Insider Sell: Exec. Chairman & CEO D Bidzos Sells 15,000 Shares of VeriSign Inc (VRSN)

In a notable insider transaction, D Bidzos, the Executive Chairman and CEO of VeriSign Inc, sold 15,000 shares of the company on November 16, 2023. This move has caught the attention of investors and market analysts, as insider trades can often provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is D Bidzos of VeriSign Inc?

D. Bidzos is a prominent figure in the internet infrastructure industry, having served as the Executive Chairman and CEO of VeriSign Inc. Under his leadership, VeriSign has become a global provider of domain name registry services and internet security, ensuring the stability of key internet services. Bidzos's tenure has been marked by strategic decisions that have shaped the company's growth and its position in the market.

VeriSign Inc's Business Description

VeriSign Inc is a leader in the domain name registry services and internet security, providing a critical layer of the internet's infrastructure. The company operates a diverse array of network infrastructure, including two of the world's 13 Internet root servers, and is responsible for the registry of several top-level domains such as .com and .net. VeriSign's services ensure the security, stability, and resiliency of key internet operations, which is essential for the smooth functioning of the digital economy.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving high-ranking executives like D Bidzos, are closely monitored by investors as they can signal insider perspectives on the company's future. In the case of VeriSign Inc, the insider has sold a significant number of shares over the past year, with 159,000 shares sold and no shares purchased. This pattern of selling could suggest that the insider is taking profits or reallocating personal investment portfolios, rather than reflecting a lack of confidence in the company's future prospects.

On the day of the insider's recent sale, VeriSign Inc's shares were trading at $209.04, giving the company a market cap of $21.371 billion. The price-earnings ratio stands at 29.82, which is higher than both the industry median of 26.58 and the company's historical median. This elevated P/E ratio could indicate that the market has high expectations for the company's earnings growth or that the stock is priced at a premium compared to its peers.

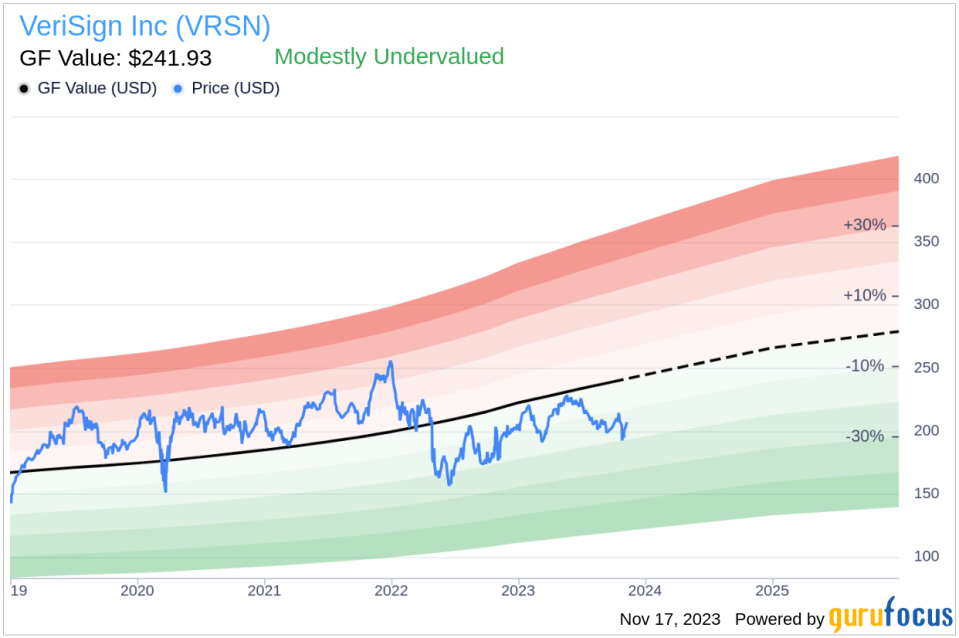

However, when considering the GuruFocus Value (GF Value) of $241.93, VeriSign Inc appears to be modestly undervalued with a price-to-GF-Value ratio of 0.86. The GF Value is a composite of historical trading multiples, an adjustment factor based on past performance, and future business estimates, suggesting that the stock may have room for price appreciation.

Insider Trends

The insider transaction history for VeriSign Inc shows a clear trend of insider selling, with 59 insider sells and no insider buys over the past year. This consistent selling activity could be interpreted in various ways, but without insider buys, it does not necessarily indicate a strong vote of confidence from insiders.

Conclusion

The recent insider sell by D Bidzos, along with the broader trend of insider selling at VeriSign Inc, may raise questions among investors. However, the company's strong position in the internet infrastructure industry and the current valuation metrics suggest that the stock may still be an attractive investment opportunity. Investors should consider the insider selling patterns in the context of the company's overall financial health, market position, and future growth prospects. As always, individual investment decisions should be made based on thorough analysis and personal investment goals.

It's important to note that insider selling does not always indicate a problem within a company. Executives may sell shares for personal reasons, such as diversifying their investment portfolio, funding personal expenses, or tax planning. Therefore, while insider transactions are an important factor to consider, they should not be the sole basis for investment decisions.

Investors interested in VeriSign Inc should continue to monitor insider transactions, along with other financial metrics and market trends, to make informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.