Insider Sell: EVP & CFO Jennifer Hamann Sells 1,000 Shares of Union Pacific Corp (UNP)

Union Pacific Corporation (NYSE:UNP), a titan in the railroad industry, has recently witnessed a notable insider transaction. Jennifer Hamann, the Executive Vice President and Chief Financial Officer of Union Pacific Corp, sold 1,000 shares of the company on December 13, 2023. This move has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Jennifer Hamann of Union Pacific Corp?

Jennifer Hamann is a key executive at Union Pacific Corp, serving as the Executive Vice President and Chief Financial Officer. Her role at the company is critical, overseeing financial operations, strategies, and reporting. Hamann's decisions and insights are integral to the financial health and strategic direction of Union Pacific. Her tenure and actions are closely watched by investors as they can provide valuable signals about the company's financial stability and future prospects.

Union Pacific Corp's Business Description

Union Pacific Corp is a leading railroad franchise, covering 23 states across the western two-thirds of the United States. The company's operations are essential for the transportation of goods and commodities, including agricultural products, automotive, chemicals, coal, industrial products, and intermodal. With a history dating back to 1862, Union Pacific has been a cornerstone of America's infrastructure, playing a pivotal role in the nation's economic development and expansion.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The insider's decision to sell shares can be influenced by various factors, ranging from personal financial planning to a less optimistic view of the company's future performance. In the case of Jennifer Hamann's recent sale of 1,000 shares, it is important to analyze the context and potential motivations behind the transaction.Over the past year, Jennifer Hamann has sold a total of 2,000 shares and has not made any purchases. This one-sided activity could suggest that the insider is taking a cautious stance towards the company's valuation or future growth prospects. However, without additional context, it is difficult to draw definitive conclusions from these actions alone.

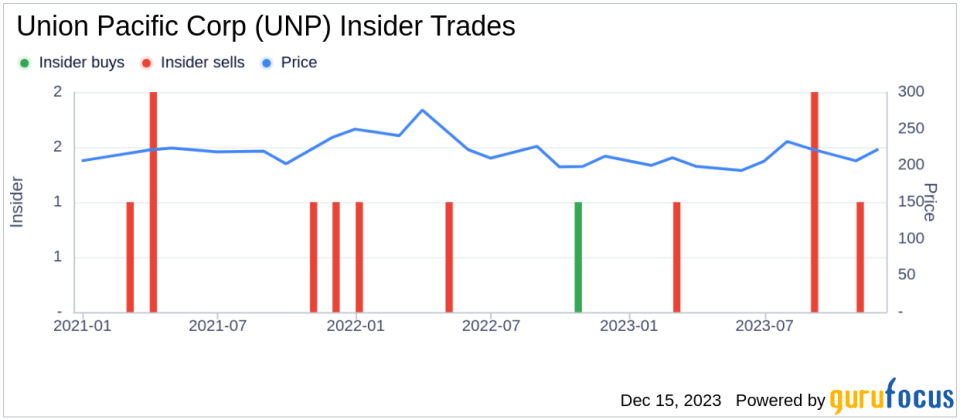

The insider trend image above provides a visual representation of the buying and selling activities of insiders at Union Pacific Corp. Over the past year, there have been no insider buys, while there have been 5 insider sells. This trend may indicate a general consensus among insiders that the current stock price does not present a compelling buying opportunity, or it may reflect individual insiders' personal financial decisions.

Valuation

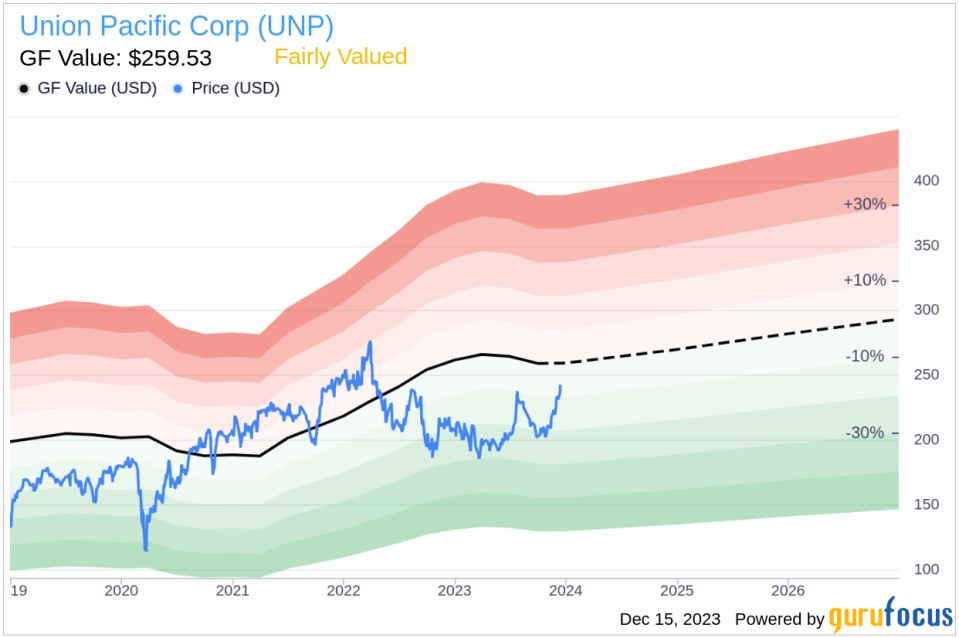

On the day of the insider's recent sale, shares of Union Pacific Corp were trading at $235, giving the company a substantial market cap of $148,046.848 billion. The price-earnings ratio of 23.31 is higher than both the industry median of 13.31 and the company's historical median, suggesting that the stock is trading at a premium compared to its peers and its own historical valuation.With a price of $235 and a GuruFocus Value of $259.53, Union Pacific Corp has a price-to-GF-Value ratio of 0.91, indicating that the stock is Fairly Valued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The GF Value serves as a benchmark for investors to gauge whether a stock is undervalued, fairly valued, or overvalued.

Conclusion

The recent insider sell by Jennifer Hamann at Union Pacific Corp raises questions about the insider's perspective on the company's valuation and future performance. While the stock is currently deemed fairly valued according to the GF Value, the lack of insider buying and the presence of multiple insider sells over the past year could be a signal for investors to monitor closely. It is essential for investors to consider the broader market conditions, the company's strategic initiatives, and its financial performance when interpreting insider transactions and making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.