Insider Sell: EVP Robert Chambers Sells 9,100 Shares of Americold Realty Trust Inc (COLD)

Recent filings with the SEC have revealed that Robert Chambers, the Executive Vice President and Chief Commercial Officer of Americold Realty Trust Inc (NYSE:COLD), has sold 9,100 shares of the company's stock. The transaction took place on November 28, 2023, marking a significant move by one of the company's top insiders. This article will delve into the details of the sale, provide background on Robert Chambers and Americold Realty Trust Inc, and analyze the implications of this insider activity on the stock's valuation and performance.

Who is Robert Chambers of Americold Realty Trust Inc?

Robert Chambers serves as the Executive Vice President and Chief Commercial Officer of Americold Realty Trust Inc. In his role, Chambers is responsible for overseeing the company's commercial strategies, including sales, account management, and marketing initiatives. His expertise in the logistics and real estate sectors is crucial for driving Americold's growth and maintaining its position as a leader in the temperature-controlled warehousing and logistics industry.

Americold Realty Trust Inc's Business Description

Americold Realty Trust Inc is a real estate investment trust (REIT) specializing in the ownership, operation, acquisition, and development of temperature-controlled warehouses. The company provides essential infrastructure for the global supply chain, focusing on the storage and distribution of perishable food products. With a network of strategically located facilities, Americold offers comprehensive warehousing solutions, including blast freezing, transportation, and other value-added services to ensure the safe and efficient movement of goods for its customers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions can provide valuable insights into a company's health and the sentiment of its executives. In the case of Americold Realty Trust Inc, the insider transaction history over the past year shows a lack of insider purchases, with Robert Chambers's recent sale being the only insider transaction reported. This could suggest that insiders are cautious about the company's near-term prospects or that they believe the stock is fairly valued at current levels.

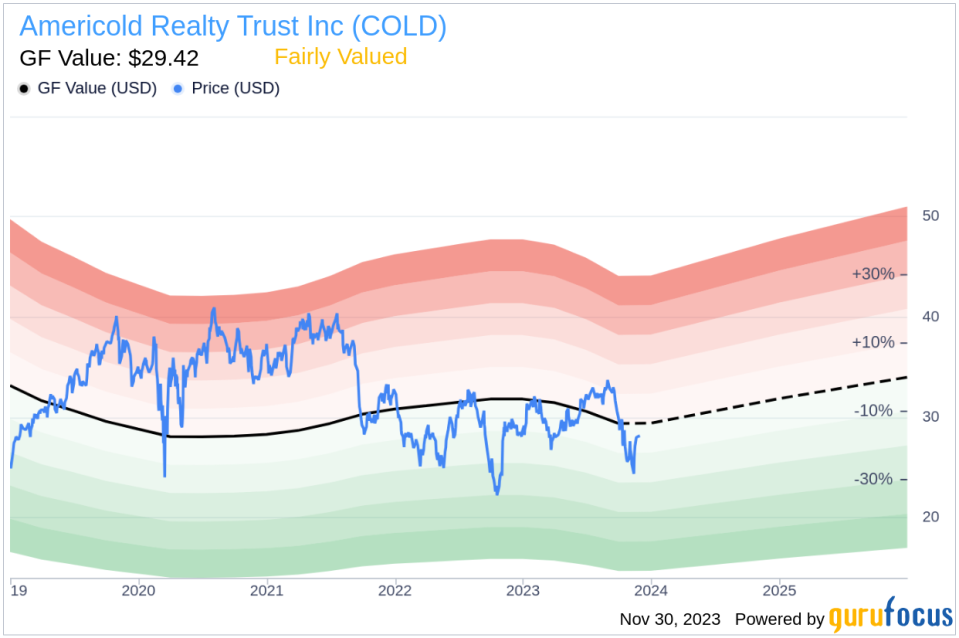

On the day of the sale, shares of Americold Realty Trust Inc were trading at $28.22, giving the company a market cap of $7.989 billion. This price point is slightly below the GuruFocus Value (GF Value) of $29.42, indicating that the stock is Fairly Valued based on its intrinsic value estimate.

The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business estimates from analysts. With a price-to-GF-Value ratio of 0.96, Americold's stock appears to be trading in line with its estimated fair value, suggesting that there is no significant undervaluation or overvaluation at the current price level.

However, the insider sell by Robert Chambers could be interpreted in various ways. It might signal that the insider believes the stock has limited upside potential in the near term or that personal financial planning necessitated the sale. Without additional insider buys to counterbalance the sell, investors may remain cautious.

The insider trend image above provides a visual representation of the insider buying and selling activities over the past year. The lack of insider buying could be a point of concern for potential investors, as insider purchases are often seen as a sign of confidence in the company's future performance.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value. The proximity of the current price to the GF Value suggests that the market has efficiently priced Americold's stock, taking into account its historical performance and future growth prospects.

Conclusion

The sale of 9,100 shares by EVP Robert Chambers is a notable event for Americold Realty Trust Inc, as it represents the only insider transaction within the past year. While the stock appears to be fairly valued according to the GF Value, the lack of insider buying could be a signal for investors to watch the company closely for further indications of its direction. As always, insider transactions are just one piece of the puzzle when evaluating a stock, and investors should consider a wide range of factors, including company fundamentals, industry trends, and broader market conditions, before making investment decisions.

For those interested in Americold Realty Trust Inc, it will be important to monitor the company's performance in the coming quarters, as well as any additional insider transactions that could provide further clues about the confidence levels of those closest to the company's operations.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.