Insider Sell: EVP, COO John Tomovcsik Sells 41,859 Shares of Iron Mountain Inc

On September 18, 2023, John Tomovcsik, the Executive Vice President and Chief Operating Officer of Iron Mountain Inc (NYSE:IRM), sold 41,859 shares of the company. This move is part of a series of insider transactions that have been taking place over the past year.

Iron Mountain Inc is a leading provider of storage and information management services. The company's real estate network of more than 85 million square feet across more than 1,400 facilities in over 50 countries allows it to serve customers around the globe with speed and accuracy. Its solutions portfolio includes records management, data management, document management, data centers, art storage and logistics, and secure shredding, helping organizations to lower storage costs, comply with regulations, recover from disaster, and better use their information.

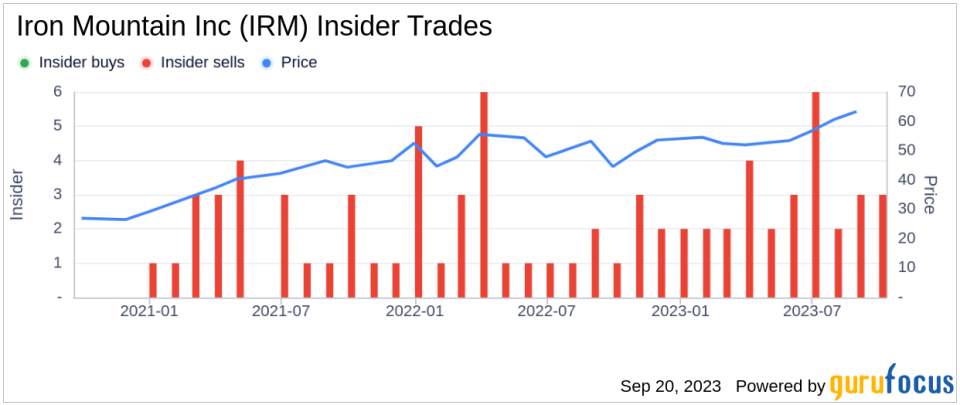

Over the past year, the insider has sold a total of 99,731 shares and purchased 0 shares. The insider transaction history for Iron Mountain Inc shows that there have been 0 insider buys in total over the past year. Meanwhile, there have been 34 insider sells over the same timeframe. This trend of insider selling could be a signal to investors about the insider's perspective on the company's future prospects.

On the day of the insider's recent sell, shares of Iron Mountain Inc were trading for $62.97 apiece. This gives the stock a market cap of $18.4 billion. The price-earnings ratio is 48.89, which is higher than the industry median of 17.16 and higher than the companys historical median price-earnings ratio. This suggests that the stock is currently overvalued compared to its peers and its own historical performance.

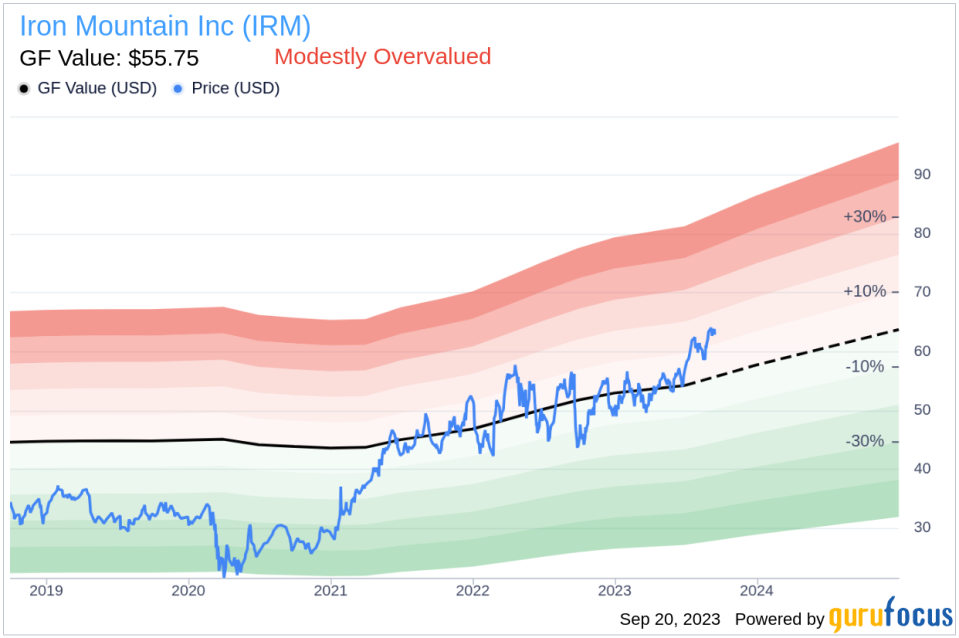

With a price of $62.97 and a GuruFocus Value of $55.75, Iron Mountain Inc has a price-to-GF-Value ratio of 1.13. This means the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus that is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider sell by John Tomovcsik, coupled with the stock's current valuation, may suggest that the stock is overvalued. However, investors should also consider other factors such as the company's financial health, its growth prospects, and the overall market conditions before making investment decisions.

This article first appeared on GuruFocus.