Insider Sell: EVP and General Counsel Shirley Kuhlmann Sells 25,600 Shares of Collegium ...

Shirley Kuhlmann, the Executive Vice President and General Counsel of Collegium Pharmaceutical Inc, has recently sold 25,600 shares of the company's stock. The transaction took place on November 27, 2023, and has caught the attention of investors and analysts alike. As a key insider of the company, Kuhlmann's trading activities are closely monitored for insights into Collegium Pharmaceutical's financial health and future prospects.

Who is Shirley Kuhlmann of Collegium Pharmaceutical Inc?

Shirley Kuhlmann serves as the Executive Vice President and General Counsel of Collegium Pharmaceutical Inc. In her role, Kuhlmann is responsible for overseeing the legal affairs of the company, providing counsel on a range of issues from compliance and governance to intellectual property and litigation. Her position places her at the heart of strategic decision-making, and her actions in the stock market are often seen as reflective of her confidence in the company's direction and performance.

Collegium Pharmaceutical Inc's Business Description

Collegium Pharmaceutical Inc is a specialty pharmaceutical company focused on developing and commercializing innovative treatments for pain management. The company aims to address the significant challenges faced by patients suffering from pain and the healthcare providers who manage their treatment. Collegium's product portfolio includes medications designed to provide pain relief while countering the potential for abuse and misuse, a critical concern in the opioid epidemic.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

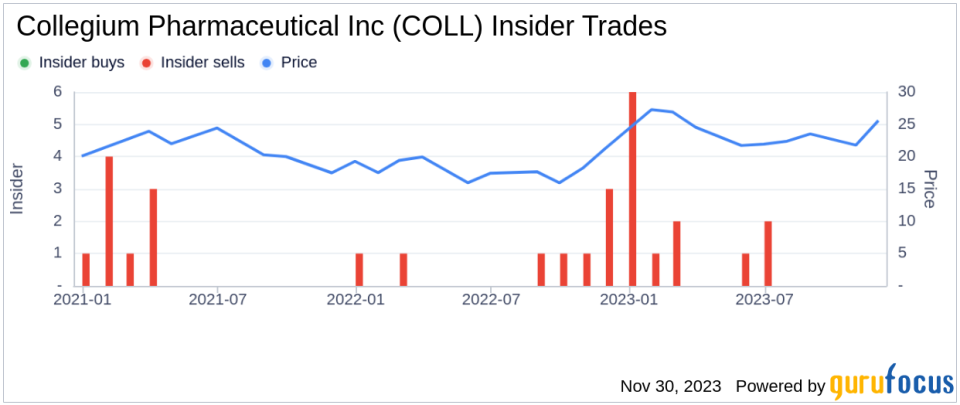

Insider trading activities, particularly those of high-ranking executives, can provide valuable clues about a company's financial health and future performance. In the case of Collegium Pharmaceutical Inc, the recent sale by Shirley Kuhlmann has raised questions among investors. Over the past year, Kuhlmann has sold a total of 65,395 shares and has not made any purchases. This one-sided activity could suggest that the insider sees limited upside potential or is simply diversifying her personal portfolio.

The broader insider transaction history for Collegium Pharmaceutical Inc shows a lack of insider buys over the past year, with 13 insider sells recorded during the same timeframe. This trend might indicate a consensus among insiders that the stock's current price does not present a compelling buying opportunity, or it could reflect a pattern of profit-taking after a period of stock appreciation.

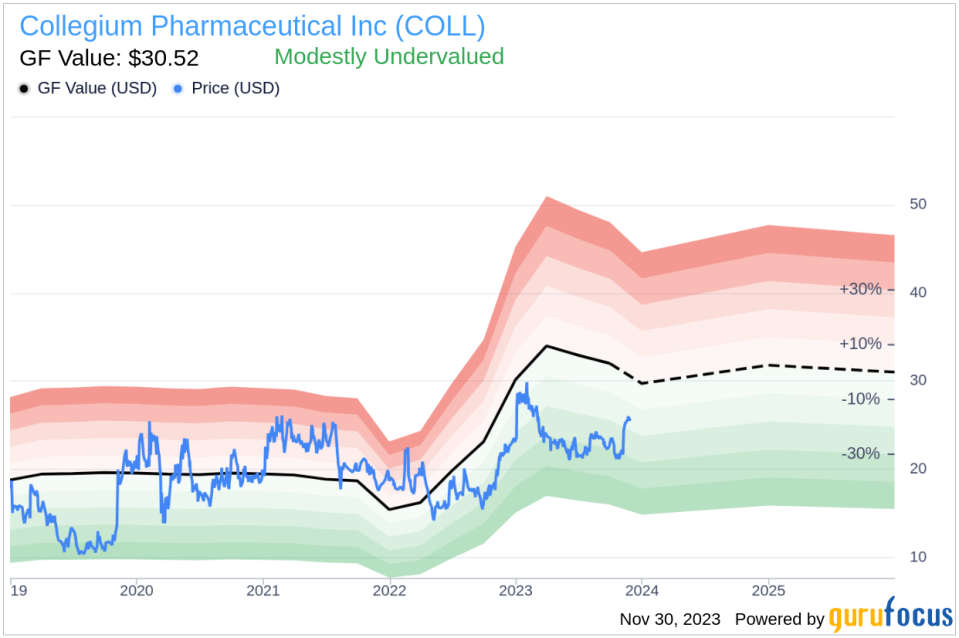

On the day of Kuhlmann's recent sale, shares of Collegium Pharmaceutical Inc were trading at $25.78, giving the company a market cap of $834.512 million. This valuation places the stock at a price-earnings ratio of 170.60, significantly higher than the industry median of 23.12 and above the company's historical median price-earnings ratio. Such a high P/E ratio could be a sign that the stock is overvalued, or it may reflect investors' high expectations for future earnings growth.

However, when considering the GuruFocus Value (GF Value) of $30.52, Collegium Pharmaceutical Inc appears to be modestly undervalued with a price-to-GF-Value ratio of 0.84. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above illustrates the recent selling pattern among Collegium Pharmaceutical's insiders, which could be interpreted as a cautious signal by market observers.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value, suggesting that despite the insider selling, the stock may still hold value for potential investors.

Conclusion

The recent insider sell by Shirley Kuhlmann, EVP and General Counsel of Collegium Pharmaceutical Inc, is a significant event that warrants attention. While the insider's actions may raise some concerns, it is essential to consider the broader context, including the company's valuation and market performance. The high P/E ratio suggests a premium on the stock, yet the GF Value indicates that it may be undervalued. Investors should weigh these factors, along with the overall insider selling trend, when making investment decisions regarding Collegium Pharmaceutical Inc.

As with any insider trading activity, it is crucial to remember that many personal and strategic factors can influence an insider's decision to sell shares. Therefore, while insider transactions can provide valuable insights, they should not be the sole basis for investment decisions. A comprehensive analysis of Collegium Pharmaceutical Inc's financials, market position, and growth prospects, alongside insider trading patterns, will offer a more robust framework for evaluating the stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.