Insider Sell: GoDaddy Inc's COO Roger Chen Sells 21,165 Shares

GoDaddy Inc (NYSE:GDDY), a leading company in the domain registration and web hosting industry, has recently witnessed a significant insider sell by its Chief Operating Officer, Roger Chen. On November 14, 2023, Roger Chen sold 21,165 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Roger Chen?

Roger Chen has been an integral part of GoDaddy Inc, serving as the Chief Operating Officer. His role within the company involves overseeing the day-to-day administrative and operational functions, a position that grants him an in-depth understanding of the company's performance and future prospects. Chen's actions, particularly in the stock market, are closely watched as they may reflect his confidence in the company's current strategy and outlook.

GoDaddy Inc's Business Description

GoDaddy Inc is a publicly traded company known for providing a variety of internet services to small businesses and entrepreneurs. The company's offerings include domain name registration, website hosting, website building tools, and online marketing services. GoDaddy has established itself as a one-stop-shop for individuals and businesses looking to establish and grow their online presence. With a customer-centric approach and a suite of comprehensive tools and services, GoDaddy has carved out a significant niche in the competitive web services market.

Analysis of Insider Buy/Sell and Relationship with Stock Price

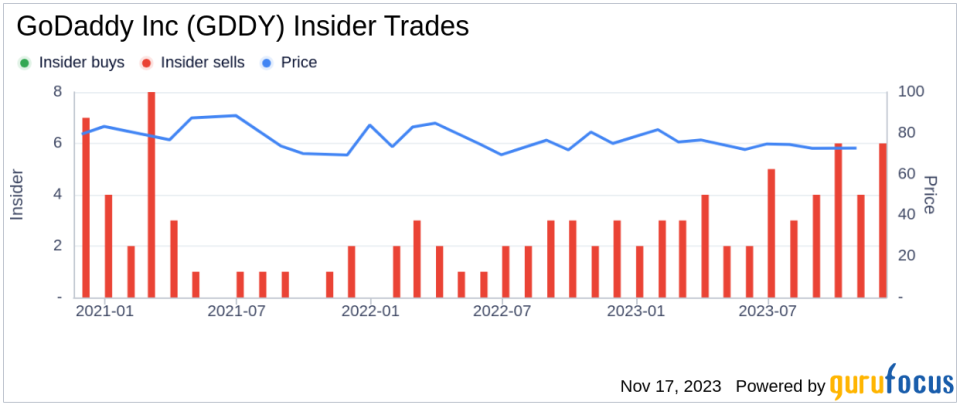

Insider transactions are often considered a barometer of a company's health and future performance. Over the past year, Roger Chen has sold a total of 87,251 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in various ways. While some may see it as a lack of confidence in the company's future growth, it is also possible that the insider is diversifying their portfolio or addressing personal financial planning needs.

The relationship between insider sells and the stock price can be complex. While a sell-off by insiders might lead to negative market sentiment, it is essential to consider the context and volume of the transactions. In the case of GoDaddy Inc, there have been 46 insider sells over the past year with no insider buys. This trend could suggest that insiders, including Roger Chen, may believe that the stock is currently valued fairly, and they are taking the opportunity to realize gains.

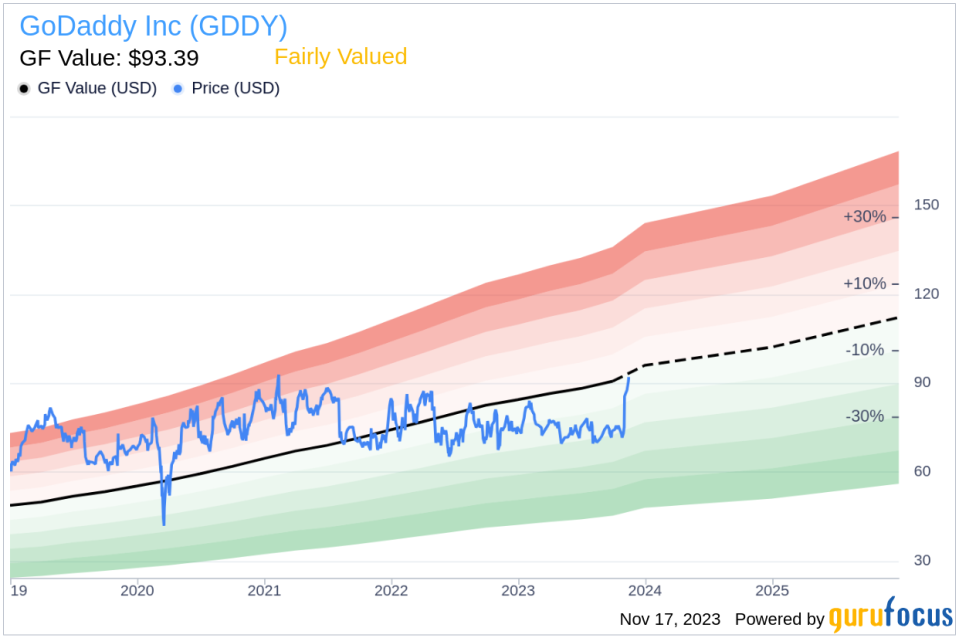

On the day of Roger Chen's recent sell, shares of GoDaddy Inc were trading at $90, giving the company a market cap of $12,988.269 million. The price-earnings ratio stands at 39.58, which is higher than the industry median of 26.59 but lower than the company's historical median price-earnings ratio. This indicates that while the stock may be trading at a premium compared to the industry, it is relatively lower than its historical valuation.

With a price of $90 and a GuruFocus Value of $93.39, GoDaddy Inc has a price-to-GF-Value ratio of 0.96, suggesting that the stock is Fairly Valued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling pattern by insiders at GoDaddy Inc. The absence of insider buys may raise questions among investors, but it is crucial to analyze these trends alongside the company's performance and market conditions.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. The close proximity of the current price to the GF Value indicates that the market is pricing the stock in line with its estimated true worth.

Conclusion

The recent insider sell by Roger Chen at GoDaddy Inc is a significant event that warrants attention from investors. While the insider's sell-off may not necessarily indicate a bearish outlook for the company, it is a reminder for shareholders to consider the broader context of insider actions, the company's valuation, and market conditions. As GoDaddy Inc continues to navigate the competitive landscape of web services, investors should keep a close eye on insider trends and valuation metrics to make informed investment decisions.

It is also worth noting that insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential. A comprehensive analysis should also include an examination of the company's financial health, growth prospects, competitive position, and the overall market environment. By considering these factors, investors can better understand the implications of insider sells and how they fit into the larger picture of their investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.