Insider Sell: EVP & COO Kristine Anderson Sells Shares of Booz Allen Hamilton Holding Corp (BAH)

Booz Allen Hamilton Holding Corp (NYSE:BAH) has recently witnessed an insider sell that has caught the attention of investors and market analysts. Kristine Anderson, the company's Executive Vice President & Chief Operating Officer, sold 5,064 shares of the company on December 4, 2023. This transaction has prompted a closer look into the insider's trading behavior, the company's business operations, and the potential implications for the stock's valuation and performance.

Who is Kristine Anderson of Booz Allen Hamilton Holding Corp?

Kristine Anderson has been a key figure at Booz Allen Hamilton Holding Corp, serving as the Executive Vice President & Chief Operating Officer. In her role, Anderson is responsible for overseeing the company's day-to-day operations and ensuring that the strategic initiatives align with the firm's growth and performance objectives. Her insights into the company's operations and her decision to sell a significant number of shares may provide valuable information to investors regarding the internal perspective on the company's future prospects.

Booz Allen Hamilton Holding Corp's Business Description

Booz Allen Hamilton Holding Corp is a leading provider of management and technology consulting services to the US government in defense, intelligence, and civil markets. Additionally, the company offers engineering services and solutions for international corporations and non-profit organizations. Booz Allen Hamilton is known for its expertise in cybersecurity, analytics, digital solutions, engineering, and mission operations, making it a critical partner for clients facing complex challenges and seeking strategic advice.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

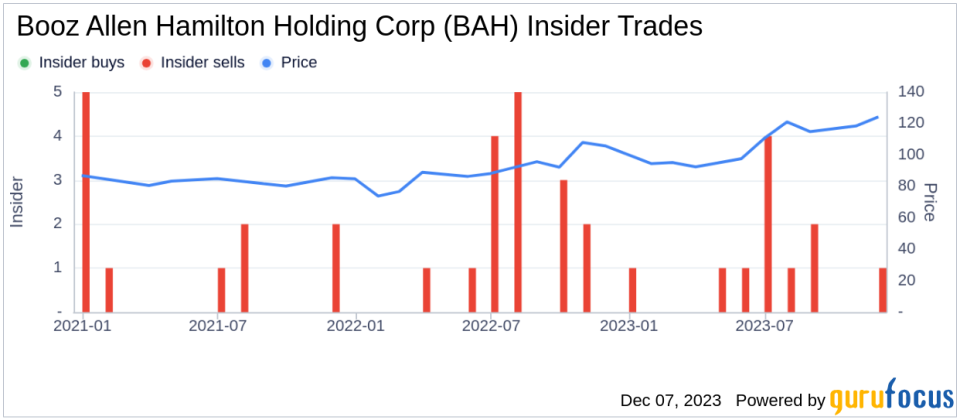

The insider's recent sell transaction follows a pattern observed over the past year, where Kristine Anderson has sold a total of 20,256 shares and has not made any purchases. This one-sided activity raises questions about the insider's confidence in the company's stock and its future price performance. The absence of insider buys over the past year, coupled with 12 insider sells, may suggest a cautious or bearish sentiment among those with intimate knowledge of the company's operations and outlook.

Shares of Booz Allen Hamilton Holding Corp were trading at $130 on the day of the insider's recent sell, giving the stock a market cap of $16.278 billion. The price-earnings ratio stands at 55.99, which is significantly higher than the industry median of 17.36 and above the company's historical median price-earnings ratio. This elevated P/E ratio could indicate that the stock is priced at a premium compared to its peers and historical standards, potentially justifying the insider's decision to sell at current levels.

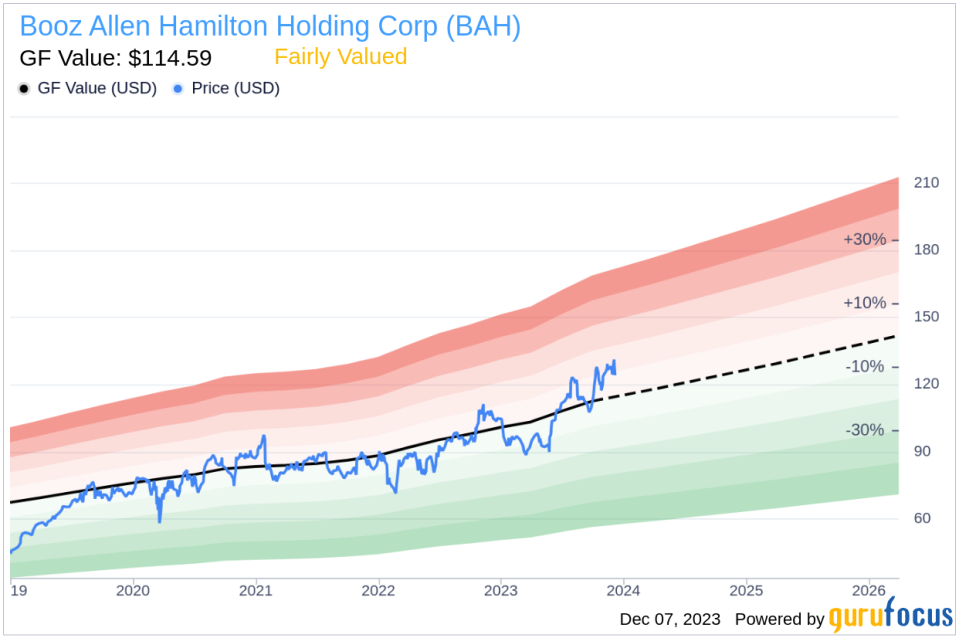

With a stock price of $130 and a GuruFocus Value of $114.59, Booz Allen Hamilton Holding Corp has a price-to-GF-Value ratio of 1.13. This suggests that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above illustrates the recent selling activity by insiders, which could be interpreted as a lack of confidence in the stock's ability to provide substantial returns in the near term. However, it is also important to consider that insiders may sell shares for various reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investment portfolio.

The GF Value image provides a visual representation of the stock's current valuation in relation to its intrinsic value estimate. The proximity of the stock's price to the GF Value line indicates that the market's valuation is in line with what GuruFocus considers a fair value for the shares.

Conclusion

The recent insider sell by EVP & COO Kristine Anderson at Booz Allen Hamilton Holding Corp may raise some eyebrows among investors. While the company's business remains robust, providing essential services to government and corporate clients, the insider's trading activity could be seen as a signal to exercise caution. The high price-earnings ratio and the stock's fair valuation according to the GF Value metric suggest that the stock may not be undervalued at current levels, potentially limiting the upside for investors.

As with any insider trading activity, it is crucial for investors to consider the broader context, including the company's financial health, market position, and growth prospects, before making investment decisions. While insider sells can provide valuable insights, they are just one piece of the puzzle in the complex world of stock market investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.