Insider Sell: EVP, Chief Technology Officer Kathryn Schoenrock Sells Shares of Graco Inc (GGG)

Graco Inc (NYSE:GGG), a renowned player in the manufacturing of fluid handling systems and components, has recently witnessed an insider sell that has caught the attention of investors and market analysts. Kathryn Schoenrock, the company's Executive Vice President and Chief Technology Officer, sold 1,858 shares of Graco Inc on November 21, 2023. This transaction has prompted a closer look into the insider's trading behavior and its potential implications on the stock's performance.

Who is Kathryn Schoenrock?

Kathryn Schoenrock is a key executive at Graco Inc, holding the position of EVP and Chief Technology Officer. Her role involves overseeing the technological advancements and innovation strategies within the company. Schoenrock's expertise and leadership are crucial in maintaining Graco's competitive edge in the market. Her recent sell-off of company shares may provide insights into her confidence in the company's future prospects or could be interpreted as a routine financial decision.

Graco Inc's Business Description

Graco Inc is a global leader in the design, manufacture, and sale of systems and equipment used to move, measure, control, dispense, and spray fluid and powder materials. The company caters to a diverse range of industries, including construction, manufacturing, processing, and maintenance sectors. Graco's products are known for their quality, reliability, and ability to enhance productivity and reduce environmental impact, making them essential tools for various industrial applications.

Analysis of Insider Buy/Sell and Relationship with Stock Price

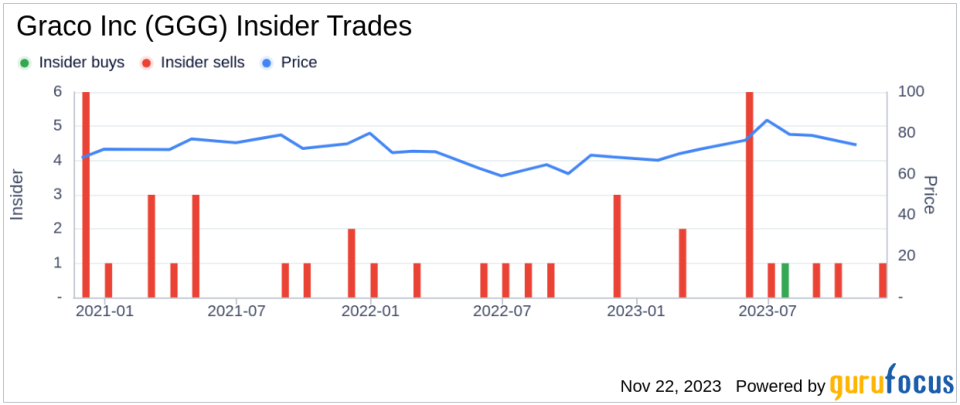

Insider trading activities, such as buys and sells, can offer valuable clues about a company's internal perspective on its stock's valuation. Over the past year, Kathryn Schoenrock has exclusively sold shares, with a total of 1,858 shares sold and no purchases. This one-sided activity could signal a lack of buying interest at current price levels from the insider's viewpoint.

The broader insider transaction history for Graco Inc shows a pattern of more sells than buys over the past year, with 16 insider sells and only 1 insider buy. This trend might suggest that insiders, on the whole, believe the stock might be fully valued or are taking profits after a period of appreciation.

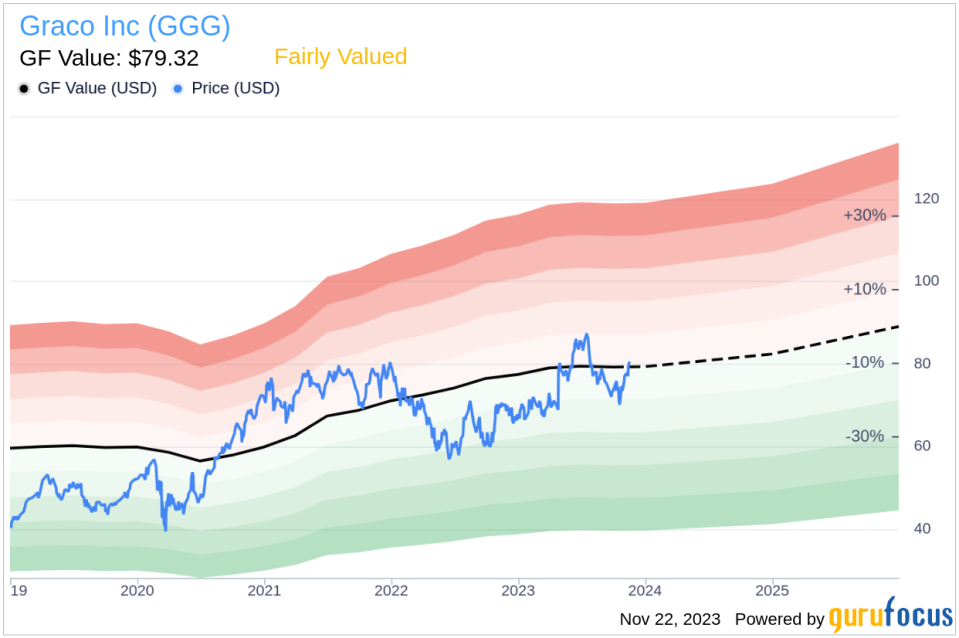

On the day of Schoenrock's recent sell, shares of Graco Inc were trading at $80.04, giving the company a market cap of $13.599 billion. The price-earnings ratio stood at 26.50, above both the industry median of 22.21 and the company's historical median. This elevated P/E ratio could indicate that the stock is priced on the higher end of its valuation spectrum.

When considering the price-to-GF-Value ratio of 1.01, Graco Inc appears to be Fairly Valued based on its GF Value of $79.32. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the insider trading activities, highlighting the recent sell by Schoenrock and the overall trend of more insider sells than buys.

The GF Value image further illustrates the stock's valuation, showing that Graco Inc is hovering around its fair value estimate, which aligns with the current market price.

Conclusion

The recent insider sell by EVP and Chief Technology Officer Kathryn Schoenrock may raise questions among investors regarding the stock's future trajectory. While the insider's sell-off does not necessarily predict a downturn, it is an important piece of information that should be considered alongside other financial data and market analysis. With Graco Inc's stock being fairly valued according to the GF Value and trading at a higher P/E ratio than the industry median, investors should keep a close eye on the company's performance and any further insider trading activities to gauge the stock's potential movements.

As always, insider trades should not be used in isolation but rather as one of several tools for investors to assess the attractiveness of a stock. It is also essential to consider the broader market conditions, the company's fundamentals, and any recent news or developments that could impact the stock's price. By staying informed and analyzing a comprehensive set of data, investors can make more educated decisions regarding their investment in Graco Inc or any other stock of interest.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.