Insider Sell: EVP & Chief Commercial Officer Ban Teh Sells 5,000 Shares of Seagate ...

Seagate Technology Holdings PLC (NASDAQ:STX), a global leader in data storage solutions, has recently witnessed an insider sell that has caught the attention of investors and market analysts. Ban Teh, the company's Executive Vice President & Chief Commercial Officer, sold 5,000 shares of the company on November 15, 2023. This transaction has prompted a closer look into the insider's trading behavior and its potential implications for the stock's performance.

Who is Ban Teh of Seagate Technology Holdings PLC?

Ban Teh serves as the Executive Vice President & Chief Commercial Officer at Seagate Technology Holdings PLC. In this role, Teh is responsible for overseeing the company's global sales, marketing, and product line management. With a deep understanding of the data storage industry and a strategic approach to commercial operations, Teh plays a crucial role in driving Seagate's growth and maintaining its competitive edge in the market.

Seagate Technology Holdings PLC's Business Description

Seagate Technology Holdings PLC is a preeminent provider of data storage technology and solutions. The company's product portfolio includes hard disk drives (HDDs), solid-state drives (SSDs), and enterprise storage systems, catering to a wide range of customers from individual consumers to large enterprises. Seagate's commitment to innovation and quality has established it as a trusted name in the storage industry, enabling the world to create, store, and access vast amounts of digital information.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, particularly sells, can provide valuable insights into a company's internal perspective on its stock's valuation. Ban Tehs recent sell of 5,000 shares is part of a broader pattern observed over the past year, where Teh has sold a total of 5,000 shares and made no purchases. This one-sided transaction history may signal Teh's belief that the stock's current price does not present an attractive buying opportunity or that it may be overvalued.

When examining the insider trends for Seagate Technology Holdings PLC, it is notable that there have been no insider buys over the past year, while there have been 8 insider sells during the same period. This trend suggests a lack of confidence among insiders in the stock's growth prospects or a consensus that the stock is adequately valued or overvalued at current prices.

On the day of Ban Teh's sell, Seagate Technology Holdings PLC shares were trading at $75, giving the company a market cap of $15.816 billion. This valuation places the company among the significant players in the technology sector.

The relationship between insider trading activities and stock prices is complex. While insider sells do not always indicate a bearish outlook, they can sometimes precede a period of underperformance in the stock market. Investors often monitor insider transactions as part of their due diligence, considering them alongside other fundamental and technical analysis indicators.

Valuation and GF Value Analysis

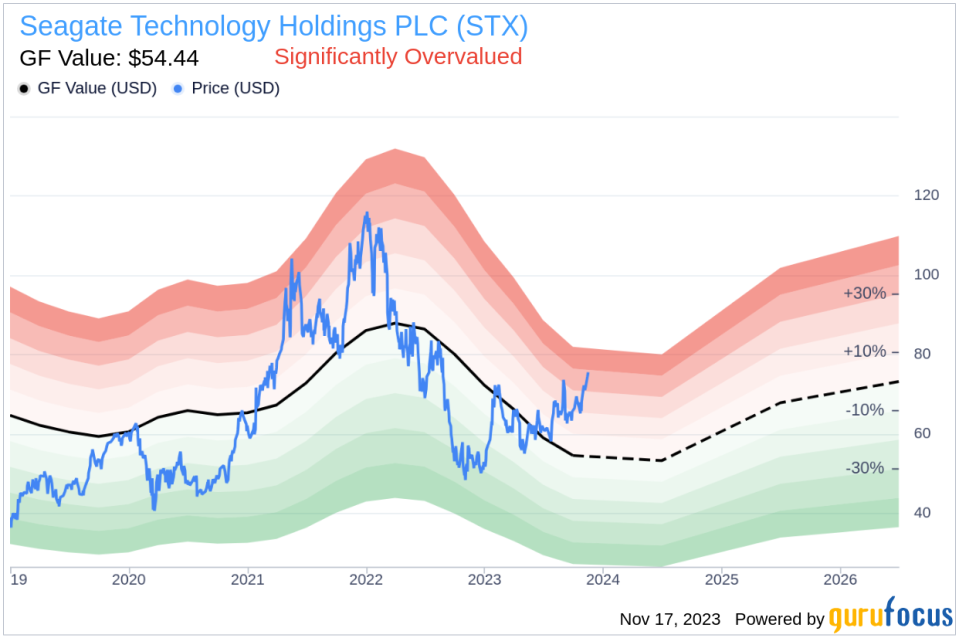

With a trading price of $75 and a GuruFocus Value (GF Value) of $54.44, Seagate Technology Holdings PLC has a price-to-GF-Value ratio of 1.38. This ratio indicates that the stock is significantly overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The discrepancy between the stock's trading price and its GF Value could be a contributing factor to Ban Teh's decision to sell shares. If insiders believe that the stock's market price exceeds its intrinsic value by a considerable margin, they may choose to realize gains before any potential market correction.

It is also important to consider that insider sells can be motivated by various personal factors, such as diversification of assets, liquidity needs, or tax planning, which may not necessarily reflect the insider's view on the company's future performance.

Conclusion

The recent insider sell by EVP & Chief Commercial Officer Ban Teh at Seagate Technology Holdings PLC has prompted market participants to scrutinize the stock's valuation and insider trading trends. While the sell itself does not conclusively indicate a negative outlook for the company, the absence of insider buys and the stock's overvaluation relative to the GF Value warrant careful consideration by investors. As always, it is advisable for investors to look at a comprehensive set of factors, including insider trading patterns, fundamental analysis, and broader market conditions, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.