Insider Sell: Group President Jai Shah Sells 25,000 Shares of Masco Corp (MAS)

Recent filings with the SEC have revealed that Jai Shah, Group President of Masco Corporation (NYSE:MAS), has sold 25,000 shares of the company on December 4, 2023. This transaction has caught the attention of investors and analysts alike, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Jai Shah of Masco Corp?

Jai Shah has been a key executive at Masco Corp, serving as the Group President. His role within the company involves overseeing various strategic initiatives and operations, which gives him a deep understanding of the company's business and market position. Insider sales by high-ranking executives like Shah are closely monitored because they may signal their confidence in the company's current valuation and future performance.

Masco Corp's Business Description

Masco Corp is a global leader in the design, manufacture, and distribution of branded home improvement and building products. The company's portfolio includes a wide range of products such as faucets, cabinetry, architectural coatings, and other hardware-related items. Masco Corp's brands are recognized for their quality, innovation, and performance, which has allowed the company to establish a strong presence in both residential and commercial markets.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can be a valuable indicator of a company's internal perspective on its stock's value. Over the past year, Jai Shah has sold a total of 25,000 shares and has not made any purchases. This one-sided activity could suggest that insiders might believe the stock is fully valued or potentially overvalued at current levels.

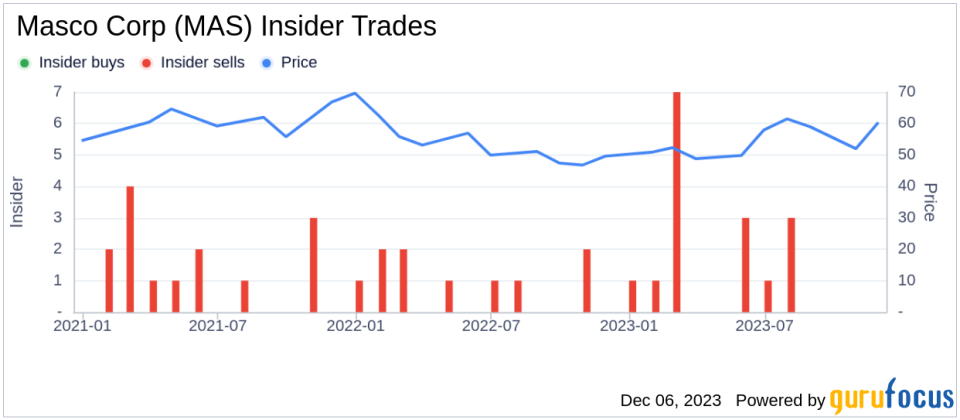

When examining the broader insider transaction history for Masco Corp, we see a pattern of 18 insider sells and no insider buys over the past year. This trend could indicate that insiders are taking advantage of the stock's market performance to realize gains, or they may have concerns about the company's future growth prospects or market conditions.

On the day of Shah's recent sale, Masco Corp shares were trading at $62.38, giving the company a market cap of $13.98 billion. The price-earnings ratio stood at 16.90, which is higher than the industry median of 14.65 but lower than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to its industry peers, it is still below its own historical valuation levels.

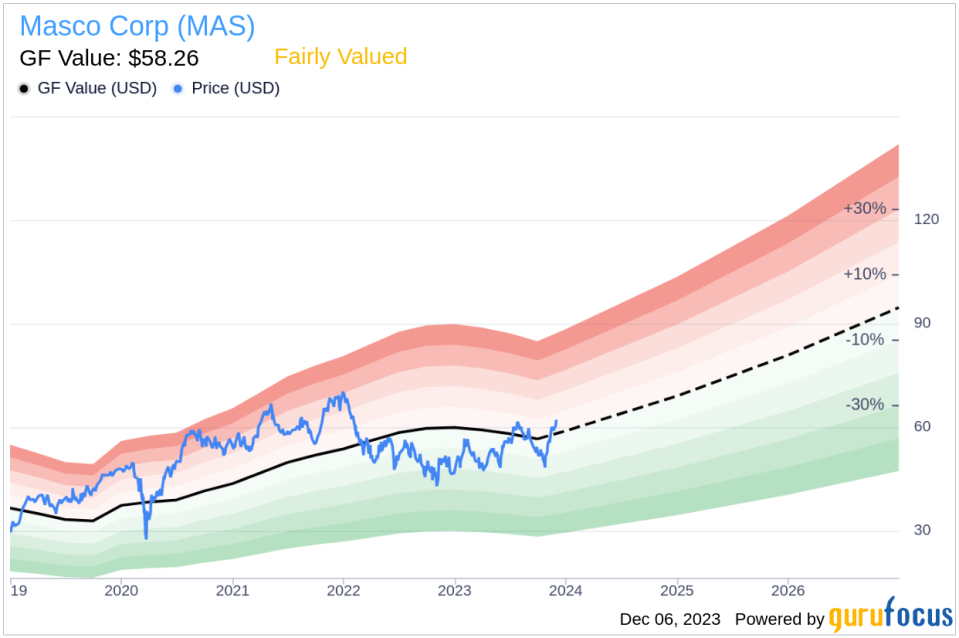

The price-to-GF-Value ratio of 1.07 indicates that Masco Corp is Fairly Valued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. A ratio close to 1 suggests that the stock is trading at a price that is in line with its intrinsic value.

However, it is important to note that insider selling does not always imply a lack of confidence in the company. Executives may sell shares for personal financial planning, diversification, or other non-company related reasons. Therefore, while insider sales can provide context, they should not be the sole factor in investment decisions.

The insider trend image above provides a visual representation of the selling pattern over the past year. The absence of insider buys may raise questions among investors, but it is essential to consider the overall financial health and market conditions when interpreting these actions.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. With the stock being Fairly Valued, it appears that the market has efficiently priced Masco Corp's shares, taking into account its historical performance and future growth expectations.

Conclusion

The recent insider sell by Group President Jai Shah of Masco Corp is a significant event that warrants attention. While the insider's actions may suggest a belief that the stock is adequately valued, investors should also consider the broader market context and the company's fundamentals before making any investment decisions. With Masco Corp's strong brand portfolio and market position, the company remains a key player in the home improvement and building products industry. However, as with any stock, it is crucial to conduct thorough research and consider a multitude of factors beyond insider transactions when evaluating its investment potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.