Insider Sell: EVP Ryan Ostrom Offloads Shares of Jack In The Box Inc

Jack In The Box Inc (NASDAQ:JACK), a prominent player in the fast-food industry, has witnessed a notable insider transaction. Ryan Ostrom, the company's Executive Vice President, Chief Marketing & Digital Officer, has sold 1,655 shares of the company on November 21, 2023. This move by a key insider has sparked interest among investors and market analysts, prompting a closer look at the implications of such insider activities on the stock's performance and valuation.

Before delving into the analysis, it is essential to understand who Ryan Ostrom is within the Jack In The Box Inc corporate structure. Ostrom, as the EVP, Chief Marketing & Digital Officer, plays a significant role in shaping the company's marketing strategies and digital initiatives. His actions and decisions can have a substantial impact on the company's brand image, customer engagement, and ultimately, its financial performance.

Jack In The Box Inc operates and franchises Jack In The Box restaurants, one of the nation's largest hamburger chains, with a broad selection of innovative products targeted at the fast-food consumer. The company also operates Qdoba Mexican Eats, a leader in fast-casual dining, with an emphasis on fresh and flavorful Mexican-inspired menu items.

Now, let's explore the insider trading activity. Over the past year, Ryan Ostrom has sold a total of 1,959 shares and has not made any purchases. This could signal a lack of confidence from the insider in the company's short-term growth prospects or simply a personal financial decision. However, without additional context, it is challenging to determine the exact motivation behind these sales.

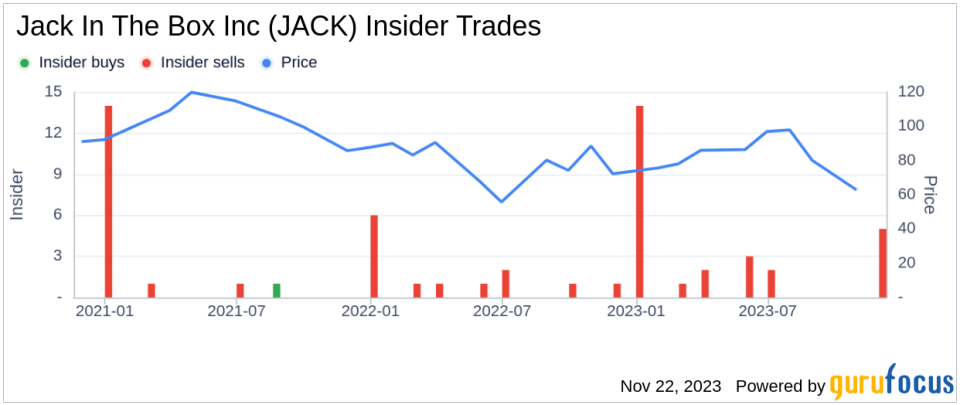

Looking at the broader insider trends for Jack In The Box Inc, there have been no insider buys over the past year, contrasted with 27 insider sells. This pattern of behavior among insiders might raise questions about their collective outlook on the company's future performance.

On the valuation front, shares of Jack In The Box Inc were trading at $68.01 on the day of Ostrom's recent sale, giving the company a market cap of $1.410 billion. The price-earnings ratio stands at 9.49, which is lower than the industry median of 23.66 and also below the company's historical median price-earnings ratio. This suggests that the stock may be undervalued when compared to its peers and its own trading history.

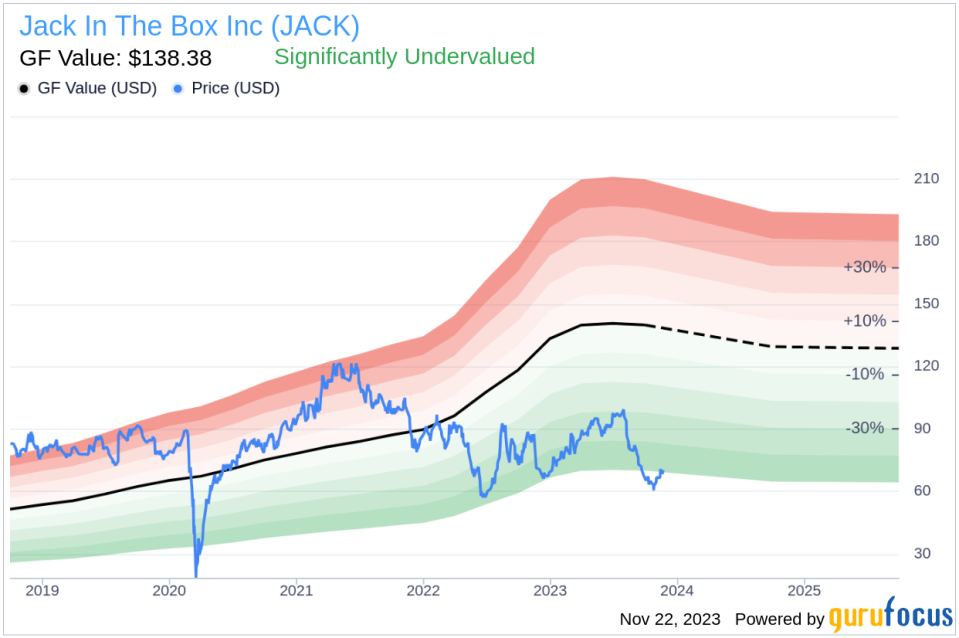

Moreover, with a price of $68.01 and a GuruFocus Value of $138.38, Jack In The Box Inc has a price-to-GF-Value ratio of 0.49. This indicates that the stock is significantly undervalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the selling pattern, which could be interpreted as a bearish signal by some investors. However, it is crucial to consider that insider sales can occur for various reasons that may not necessarily reflect on the company's financial health or future prospects.

The GF Value image further illustrates the disparity between the current stock price and the estimated intrinsic value, suggesting that Jack In The Box Inc may be a compelling investment opportunity for value investors.

In conclusion, the recent insider sell by EVP Ryan Ostrom at Jack In The Box Inc has brought the company into the spotlight. While insider sells can be a red flag for potential investors, the significantly undervalued status of the stock based on its GF Value and low price-earnings ratio compared to the industry median may offer a counter-narrative. Investors should weigh these factors, along with the company's overall financial health and growth prospects, before making any investment decisions. As always, it is recommended to conduct thorough research and consider seeking advice from financial professionals.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.