Insider Sell: Executive Chairman Vladimir Shmunis Sells 67,725 Shares of RingCentral Inc (RNG)

Executive Chairman Vladimir Shmunis has recently made a significant stock transaction, selling 67,725 shares of RingCentral Inc (NYSE:RNG) on November 22, 2023. This move by the insider has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is Vladimir Shmunis of RingCentral Inc?

Vladimir Shmunis is the co-founder and Executive Chairman of RingCentral Inc, a leading provider of global enterprise cloud communications, collaboration, and contact center solutions. Shmunis has been at the helm of the company since its inception, guiding it through significant growth phases and technological advancements. His role has been pivotal in shaping the company's strategic direction and in ensuring that RingCentral remains at the forefront of the unified communications as a service (UCaaS) industry.

RingCentral Inc's Business Description

RingCentral Inc is a renowned name in the field of cloud-based communication and collaboration solutions for businesses. The company's platform offers a wide array of services including voice, video, team messaging, customer engagement, and contact center solutions. RingCentral's innovative and scalable products enable organizations to enhance their communication infrastructure without the need for traditional on-premise hardware. With a focus on integration, mobility, and ease of use, RingCentral's solutions are designed to meet the demands of modern work environments, where remote work and team collaboration have become increasingly prevalent.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving high-ranking executives, can be a strong indicator of a company's internal perspective on its stock's value. In the case of RingCentral Inc, the insider, Vladimir Shmunis, has sold a total of 242,267 shares over the past year without purchasing any shares. This pattern of behavior could suggest that the insider may perceive the stock's current price or future prospects as less favorable, or it could be part of a personal financial management strategy.

On the day of the insider's recent sale, shares of RingCentral Inc were trading at $28.95, giving the company a market cap of $2.747 billion. This price point is significantly below the GuruFocus Value (GF Value) of $87.00, indicating a price-to-GF-Value ratio of 0.33. According to GuruFocus, this positions the stock as a "Possible Value Trap, Think Twice," suggesting that investors should be cautious and conduct further analysis before considering an investment in RingCentral Inc.

The GF Value is a proprietary metric that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The substantial gap between the current trading price and the GF Value could imply that the market is undervaluing the stock, or it could reflect underlying challenges that the company may face.

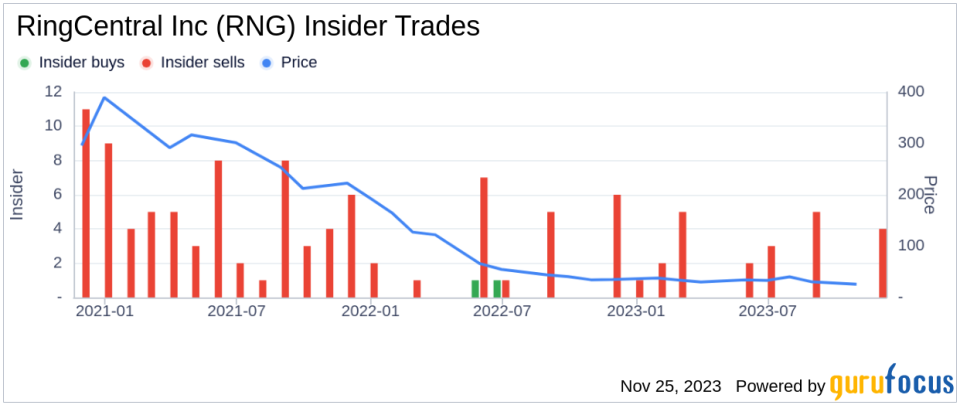

The insider trend image above illustrates the recent selling activity by insiders at RingCentral Inc. The absence of insider buys over the past year, coupled with the consistent selling, may raise questions about insider confidence in the stock's potential for appreciation.

The GF Value image provides a visual representation of the stock's valuation in relation to its intrinsic value estimate. The current market price's significant deviation from the GF Value suggests that the stock may be undervalued, but the insider selling activity could indicate that there are other factors at play that investors should be aware of.

Conclusion

The recent insider sell by Vladimir Shmunis is a noteworthy event for current and potential investors of RingCentral Inc. While the stock appears to be trading at a substantial discount according to the GF Value, the lack of insider buying and the pattern of insider selling over the past year could be a signal for investors to proceed with caution. It is essential for investors to consider not only the insider transactions but also the broader market conditions, the company's financial health, and its growth prospects before making any investment decisions.

As with any investment, due diligence is key, and insider transactions are just one piece of the puzzle. Investors should also review the company's recent earnings reports, analyst forecasts, competitive landscape, and overall market trends to form a comprehensive view of RingCentral Inc's potential as an investment opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.