Insider Sell: EVP Darby Anderson Offloads Shares of Addus HomeCare Corp

In a notable insider transaction, Darby Anderson, EVP and Chief Legislative Officer of Addus HomeCare Corp (ADUS), sold 9,690 shares of the company on November 14, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's financial health and future prospects.

Darby Anderson is a key executive at Addus HomeCare Corp, a provider of comprehensive home care services that include personal care, home health, and hospice services. These services are primarily aimed at individuals who need assistance with the activities of daily living due to age, chronic illness, or disability. Anderson's role as Chief Legislative Officer involves overseeing the company's interactions with government entities and ensuring compliance with legislative requirements, which is crucial for a company operating in the healthcare sector.

Addus HomeCare Corp's business model focuses on delivering cost-effective care that allows individuals to remain in their homes rather than using institutional-based care settings. The company operates in a growing industry, as an aging population and rising healthcare costs drive demand for home-based care solutions.

The insider's recent sale of 9,690 shares is part of a larger pattern observed over the past year. According to the data, Darby Anderson has sold a total of 14,274 shares and has not made any purchases. This one-sided transaction history could suggest a lack of confidence in the company's short-term growth potential or simply a personal financial decision by the insider.

The broader insider transaction history for Addus HomeCare Corp shows a significant imbalance between buys and sells. Over the past year, there have been no insider buys but a substantial 35 insider sells. This trend could be interpreted as a bearish signal by market participants, as it may indicate that those with the most intimate knowledge of the company's workings are choosing to reduce their holdings.

On the valuation front, shares of Addus HomeCare Corp were trading at $85 on the day of Anderson's sale, giving the company a market cap of $1.392 billion. The price-earnings ratio stands at 24.20, which is lower than both the industry median of 26.25 and the company's historical median price-earnings ratio. This suggests that the stock may be undervalued compared to its peers and its own trading history.

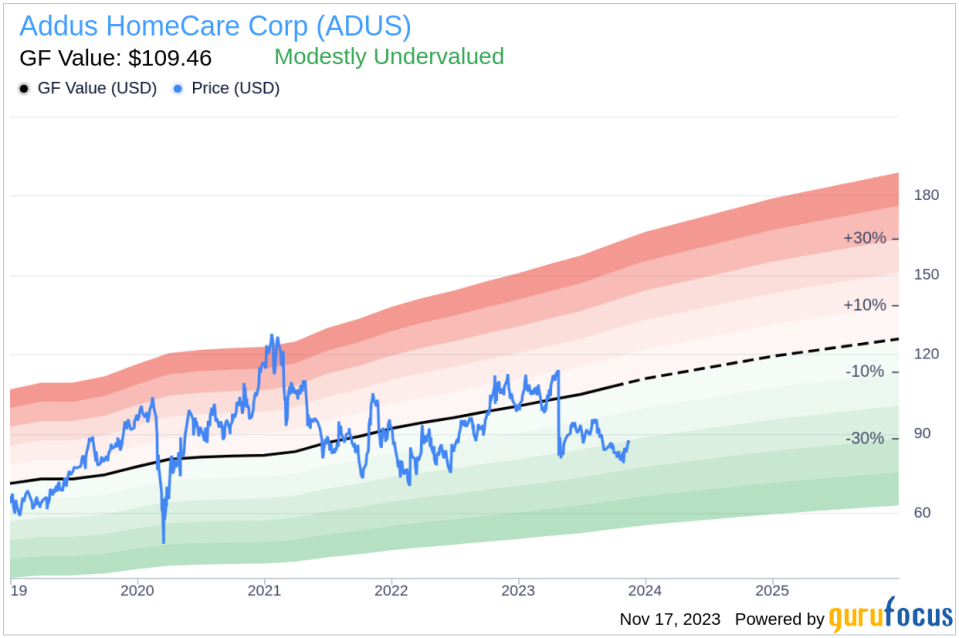

The stock's valuation becomes even more interesting when considering the GuruFocus Value. With a share price of $85 and a GuruFocus Value of $109.46, Addus HomeCare Corp has a price-to-GF-Value ratio of 0.78, indicating that the stock is modestly undervalued. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The relationship between insider selling and stock price can be complex. While a high volume of insider selling could be perceived negatively, it is essential to consider the context. Insiders might sell shares for various reasons unrelated to their outlook on the company, such as diversifying their investments, tax planning, or personal financial needs. Therefore, while insider transactions are an important piece of the puzzle, they should not be the sole basis for investment decisions.

In the case of Addus HomeCare Corp, the insider selling trend, particularly the recent sale by Darby Anderson, may raise questions among investors. However, the company's fundamentals, including its lower-than-industry price-earnings ratio and its modestly undervalued status according to the GF Value, suggest that the stock may still have upside potential.

Investors should also consider the broader market conditions, the company's growth prospects, and its competitive position within the home care industry. Addus HomeCare Corp's focus on home-based care solutions positions it well to capitalize on demographic trends and the shift towards more cost-effective healthcare delivery models.

In conclusion, while the insider selling activity, particularly by EVP Darby Anderson, is a factor to consider, it should be weighed against the company's valuation metrics and growth outlook. Addus HomeCare Corp's current market position and the industry's favorable trends could provide a counterbalance to the insider selling, potentially offering a compelling opportunity for investors who are willing to look beyond the insider transactions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.