Insider Sell: Global Chief Comm. Officer Julie Eddleman Sells 4,971 Shares of DoubleVerify ...

Julie Eddleman, the Global Chief Communications Officer of DoubleVerify Holdings Inc (NYSE:DV), has recently sold 4,971 shares of the company's stock. The transaction took place on November 14, 2023, and has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's health and future performance.

Who is Julie Eddleman?

Julie Eddleman is a seasoned executive with a wealth of experience in the advertising and marketing industry. As the Global Chief Communications Officer at DoubleVerify Holdings Inc, Eddleman plays a crucial role in shaping the company's strategic messaging and enhancing its reputation in the market. Her expertise in digital marketing and brand strategy is instrumental in driving DoubleVerify's growth and maintaining its position as a leader in digital media measurement and analytics.

About DoubleVerify Holdings Inc

DoubleVerify Holdings Inc is a software platform that provides online media verification and campaign effectiveness solutions for digital advertisers, publishers, and ad tech companies. The company's suite of products and services is designed to ensure ad viewability, brand safety, fraud protection, and accurate impression delivery, helping clients optimize their online advertising efforts and maximize return on investment. With the rise of digital advertising, DoubleVerify's role in the ecosystem has become increasingly important, making it a key player in the industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly sales, can provide valuable insights into a company's internal perspective. Over the past year, Julie Eddleman has sold a total of 25,121 shares and has not made any purchases. This pattern of selling could be interpreted in various ways; however, without additional context, it is challenging to draw definitive conclusions. Insiders may sell shares for personal financial planning, diversification, or other non-company related reasons.

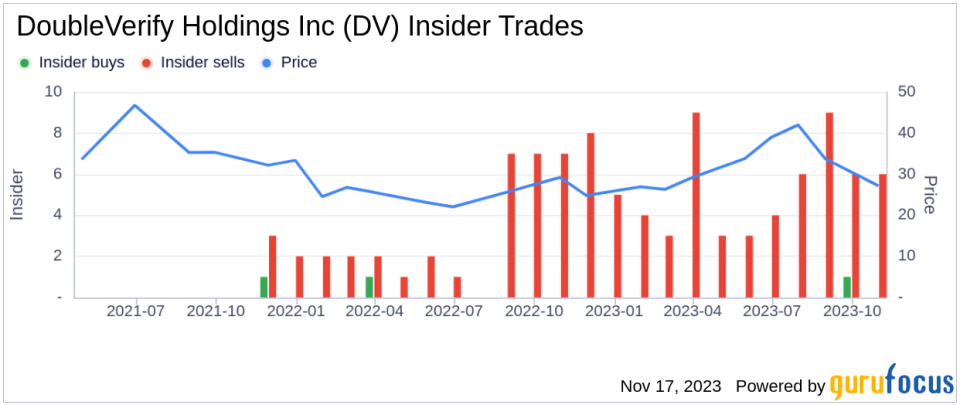

The insider transaction history for DoubleVerify Holdings Inc shows a significant imbalance between insider sells and buys, with only 1 insider buy compared to 65 insider sells over the past year. This trend could suggest that insiders, on the whole, are choosing to decrease their holdings, potentially signaling a cautious or bearish outlook on the company's near-term prospects.

On the day of Eddleman's recent sale, shares of DoubleVerify Holdings Inc were trading at $31.29, giving the company a market cap of $5.289 billion. The price-earnings ratio of 97.25 is notably higher than the industry median of 26.59, indicating that the stock may be priced at a premium compared to its peers. However, it is lower than the company's historical median price-earnings ratio, suggesting some level of undervaluation relative to its own past performance.

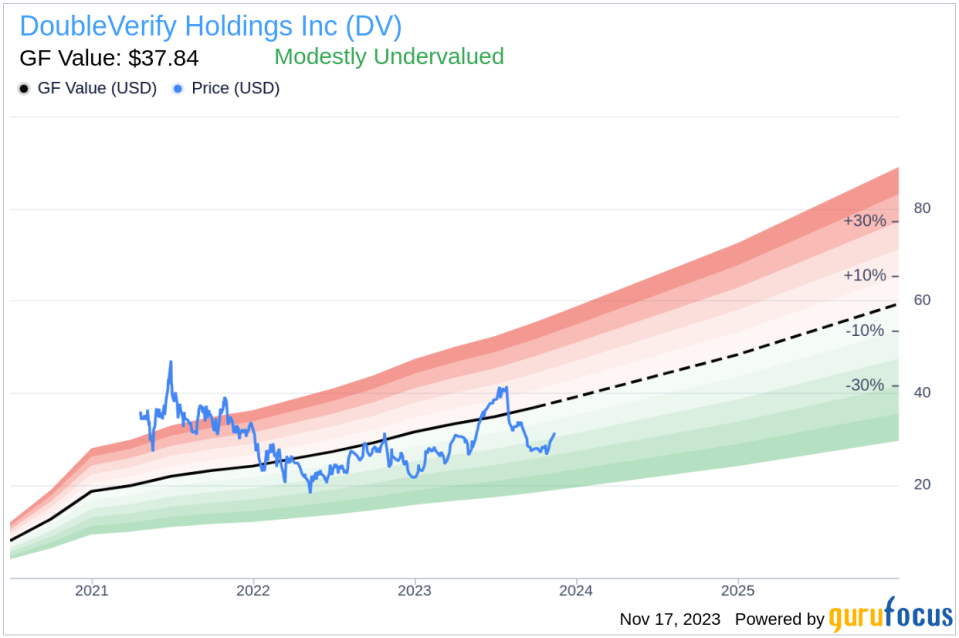

Considering the price-to-GF-Value ratio of 0.83, DoubleVerify Holdings Inc appears to be modestly undervalued based on its GF Value. The GF Value, which stands at $37.84, is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time. The predominance of selling transactions could be a point of concern for potential investors, as it may imply that those with the most intimate knowledge of the company's workings are choosing to liquidate their positions.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. The current market price below the GF Value suggests that the stock might be an attractive buy for value investors, assuming the company's fundamentals remain strong and the market eventually recognizes its true worth.

Conclusion

Julie Eddleman's recent sale of 4,971 shares of DoubleVerify Holdings Inc is a transaction that warrants attention, especially when viewed in the context of the broader insider selling trend at the company. While the stock appears modestly undervalued based on the GF Value, the high price-earnings ratio and the pattern of insider sales could be a cause for investor caution. As always, it is essential for investors to conduct their own due diligence, considering both insider activities and comprehensive analysis of the company's financial health and market position before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.