Insider Sell: EVP, CFO & Treasurer Jill Klindt Sells 2,931 Shares of Workiva Inc (WK)

In a notable insider transaction, Jill Klindt, the EVP, CFO & Treasurer of Workiva Inc (NYSE:WK), sold 2,931 shares of the company on December 11, 2023. This sale has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's financial health and future prospects.

Who is Jill Klindt of Workiva Inc?

Jill Klindt is a seasoned executive with a deep understanding of financial management and corporate strategy. As the EVP, CFO & Treasurer of Workiva Inc, Klindt oversees the company's financial operations, including accounting, treasury, financial planning, and investor relations. Her role is critical in ensuring the company's financial stability and growth, making her insider transactions particularly noteworthy.

Workiva Inc's Business Description

Workiva Inc is a leading provider of cloud-based software solutions for improving business productivity. The company's flagship platform, Wdesk, is designed to help organizations streamline complex reporting and compliance processes. Workiva's solutions are used by thousands of enterprises across various industries, including banking, insurance, energy, and government, to enhance data integrity and simplify workflow collaboration.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, such as those executed by Jill Klindt, can be a valuable indicator of a company's internal perspective on its stock's value. Over the past year, Klindt has sold a total of 17,931 shares and has not made any purchases. This pattern of selling could suggest that the insider believes the stock may be fully valued or that they are diversifying their personal portfolio.

The absence of insider buys over the past year, coupled with 11 insider sells, may raise questions among investors. However, it is essential to consider these transactions within the broader context of the company's performance and market conditions.

On the day of Klindt's recent sale, shares of Workiva Inc were trading at $95.2, giving the company a market cap of $5,304.815 billion. This valuation places the stock in the upper echelons of the market, reflecting investor confidence in Workiva's business model and growth potential.

The insider trend image above provides a visual representation of the selling pattern by Workiva insiders. While insider selling can sometimes be a red flag, it is not uncommon for executives to sell shares for personal financial planning reasons, such as estate planning or diversifying assets.

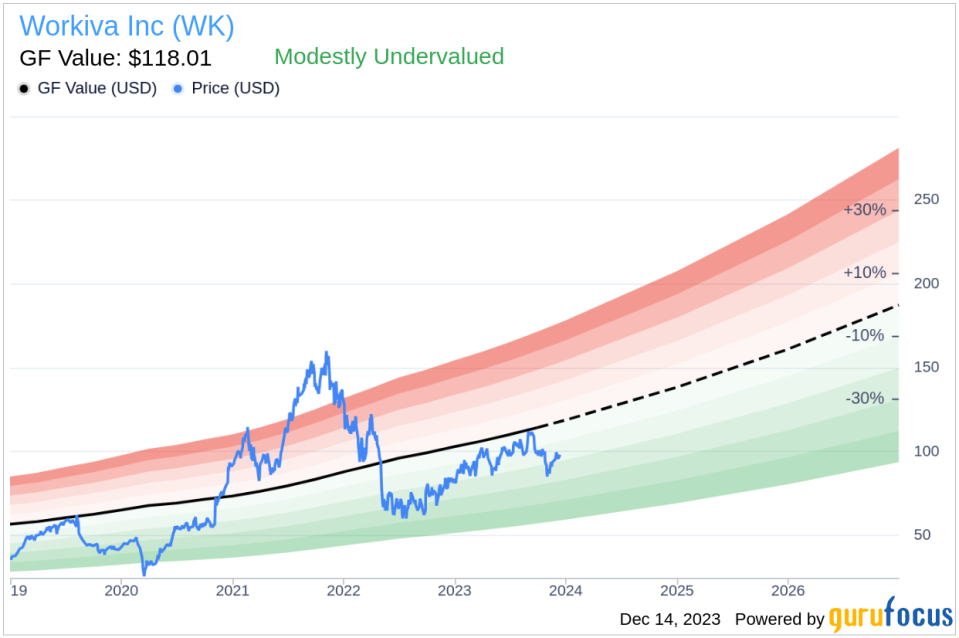

The GF Value image offers additional context for evaluating Workiva's stock price. With a price of $95.2 and a GuruFocus Value of $118.01, Workiva Inc has a price-to-GF-Value ratio of 0.81, indicating that the stock is modestly undervalued based on its GF Value. This suggests that despite the insider selling, the market may not fully appreciate the company's intrinsic value, as estimated by GuruFocus.

The GF Value is determined by considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. These factors collectively provide a comprehensive view of the company's valuation.

Conclusion

In conclusion, the recent insider sell by Jill Klindt may prompt investors to scrutinize Workiva Inc's stock valuation and future prospects. While insider selling can be a signal worth considering, it is crucial to analyze these transactions in the context of the company's overall financial health, market position, and the intrinsic value as suggested by the GF Value. As of now, Workiva Inc appears to be modestly undervalued, which could present an opportunity for investors who believe in the company's long-term growth trajectory.

Investors are encouraged to conduct their due diligence and consider the broader market trends, the company's strategic initiatives, and the potential impact of insider transactions on their investment decisions. As always, insider activity is just one piece of the puzzle when it comes to evaluating a stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.