Insider Sell: EVP & GM, Flash Business Robert Soderbery Sells 65,461 Shares of Western ...

On November 3, 2023, Robert Soderbery, the Executive Vice President and General Manager of Flash Business at Western Digital Corp (NASDAQ:WDC), sold 65,461 shares of the company. This move has caught the attention of investors and market analysts alike, prompting a closer look at the insider trading trends at Western Digital Corp.

Western Digital Corp is a leading global data storage company that provides cost-effective solutions for the collection, management, protection and use of digital information. The company's innovative storage solutions are at the heart of many of the world's largest data centers, and embedded in advanced smartphones, tablets, and PCs. Its consumer products are available at hundreds of thousands of retail locations worldwide.

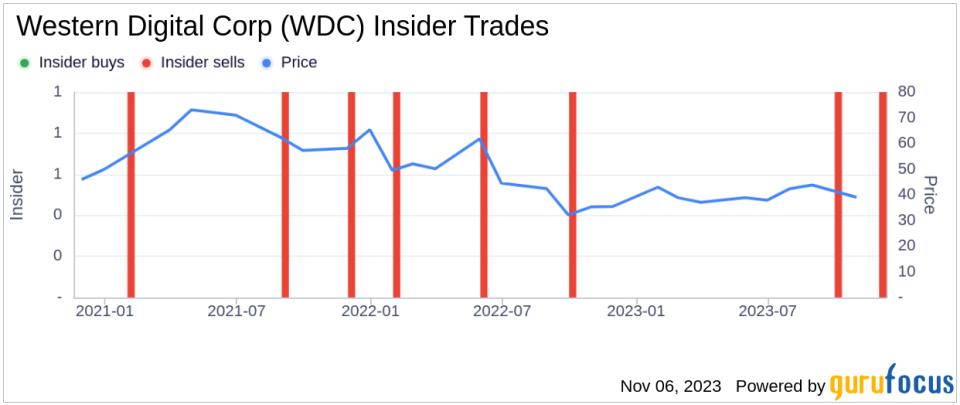

Over the past year, the insider has sold a total of 65,461 shares and made no purchases. This trend is mirrored in the company's overall insider transaction history, which shows zero insider buys and two insider sells over the same period. This could potentially indicate a lack of confidence in the company's future performance from those with intimate knowledge of its operations.

On the day of the insider's recent sell, shares of Western Digital Corp were trading at $42.92, giving the company a market cap of $13.99 billion.

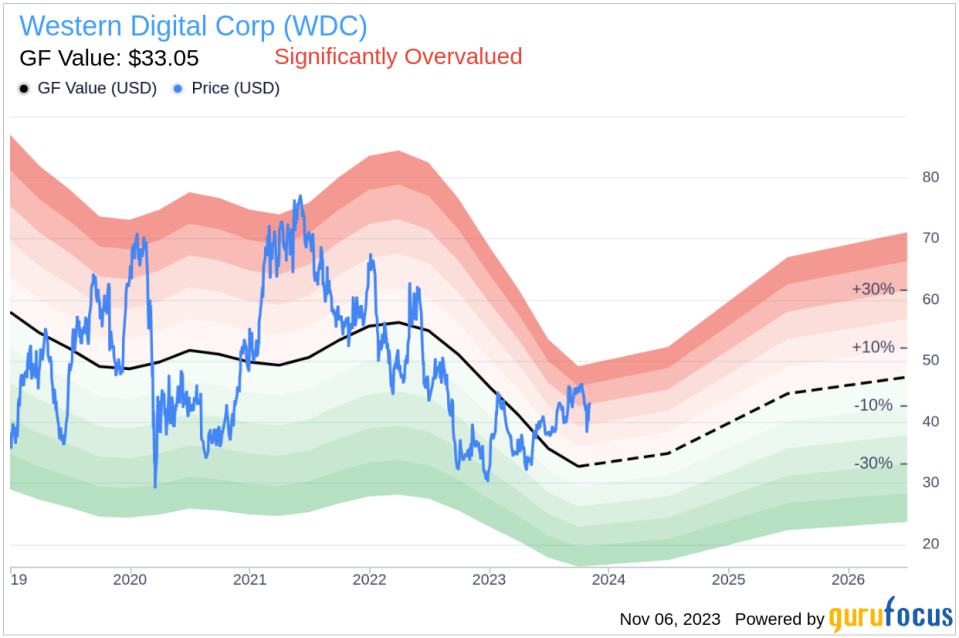

However, according to the GuruFocus Value, the stock is significantly overvalued. With a price of $42.92 and a GuruFocus Value of $33.05, Western Digital Corp has a price-to-GF-Value ratio of 1.3. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's decision to sell a significant number of shares could be seen as a negative signal to investors, especially considering the stock's current overvaluation. However, it's important to note that insider selling can occur for a variety of reasons, and it doesn't necessarily indicate a negative outlook for the company. Investors should always consider a range of factors when making investment decisions, including the company's financial health, market conditions, and their own risk tolerance.

As always, it's crucial to keep an eye on insider trading trends and to stay informed about the latest developments in the companies you invest in. Stay tuned to GuruFocus for more insider trading news and analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.