Insider Sell: EVP and CFO Mark Lumpkin Sells 10,967 Shares of Earthstone Energy Inc (ESTE)

On October 12, 2023, Mark Lumpkin, the Executive Vice President and Chief Financial Officer of Earthstone Energy Inc (NYSE:ESTE), sold 10,967 shares of the company. This move has sparked interest among investors and analysts alike, as insider trading activities often provide valuable insights into a company's prospects.

Earthstone Energy Inc is an independent oil and gas exploration and production company primarily focused on the development and production of oil, natural gas, and natural gas liquids reserves in the United States. The company's operations are concentrated in the Midland Basin of west Texas and the Eagle Ford trend of south Texas.

Over the past year, the insider has sold a total of 10,967 shares and has not made any purchases. This trend is reflected in the company's overall insider trading activities. Over the past year, there has been only one insider buy compared to nine insider sells.

The stock was trading at $20.41 per share on the day of the insider's recent sell, giving the company a market cap of $2.288 billion. The price-earnings ratio stands at 5.08, which is lower than both the industry median of 9.01 and the company's historical median price-earnings ratio. This suggests that the stock is undervalued compared to its peers and its own historical standards.

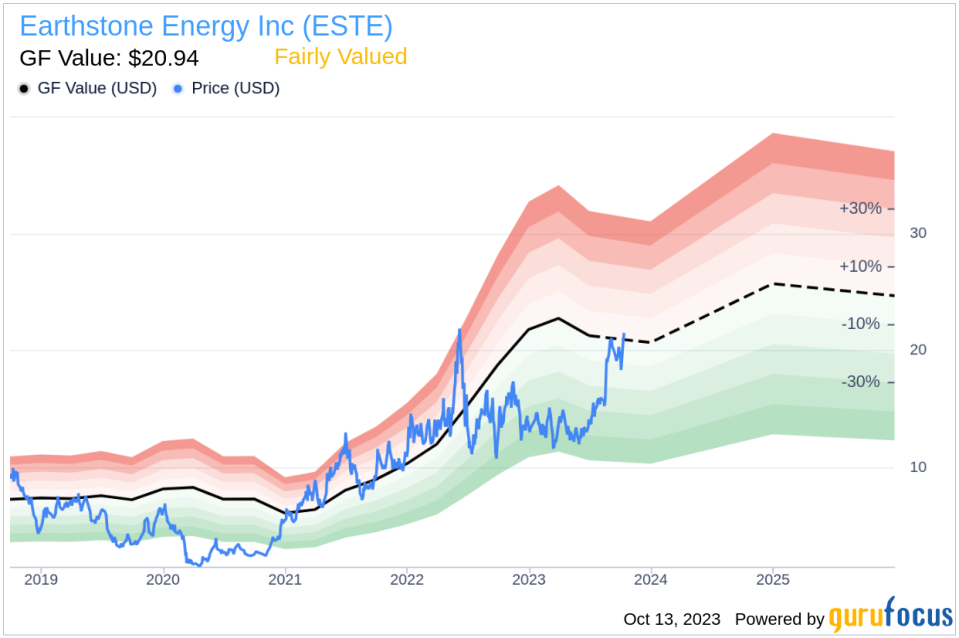

The GuruFocus Value for Earthstone Energy Inc is $20.94, resulting in a price-to-GF-Value ratio of 0.97. This indicates that the stock is fairly valued based on its intrinsic value estimate. The GF Value is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The recent sell by the insider could be interpreted in various ways. It could be a personal financial decision or it could be based on the insider's assessment of the company's future prospects. However, given the company's fair valuation and the overall trend of insider sells over the past year, investors should monitor the situation closely and conduct further research before making investment decisions.

It's important to note that while insider trading activities can provide valuable insights, they should not be used as the sole basis for any investment decisions. Other factors such as the company's financial health, market conditions, and industry trends should also be considered.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.