Insider Sell: EVP R Matz Sells 15,000 Shares of EMCOR Group Inc (EME)

EMCOR Group Inc (NYSE:EME), a leader in mechanical and electrical construction services, industrial and energy infrastructure, and building services, has recently witnessed a significant insider sell that has caught the attention of investors and market analysts. On November 13, 2023, R Matz, the Executive Vice President of Shared Services at EMCOR Group Inc, sold 15,000 shares of the company's stock. This transaction has prompted a closer look into the insider's trading behavior, the company's business operations, and the potential implications for the stock's valuation and future performance.

Who is R Matz of EMCOR Group Inc?

R Matz holds the position of Executive Vice President of Shared Services at EMCOR Group Inc. In this role, the insider is responsible for overseeing various support functions that are integral to the company's operations. These shared services can include human resources, information technology, procurement, and other administrative areas that enable EMCOR to deliver its services efficiently and effectively. R Matz's position places the insider in a strategic role, with a comprehensive view of the company's internal workings and potential future directions.

EMCOR Group Inc's Business Description

EMCOR Group Inc is a Fortune 500 company that provides a wide range of construction services, including electrical and mechanical construction, industrial and energy infrastructure, and building services. The company operates across various sectors, offering project management, system installation, maintenance, and retrofitting services. EMCOR's expertise spans critical infrastructure such as healthcare facilities, data centers, manufacturing plants, and energy plants, making it a pivotal player in the construction and services industry.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by R Matz is part of a broader pattern of insider trading activity at EMCOR Group Inc. Over the past year, the insider has sold a total of 28,462 shares and has not made any purchases. This one-sided transaction history may raise questions about the insider's confidence in the company's future prospects. However, it is essential to consider that insider sells can be motivated by various factors, including personal financial planning, diversification of assets, or other non-company-specific reasons.

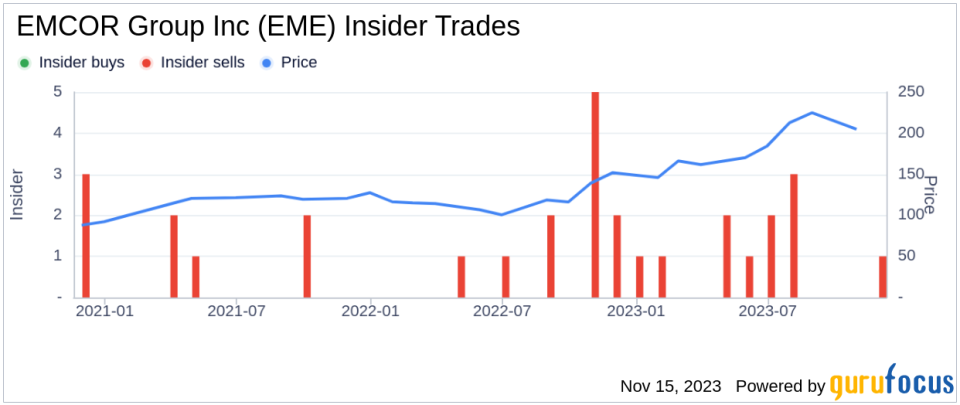

When examining the relationship between insider trading activity and the stock price, it is noteworthy that there have been 11 insider sells and no insider buys over the past year. This trend could suggest that insiders, including R Matz, may perceive the stock as being fully valued or potentially overvalued at current levels. However, without additional context, it is challenging to draw definitive conclusions from this activity alone.

On the day of the insider's recent sell, shares of EMCOR Group Inc were trading at $211.02, giving the company a market cap of $10.236 billion. The stock's price-earnings ratio of 18.97 is higher than both the industry median of 14.33 and the company's historical median, indicating that the stock may be trading at a premium compared to its peers and its own historical valuation.

Adding another layer to the valuation analysis, EMCOR Group Inc's price-to-GF-Value ratio stands at 1.16, with a GF Value of $182.17. This suggests that the stock is modestly overvalued based on GuruFocus's intrinsic value estimate, which considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the insider trading activity, reinforcing the pattern of sells without corresponding buys. This visual data can be a useful tool for investors when assessing the sentiment of company insiders.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value estimate. The modest overvaluation indicated by the price-to-GF-Value ratio may be a factor in the insider's decision to sell shares.

Conclusion

The sale of 15,000 shares by EVP R Matz is a transaction that warrants attention from EMCOR Group Inc's investors. While the insider's sell-off does not necessarily predict a downturn in the company's stock price, it does contribute to a pattern of insider selling that could be indicative of a belief that the stock is not undervalued at current levels. Investors should consider this insider activity alongside other financial metrics and market analyses when making investment decisions regarding EMCOR Group Inc.

It is also important to remember that insider trading is just one piece of the puzzle. A comprehensive investment strategy should take into account a wide range of factors, including company performance, industry trends, macroeconomic indicators, and technical analysis. As always, investors are encouraged to conduct their own due diligence and consult with financial advisors before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.