Insider Sell: EVP and General Counsel James Gallagher Sells 13,874 Shares of AMC Networks Inc (AMCX)

AMC Networks Inc (NASDAQ:AMCX) has recently witnessed an insider sell that has caught the attention of investors and market analysts. James Gallagher, the Executive Vice President and General Counsel of AMC Networks Inc, sold 13,874 shares of the company on November 20, 2023. This transaction has prompted a closer look into the insider's trading history, the company's business description, and the potential implications of such insider activity on the stock's price.

Who is James Gallagher of AMC Networks Inc?

James Gallagher serves as the Executive Vice President and General Counsel of AMC Networks Inc. In his role, Gallagher is responsible for overseeing the legal affairs of the company, providing counsel on a wide range of legal issues, and ensuring compliance with regulatory requirements. His position places him in the upper echelons of the company's management, making his trading activities particularly noteworthy to investors and analysts who track insider behavior as an indicator of a company's financial health and future prospects.

AMC Networks Inc's Business Description

AMC Networks Inc is a prominent entertainment company known for producing and delivering distinctive, compelling content to audiences across various platforms. The company operates several well-known brands, including AMC, BBC America, IFC, SundanceTV, and WE tv, as well as the streaming services AMC+, Acorn TV, Shudder, Sundance Now, and ALLBLK. AMC Networks Inc has carved out a niche in the industry with its original programming and has a reputation for creating critically acclaimed and award-winning series that captivate viewers worldwide.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

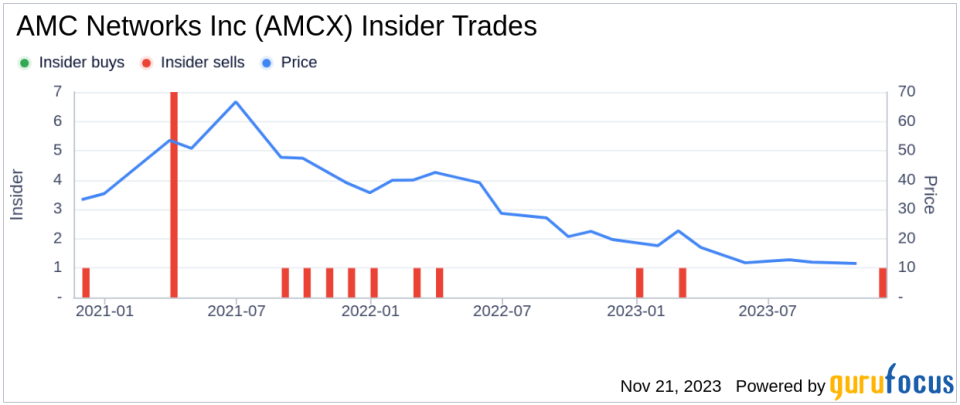

Insider trading activities, such as buys and sells, can provide valuable insights into a company's internal perspective on its stock's value. In the case of AMC Networks Inc, the insider transaction history over the past year shows a lack of insider buys, with zero purchases reported. On the other hand, there have been three insider sells during the same period, including the recent sale by James Gallagher.

James Gallagher's trades over the past year reveal a total of 33,874 shares sold and no shares purchased. This pattern of selling without corresponding buys may raise questions among investors about the insider's confidence in the company's future performance. However, it is essential to consider that insider sells can occur for various reasons, including personal financial planning, diversification of assets, or other non-company related factors.

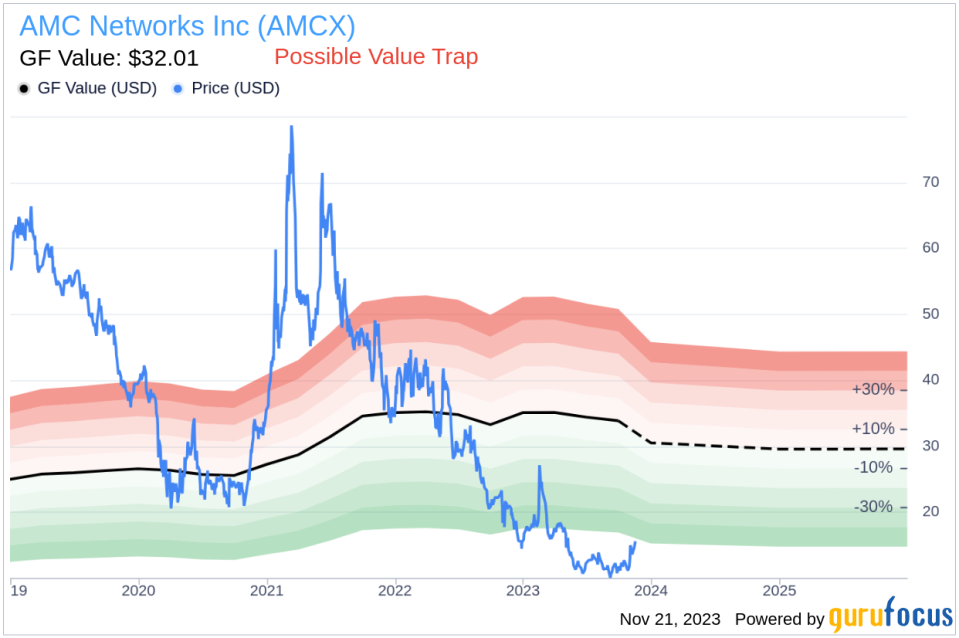

On the day of Gallagher's recent sell, shares of AMC Networks Inc were trading at $15.6, giving the company a market cap of $688.643 million. This valuation places the stock below the GuruFocus Value (GF Value) of $32.01, with a price-to-GF-Value ratio of 0.49. According to GuruFocus, this suggests that the stock is a "Possible Value Trap, Think Twice," indicating that investors should be cautious and thoroughly evaluate the company before making investment decisions.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The discrepancy between the current trading price and the GF Value may suggest that the stock is undervalued, but the insider selling trend could also imply that insiders anticipate challenges ahead that could affect the stock's performance.

The insider trend image above provides a visual representation of the insider trading activities at AMC Networks Inc. The absence of insider buys coupled with the presence of sells could be interpreted as a lack of bullish sentiment from those with intimate knowledge of the company's operations.

The GF Value image further illustrates the potential undervaluation of AMC Networks Inc's stock. However, the insider selling trend may temper investor enthusiasm, as it could be seen as a signal that insiders are not confident enough in the stock's future to hold onto their shares or acquire more.

Conclusion

The recent insider sell by James Gallagher at AMC Networks Inc, along with the overall trend of insider sells over the past year, presents a complex picture for investors. While the stock appears undervalued based on the GF Value, the lack of insider buying and the presence of insider selling may suggest caution. Investors should consider the potential reasons behind Gallagher's decision to sell, as well as the broader insider trading patterns, in conjunction with a comprehensive analysis of the company's financials, market position, and growth prospects before making investment decisions.

As with any investment, it is crucial to conduct due diligence and consider a multitude of factors, including insider trading activity, to make informed decisions. The case of AMC Networks Inc highlights the nuanced relationship between insider actions and stock valuation, reminding investors that insider trading is just one piece of the puzzle in the broader investment landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.