Insider Sell: Executive Chairman Mike Chang Sells 30,000 Shares of Alpha & Omega ...

On September 26, 2023, Mike Chang, the Executive Chairman and 10% Owner of Alpha & Omega Semiconductor Ltd (NASDAQ:AOSL), sold 30,000 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

Mike Chang is a seasoned executive with a wealth of experience in the semiconductor industry. As the Executive Chairman of Alpha & Omega Semiconductor Ltd, he plays a pivotal role in the company's strategic decisions and overall direction. His insider trades, therefore, provide valuable insights into the company's performance and future prospects.

Alpha & Omega Semiconductor Ltd is a leading global designer, developer, and supplier of a broad range of power semiconductors. The company's portfolio of products includes power discretes, power ICs, and certain product categories of power MOSFETs. These products are integral to a wide range of applications, including computing, consumer electronics, motor controls, industrial, and automotive.

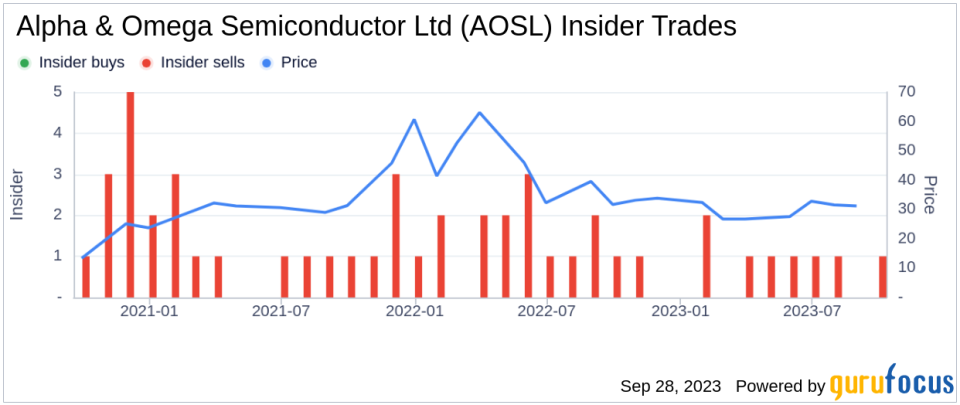

Over the past year, the insider has sold a total of 116,400 shares and has not made any purchases. This trend is mirrored in the company's overall insider transactions, with 10 insider sells and 0 insider buys over the same period.

The relationship between insider transactions and the stock price is often a key indicator of a company's health. In the case of Alpha & Omega Semiconductor Ltd, the stock was trading at $28.64 per share on the day of the insider's recent sell, giving the company a market cap of $797.665 million.

The company's price-earnings ratio stands at 77.81, significantly higher than the industry median of 23.75 and the companys historical median price-earnings ratio. This suggests that the stock is currently overvalued compared to its peers and its own historical performance.

However, the company's price-to-GF-Value ratio of 0.92 indicates that the stock is fairly valued based on its GF Value. The GF Value is a proprietary estimate of intrinsic value developed by GuruFocus, taking into account historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

In conclusion, the recent insider sell by Mike Chang, coupled with the company's high price-earnings ratio, may raise some concerns for potential investors. However, the stock's fair GF Value suggests that it may still hold potential for long-term investors. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.