Insider Sell: EVP and CFO Neil Dougherty Offloads Shares of Keysight Technologies Inc

Neil Dougherty, the Executive Vice President and Chief Financial Officer of Keysight Technologies Inc (NYSE:KEYS), has recently sold 14,686 shares of the company's stock. The transaction took place on December 15, 2023, marking a significant move by a key insider within the organization.

Who is Neil Dougherty?

Neil Dougherty is a seasoned executive with a deep understanding of financial operations within the tech industry. As the EVP and CFO of Keysight Technologies Inc, Dougherty is responsible for overseeing the company's financial strategies, operations, and reporting. His role is crucial in ensuring that Keysight maintains its financial health and continues to deliver value to its shareholders. With years of experience in the sector, Dougherty's actions, especially in the stock market, are closely watched by investors and analysts alike.

About Keysight Technologies Inc

Keysight Technologies Inc is a leading technology company that provides electronic design and test solutions to help its customers bring breakthrough electronic products to market faster and at a lower cost. Keysight's solutions go beyond measurement to provide a full set of design, simulation, and prototyping tools that help engineers address their toughest challenges from design to deployment. With a focus on innovation and quality, Keysight serves industries ranging from telecommunications and aerospace to industrial, automotive, and education.

Analysis of Insider Buy/Sell and Relationship with Stock Price

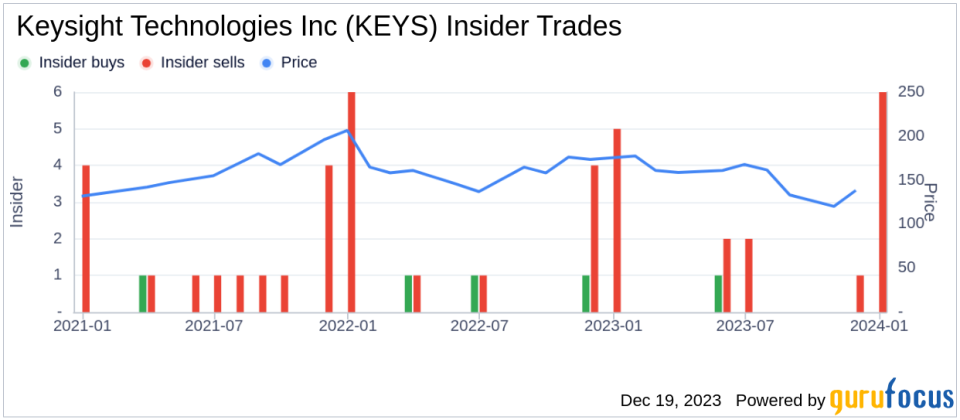

Insider transactions are often considered a signal of the management's belief in the company's future prospects. In the case of Keysight Technologies Inc, the insider transaction history shows a pattern that leans more towards selling than buying. Over the past year, there has been only 1 insider buy compared to 14 insider sells. This could indicate that insiders, including Neil Dougherty, may believe that the stock is currently valued high enough to realize some gains from their holdings.

However, it's important to note that insider selling does not always suggest a lack of confidence in the company. Executives may sell shares for various reasons, such as diversifying their portfolio, tax planning, or personal financial management. Without additional context, it's challenging to draw definitive conclusions from these transactions alone.

On the day of Dougherty's recent sale, Keysight Technologies Inc's shares were trading at $159.35, giving the company a market cap of $27.79 billion. This valuation places the company's price-earnings ratio at 26.82, which is slightly higher than the industry median but lower than the company's historical median. This suggests that while the stock may be trading at a premium compared to its peers, it is still within a reasonable range based on its own historical performance.

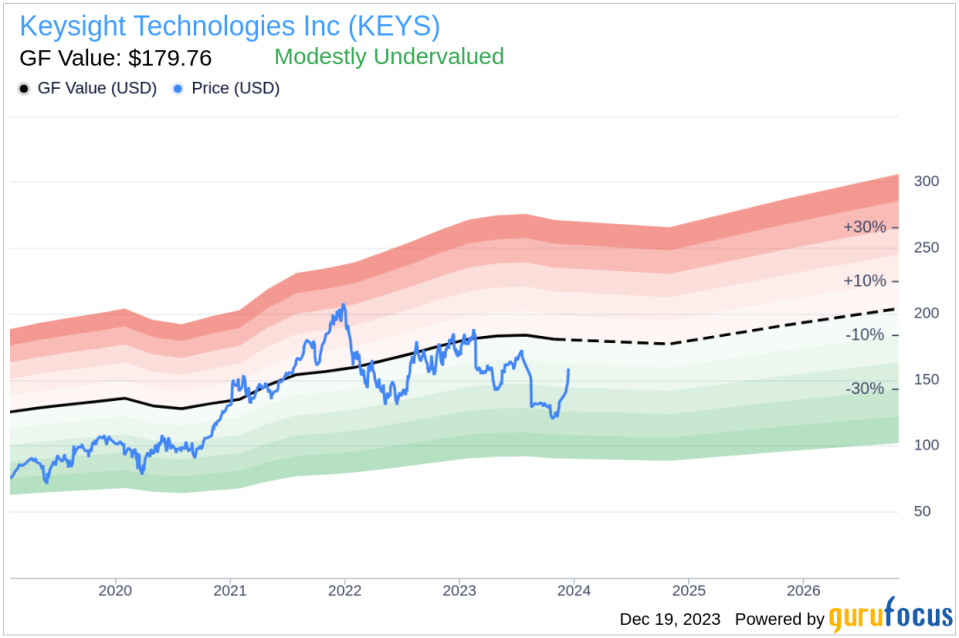

When considering the GF Value, which stands at $179.76, Keysight Technologies Inc appears to be modestly undervalued with a price-to-GF-Value ratio of 0.89. This indicates that the stock might have room for growth, according to the intrinsic value estimate developed by GuruFocus.

The GF Value is determined by historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. This comprehensive approach to valuation suggests that despite the recent insider selling, Keysight Technologies Inc may still be an attractive investment opportunity for those looking at the long-term potential.

The insider trend image above provides a visual representation of the buying and selling activities of insiders over time. It's evident that selling has been more prevalent, which could be a point of consideration for potential investors.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value. The modest undervaluation may be a signal for investors to consider Keysight Technologies Inc as a potential addition to their portfolios.

Conclusion

Neil Dougherty's recent sale of 14,686 shares of Keysight Technologies Inc is a significant insider move that warrants attention. While the insider selling trend over the past year may raise questions, the company's current valuation and GF Value suggest that Keysight Technologies Inc could still be a sound investment. Investors should consider the reasons behind insider transactions, the company's financial health, and its growth prospects before making any investment decisions.

As always, it's recommended to look at a comprehensive set of factors, including insider trends, valuation metrics, and the overall market environment, to make informed investment choices. Keysight Technologies Inc's position in the electronic design and test industry, combined with its financial metrics, presents a nuanced picture that could be appealing to those with a long-term investment horizon.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.