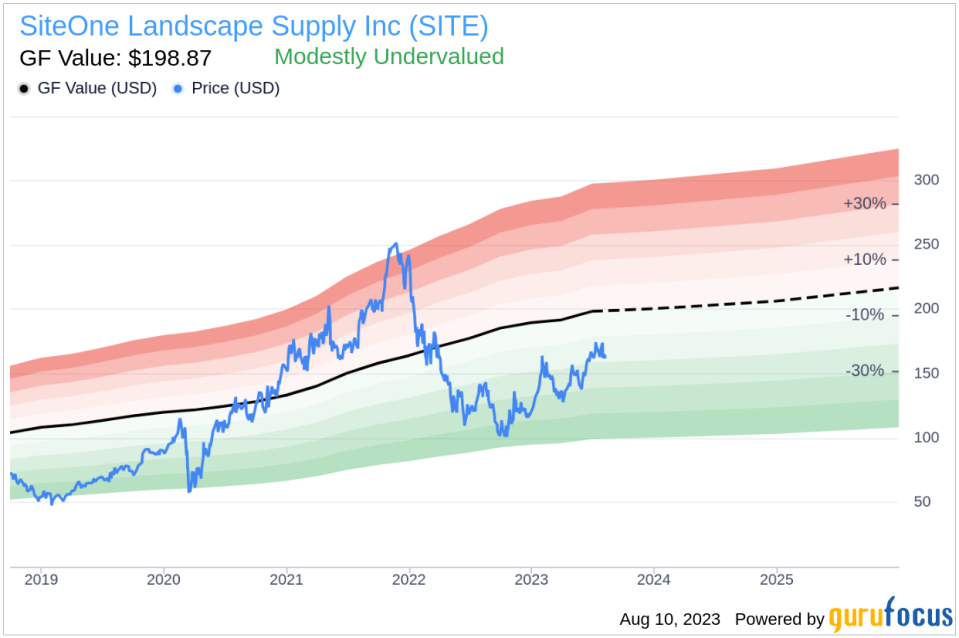

On the day of Guthries recent sell, shares of SiteOne Landscape Supply Inc were trading for $164.47 apiece, giving the stock a market cap of $7.292 billion. The price-earnings ratio stands at 38.63, which is higher than the industry median of 12.26 but lower than the companys historical median price-earnings ratio.

With a price of $164.47 and a GuruFocus Value of $198.87, SiteOne Landscape Supply Inc has a price-to-GF-Value ratio of 0.83. This suggests that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider sell by John Guthrie, coupled with the overall trend of insider sells over the past year, could be a signal to investors to exercise caution. However, the stock's modest undervaluation according to the GF Value might present an opportunity for investors who believe in the company's long-term prospects. As always, investors should conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.