Insider Sell: EVP & President Interventional Richard Byrd Sells Shares of Becton Dickinson ...

In a notable insider transaction, EVP & President Interventional Richard Byrd of Becton Dickinson & Co (NYSE:BDX) sold 2,156 shares of the company's stock on November 28, 2023. This sale is part of a series of transactions over the past year, where Richard Byrd has sold a total of 4,036 shares and has not made any purchases. Such insider activity often draws the attention of investors as it may signal executives' confidence levels in their company's prospects.

Who is Richard Byrd? Richard Byrd serves as the Executive Vice President & President of the Interventional segment at Becton Dickinson & Co, a global medical technology company. In his role, Byrd is responsible for overseeing the strategic direction and growth initiatives of the Interventional segment, which is a critical component of Becton Dickinson's business operations.

Becton Dickinson & Co, commonly known as BD, is a global medical technology company that operates in the healthcare sector. The company focuses on improving medical discovery, diagnostics, and the delivery of care. BD provides solutions that help advance both clinical therapy for patients and the clinical process for healthcare providers. The company's product portfolio includes a wide range of medical supplies, devices, laboratory equipment, and diagnostic products used by healthcare institutions, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public.

Let's delve into the analysis of insider buy/sell activities and their relationship with the stock price of Becton Dickinson & Co.

The insider trend image above illustrates the pattern of insider transactions over the past year. Notably, there have been zero insider buys and six insider sells during this period. This could be interpreted in various ways; however, investors often view a higher number of insider sells as a potential red flag. It's important to consider that insiders might sell shares for numerous reasons unrelated to their outlook on the company, such as diversifying their personal investment portfolios or financing personal expenditures.

On the valuation front, shares of Becton Dickinson & Co were trading at $238.47 on the day of the insider's recent sale, giving the stock a market cap of $68.56 billion. The price-earnings ratio stands at 47.47, which is higher than the industry median of 30.74 and also above the company's historical median price-earnings ratio. This suggests that the stock is trading at a premium compared to its peers and its own historical valuation.

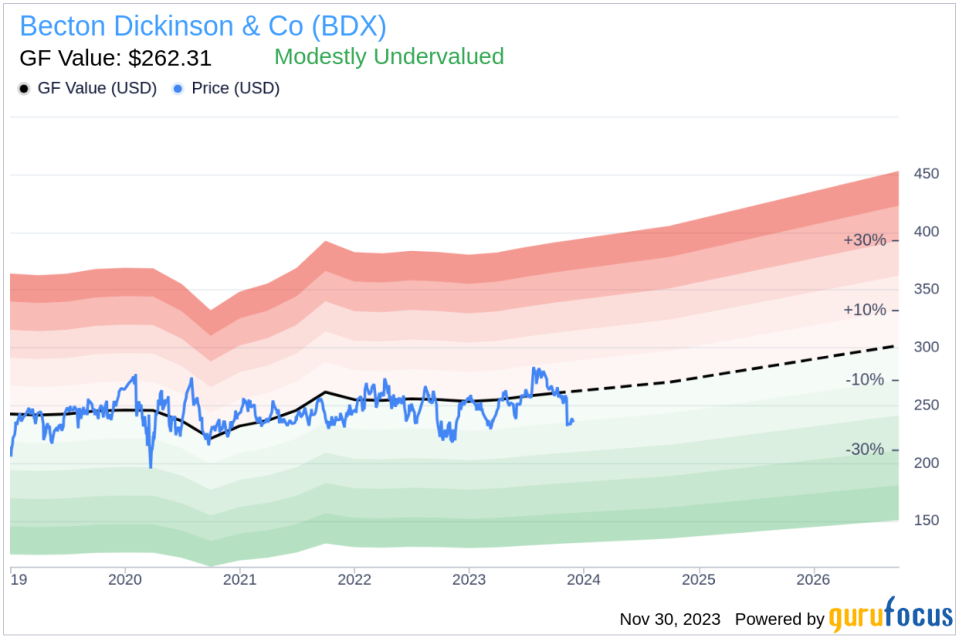

However, when considering the GuruFocus Value, Becton Dickinson & Co appears to be modestly undervalued. With a stock price of $238.47 and a GF Value of $262.31, the price-to-GF-Value ratio is 0.91, indicating that the stock might be undervalued based on intrinsic value estimates.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The fact that Becton Dickinson & Co's stock is trading below its GF Value could suggest that the market has not fully recognized the company's potential, or it may reflect broader market conditions that have led to a general undervaluation of the healthcare sector.

It's also worth noting that insider selling does not always correlate with a negative outlook on the stock. Insiders might sell shares for personal financial planning or other reasons that do not necessarily reflect their view of the company's future performance. Moreover, the volume of shares sold by Richard Byrd represents a small fraction of the company's total market cap, which could mean that the impact of such sales on the stock price is limited.

In conclusion, while the insider selling by EVP & President Interventional Richard Byrd at Becton Dickinson & Co may raise questions among investors, it is essential to consider the broader context of the company's valuation, industry position, and the reasons behind insider transactions. With Becton Dickinson & Co's stock appearing modestly undervalued based on the GF Value, investors may find it an opportune time to conduct further research and potentially capitalize on the discrepancy between the market price and intrinsic value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.