Insider Sell: Executive Vice President Patrick Lord Sells Shares of Lam Research Corp (LRCX)

Lam Research Corp (NASDAQ:LRCX), a leading supplier of wafer fabrication equipment and services to the global semiconductor industry, has recently witnessed an insider sell that has caught the attention of investors and market analysts. Executive Vice President Patrick Lord sold 2,128 shares of the company on December 14, 2023. This transaction has prompted a closer look into the insider's trading history, the company's business operations, and the potential implications of such insider activities on the stock's valuation and price.

Who is Patrick Lord of Lam Research Corp?

Patrick Lord serves as the Executive Vice President of Lam Research Corp, a key figure in the company's executive leadership team. His role involves overseeing critical aspects of the company's operations and strategic initiatives. With a deep understanding of the semiconductor industry and a track record of leadership within the company, Lord's actions, particularly in the stock market, are closely monitored for insights into the company's performance and future prospects.

Lam Research Corp's Business Description

Lam Research Corp is a global leader in the semiconductor industry, providing market-leading equipment and services for wafer processing. The company's innovative solutions are integral to the fabrication of semiconductor devices, which are essential components in a wide array of electronic products. Lam Research's offerings include etch and deposition systems that help create intricate patterns on silicon wafers, a critical step in the semiconductor manufacturing process. The company's technology enables the production of smaller, faster, and more complex devices, catering to the ever-increasing demand for advanced electronics.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

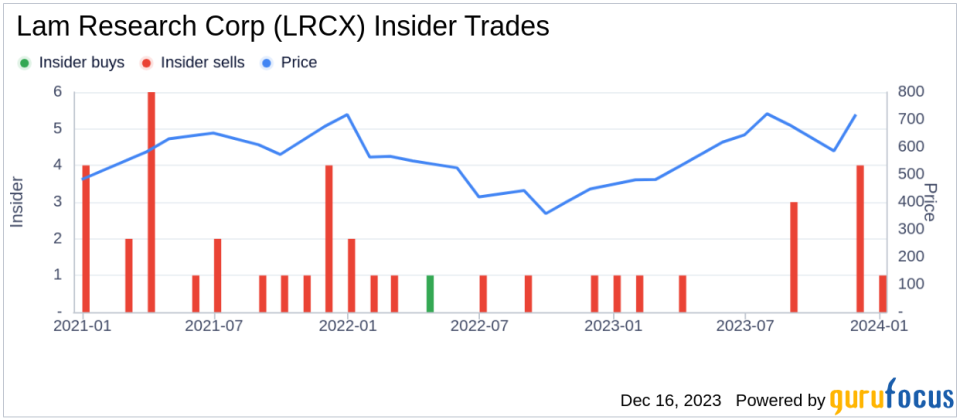

Insider trading activities, such as the recent sale by Executive Vice President Patrick Lord, can provide valuable insights into a company's internal perspective on its stock's valuation and future performance. Over the past year, Patrick Lord has sold a total of 9,509 shares and has not made any purchases. This one-sided transaction history may suggest that the insider perceives the stock's current price as favorable for selling rather than buying.

The insider transaction history for Lam Research Corp shows a trend of more insider selling than buying over the past year, with 12 insider sells and no insider buys. This pattern could indicate that insiders, including Patrick Lord, may believe that the stock is fully valued or potentially overvalued at current prices, prompting them to lock in profits.

On the day of the insider's recent sale, shares of Lam Research Corp were trading at $750.09, giving the company a substantial market cap of $101,930,569,000. The price-earnings ratio stood at 26.30, slightly lower than the industry median of 26.47 but higher than the company's historical median price-earnings ratio. This suggests that while the stock is trading at a reasonable valuation relative to its peers, it may be slightly overpriced based on its own historical standards.

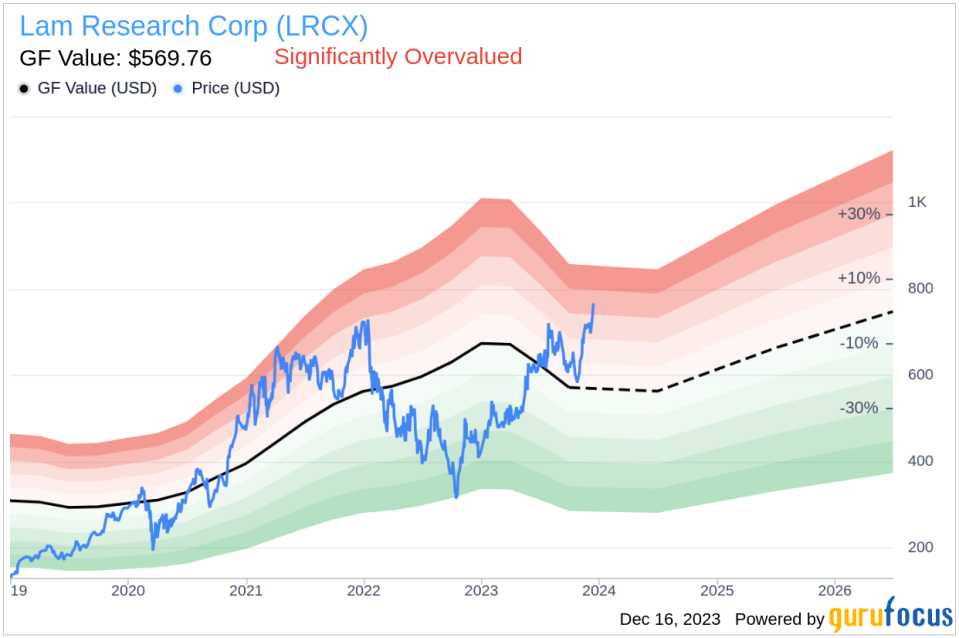

Moreover, with a price of $750.09 and a GuruFocus Value of $569.76, Lam Research Corp has a price-to-GF-Value ratio of 1.32, indicating that the stock is Significantly Overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Considering the GF Value and the insider's recent sell activity, investors may interpret this as a signal that the stock's current price exceeds its intrinsic value, suggesting caution for those considering buying at these levels.

Insider Trend Image Analysis

The insider trend image above provides a visual representation of the selling and buying activities of insiders at Lam Research Corp. The absence of insider buys and the presence of consistent sells over the past year reinforce the notion that insiders may have concerns about the stock's future appreciation potential or believe that the current market conditions offer an opportune time to realize gains.

GF Value Image Analysis

The GF Value image illustrates the disparity between the stock's current price and its estimated intrinsic value. The significant overvaluation based on the GF Value metric suggests that the stock's price may be ahead of its fundamental worth, which could be a contributing factor to the insider's decision to sell shares.

In conclusion, the recent insider sell by Executive Vice President Patrick Lord at Lam Research Corp, along with the analysis of insider trends and the company's valuation, provides a comprehensive picture for investors. While insider selling does not always indicate a bearish outlook, the combination of the sell activity, the stock's high price-to-GF-Value ratio, and the absence of insider buying over the past year could be interpreted as cautionary signals. Investors should consider these factors, along with broader market conditions and individual investment strategies, when evaluating Lam Research Corp's stock for their portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.