Insider Sell: EVP Jason Silberstein Trades Shares of SBA Communications Corp (SBAC)

In the realm of stock market movements, insider trading activity is often a significant indicator that investors and analysts closely monitor. Recently, an insider sell event has caught the attention of the market. Jason Silberstein, the Executive Vice President - Site Leasing of SBA Communications Corp (SBAC), has sold a substantial number of shares, prompting a deeper look into the transaction and its implications.

Jason Silberstein, a key figure at SBA Communications Corp, has been associated with the company for several years. His role as EVP - Site Leasing involves overseeing the leasing operations for the company's extensive portfolio of wireless communication towers. Silberstein's position grants him a unique perspective on the company's operational performance and future prospects, making his trading activities particularly noteworthy.

SBA Communications Corp is a leading player in the wireless communications infrastructure sector. The company owns and operates a vast network of cell towers, primarily in the United States and South America. These towers are leased to wireless service providers who need the infrastructure to support their networks and deliver services to customers. SBA Communications Corp's business model is built on long-term leases, which provide a stable revenue stream and make it an integral part of the telecommunications ecosystem.

On December 14, 2023, the insider executed a significant transaction, selling 16,465 shares of SBA Communications Corp. This sale represents a notable change in the insider's holdings and warrants an analysis of the potential reasons behind the move and its impact on the stock's valuation.

Over the past year, Jason Silberstein's trading record shows a clear pattern: he has sold 16,465 shares in total and has not made any purchases. This one-sided activity could suggest various things, including portfolio rebalancing, personal financial planning, or a response to the company's valuation.

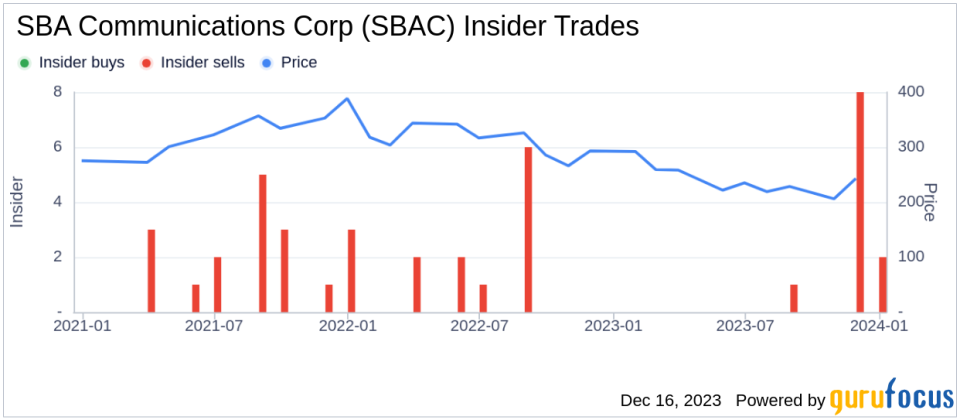

Insider Trends

The insider transaction history for SBA Communications Corp reveals a lack of insider buying over the past year, with zero insider purchases recorded. On the other hand, there have been 13 insider sells during the same period, indicating a trend where insiders are choosing to liquidate rather than accumulate shares.

Valuation

On the date of the insider's recent sale, shares of SBA Communications Corp were trading at $255.44, giving the company a market capitalization of $26,808,848,000. This valuation places the stock at a price-earnings ratio of 54.73, which is significantly higher than the industry median of 17.73. However, it is lower than the company's historical median price-earnings ratio, suggesting a mixed picture in terms of valuation.

Considering the stock's price of $255.44 against the GuruFocus Value (GF Value) of $373.59, SBA Communications Corp has a price-to-GF-Value ratio of 0.68. This ratio positions the stock as a Possible Value Trap, indicating that investors should think twice before making an investment decision based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated using a combination of historical trading multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future business performance estimates provided by Morningstar analysts.

When analyzing insider buy/sell activities, it's crucial to consider the relationship between these transactions and the stock price. In the case of SBA Communications Corp, the insider's decision to sell shares at a price below the GF Value could be interpreted in several ways. It might suggest that the insider believes the stock is currently overvalued, despite the GF Value indicating otherwise. Alternatively, the sale could be unrelated to the company's valuation, driven instead by personal financial considerations or a strategic portfolio adjustment.

Investors often look at insider selling as a negative signal, assuming that insiders might have access to information that leads them to reduce their stake. However, insider sales can occur for various reasons that do not necessarily reflect a lack of confidence in the company's future prospects. For instance, insiders might sell shares to diversify their investments, fund personal expenses, or take advantage of a stock's high market price.

In conclusion, the recent insider sell transaction by Jason Silberstein at SBA Communications Corp presents an intriguing scenario for investors. While the insider's activity and the company's valuation metrics provide important data points, they should be considered as part of a broader investment analysis. Investors should conduct their due diligence, taking into account the company's financial health, growth prospects, and market conditions before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.