Insider Sell: EVP Maria Borras Divests 10,000 Shares of Baker Hughes Co (BKR)

In a notable insider transaction, Maria Borras, Executive Vice President of Oilfield Services & Equipment at Baker Hughes Co (BKR), sold 10,000 shares of the company on December 4, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Maria Borras of Baker Hughes Co?

Maria Borras is a seasoned executive with extensive experience in the oil and gas industry. As the Executive Vice President of Oilfield Services & Equipment at Baker Hughes Co, she is responsible for overseeing a significant portion of the company's operations and strategic direction. Her role is critical in shaping the company's performance in a highly competitive and dynamic energy sector.

Baker Hughes Co's Business Description

Baker Hughes Co is a leading global energy technology company that provides solutions for energy and industrial customers worldwide. With a history dating back over a century, Baker Hughes operates in over 120 countries and is known for its innovative technologies and services that help to make energy safer, cleaner, and more efficient. The company's product and service portfolio includes oilfield services, oilfield equipment, turbomachinery and process solutions, and digital solutions, catering to the full spectrum of operations in the energy sector.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

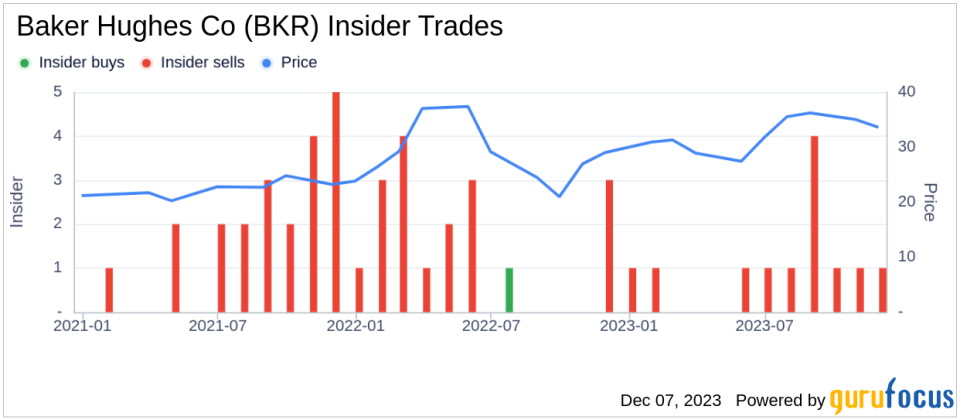

Insider transactions, particularly sales, can be interpreted in various ways. While an insider sell does not necessarily indicate a lack of confidence in the company, a significant divestiture by a top executive like Maria Borras may lead investors to scrutinize the reasons behind the transaction. Over the past year, Maria Borras has sold a total of 59,811 shares and has not made any purchases, which could suggest a pattern of profit-taking or portfolio diversification on her part.

The insider transaction history for Baker Hughes Co shows a lack of insider buying over the past year, with 0 insider buys recorded. On the other hand, there have been 12 insider sells in the same timeframe. This trend could signal that insiders, including Maria Borras, may perceive the stock's current price as being on the higher end of its value range, prompting them to lock in gains.

On the day of the insider's recent sale, shares of Baker Hughes Co were trading at $33.53, giving the company a market cap of $32,058,612,000. The price-earnings ratio of 19.19 is higher than the industry median of 9.04 but lower than the company's historical median price-earnings ratio. This indicates that while the stock is trading at a premium compared to its industry peers, it is still below its own historical valuation norms.

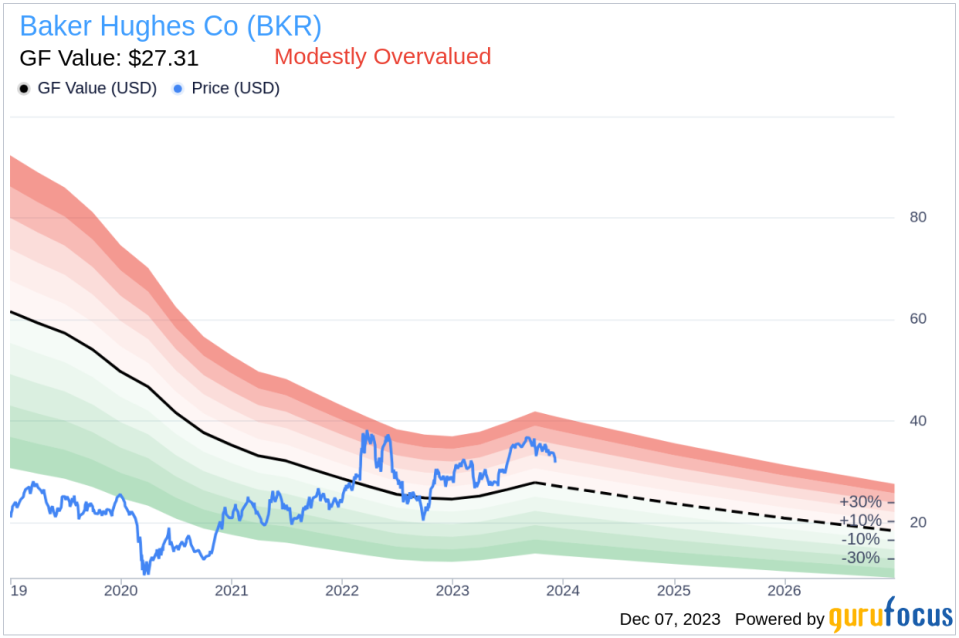

With a price of $33.53 and a GuruFocus Value of $27.31, Baker Hughes Co has a price-to-GF-Value ratio of 1.23, suggesting that the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above reflects the recent insider selling activity, which could be a point of concern for potential investors. It is important to consider whether these sales are part of a broader insider sentiment about the company's valuation or simply individual financial decisions.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current price-to-GF-Value ratio above 1 indicates that the stock is trading at a premium to its estimated fair value, which aligns with the insider selling trend.

Conclusion

The recent insider sell by Maria Borras, along with the overall trend of insider sales and absence of insider purchases, may raise questions among investors about the current valuation of Baker Hughes Co. While the company's market cap and price-earnings ratio suggest a solid standing in the industry, the modest overvaluation indicated by the price-to-GF-Value ratio and the insider selling activity could imply that the stock's current price has factored in much of its near-term growth potential.

Investors should consider these insider transactions as part of a broader investment analysis, taking into account the company's fundamentals, industry trends, and broader market conditions. As always, it is advisable to conduct thorough research and, if necessary, consult with financial advisors before making investment decisions based on insider activity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.