Insider Sell: EVP & CFO Gianluca Romano Offloads 61,895 Shares of Seagate Technology ...

Seagate Technology Holdings PLC (NASDAQ:STX), a global leader in data storage solutions, has recently witnessed a significant insider sell by one of its top executives. Gianluca Romano, the company's Executive Vice President and Chief Financial Officer, sold a substantial number of shares, raising questions about the insider's confidence in the company's future performance.

Who is Gianluca Romano?

Gianluca Romano has been serving as the Executive Vice President and Chief Financial Officer of Seagate Technology Holdings PLC. With a deep understanding of the financial aspects of the technology sector, Romano plays a crucial role in steering the company's financial strategies and ensuring its fiscal health. His actions, especially in the realm of stock transactions, are closely monitored by investors as they can provide insights into the company's internal perspective on its valuation and future prospects.

Seagate Technology Holdings PLC's Business Description

Seagate Technology Holdings PLC is a preeminent player in the data storage industry, providing products that span from hard disk drives (HDDs) to solid-state drives (SSDs) and enterprise storage solutions. The company's products are essential for data creation, storage, and management, catering to a wide array of customers including enterprises, cloud service providers, and end consumers. Seagate's commitment to innovation ensures that it remains at the forefront of the data storage market, even as the demand for data capacity continues to surge globally.

Analysis of Insider Buy/Sell and Relationship with Stock Price

On November 29, 2023, Gianluca Romano sold 61,895 shares of Seagate Technology Holdings PLC at a price of $79.02 per share. This transaction reduced Romano's holdings in the company and was part of a series of sales conducted by the insider over the past year. In total, Romano has sold 78,877 shares and has not made any purchases during the same period. This pattern of selling without corresponding buys could be interpreted as a lack of confidence by the insider in the company's short-term growth potential or valuation.

Insider transactions are often considered a signal by investors, as insiders may sell shares for various reasons including personal financial planning or diversification. However, consistent selling by insiders, particularly without any buys, can be perceived as a bearish indicator. It is important to consider these transactions in the context of the company's overall performance and market conditions.

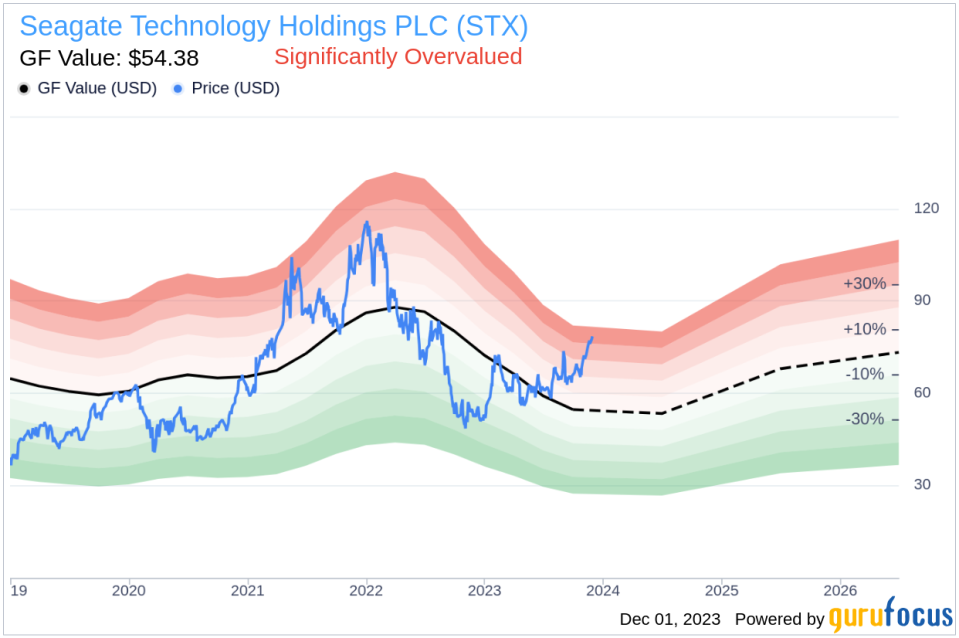

The relationship between insider transactions and stock price is complex. While insider sells do not always lead to a decline in stock prices, they can influence investor sentiment, especially when they are part of a broader trend. In the case of Seagate Technology Holdings PLC, the stock has been trading at a price-to-GF-Value ratio of 1.45, indicating that it is significantly overvalued based on its GF Value.

The GF Value, an intrinsic value estimate developed by GuruFocus, suggests that Seagate's stock is trading well above its estimated fair value of $54.38. This overvaluation could be a contributing factor to the insider's decision to sell shares, as it may represent a strategic move to capitalize on the current high stock price.

Historically, the stock has traded at various multiples, and the GF Value takes into account historical price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. Additionally, the GuruFocus adjustment factor is applied based on the company's past returns and growth, along with future business performance estimates from Morningstar analysts.

Insider Trends

The insider transaction history for Seagate Technology Holdings PLC shows a lack of insider buying over the past year, with zero insider buys recorded. On the other hand, there have been nine insider sells in the same timeframe. This trend could be indicative of insiders' collective assessment that the stock's current price does not present a compelling buying opportunity, or it may reflect a broader strategy of profit-taking during a period of perceived overvaluation.

Valuation

With a market cap of $16.546 billion, Seagate Technology Holdings PLC is a significant player in the technology sector. The stock's trading price of $79.02 on the day of Gianluca Romanos recent sell, combined with the GF Value of $54.38, paints a picture of a stock that may be overextended in terms of valuation. Investors should consider whether the current price reflects the company's long-term growth potential or if it is inflated due to short-term market dynamics.

In conclusion, the recent insider sell by EVP & CFO Gianluca Romano is a noteworthy event for investors of Seagate Technology Holdings PLC. While insider sells are not uncommon, the absence of insider buys and the stock's significant overvaluation based on the GF Value warrant careful consideration. Investors should continue to monitor insider activity and company performance to make informed decisions regarding their investment in Seagate Technology Holdings PLC.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.