Insider Sell: EVP - CFO Benjamin Jaenicke Sells 6,573 Shares of CBL & Associates Properties ...

Executive Vice President and Chief Financial Officer Benjamin Jaenicke has sold 6,573 shares of CBL & Associates Properties Inc (NYSE:CBL) on March 7, 2024, according to a recent SEC filing. The transaction was executed at an average price of $23.27 per share, resulting in a total sale amount of $152,975.71.

CBL & Associates Properties Inc is a real estate investment trust (REIT) that focuses on the ownership, development, acquisition, leasing, management, and operation of regional shopping malls, open-air and mixed-use centers, outlet centers, associated centers, community centers and office properties. The company's properties are located in various states across the United States.

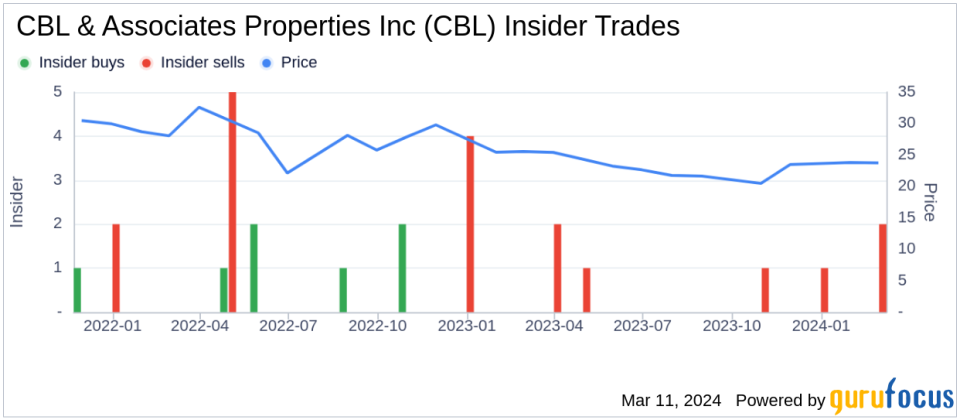

Over the past year, the insider has sold a total of 10,355 shares of the company and has not made any purchases. The recent sale by Benjamin Jaenicke is part of a trend observed over the last year, where there have been no insider buys but nine insider sells for CBL & Associates Properties Inc.

On the day of the sale, shares of CBL & Associates Properties Inc were trading at $23.27, giving the company a market capitalization of $738.897 million. The price-earnings ratio of the stock stands at 134.68, which is above the industry median of 16.835 and compares to the companys historical median price-earnings ratio.

The insider's recent transaction adds to the data on insider trends for CBL & Associates Properties Inc, which shows a pattern of insider sales over the past year. Investors often monitor insider buying and selling behaviors as an indicator of a stock's future performance, although such transactions do not always predict market movements.

For more detailed information on Benjamin Jaenicke's insider transactions, as well as the financial performance and stock valuation of CBL & Associates Properties Inc, interested parties can refer to the full SEC filing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.