Insider Sell: Iron Mountain Inc's CEO William Meaney Disposes of Shares

Iron Mountain Inc (NYSE:IRM), a global leader in storage and information management services, has recently witnessed a significant insider sell by its President and CEO, William Meaney. On November 17, 2023, Meaney sold 21,014 shares of the company, a move that has caught the attention of investors and market analysts alike. This article delves into the details of the transaction, the insider's history, and the potential implications for Iron Mountain Inc's stock valuation.

Who is William Meaney of Iron Mountain Inc?

William Meaney has been at the helm of Iron Mountain Inc as President and CEO since 2013. Under his leadership, the company has expanded its global footprint and diversified its services beyond physical document storage to include digital transformation solutions. Meaney's tenure has been marked by strategic acquisitions and a focus on leveraging technology to enhance Iron Mountain's offerings. His experience in the industry and his role in shaping the company's direction make his insider transactions particularly noteworthy to investors.

Iron Mountain Inc's Business Description

Iron Mountain Inc is a storied institution in the realm of records and data management. Founded in 1951, the company has evolved from its roots in physical document storage to become a comprehensive provider of storage and information management services. Iron Mountain's services include records management, data protection and recovery, document management, secure shredding, and data centers. The company serves organizations across various sectors, including government, legal, financial, and healthcare, helping them to protect and manage their information assets.

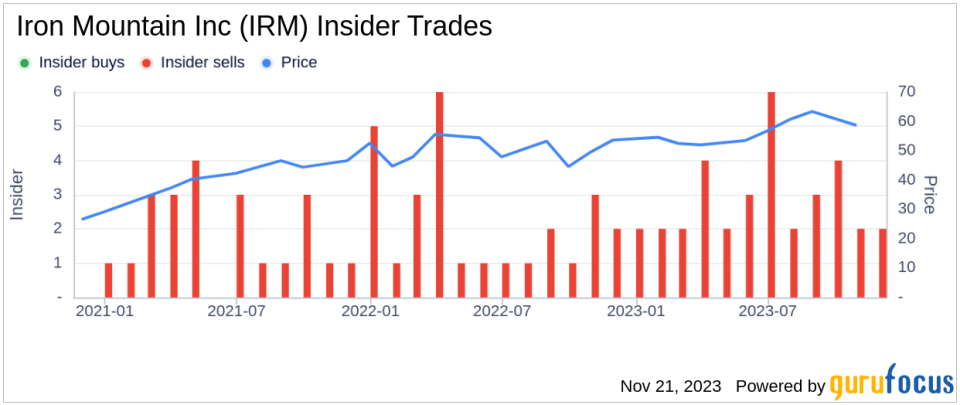

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by William Meaney of 21,014 shares is part of a broader pattern of insider selling at Iron Mountain Inc. Over the past year, Meaney has sold a total of 386,693 shares and has not made any purchases. This one-sided transaction history could signal Meaney's belief that the stock may be fully valued or that he is diversifying his personal investments. However, without additional context, it is challenging to determine the exact motivation behind these sales.

Insider transactions can often provide valuable clues about a company's future prospects. While insider buying is typically seen as a positive sign, indicating that executives are confident in the company's future performance, insider selling is more ambiguous. It can be motivated by a variety of personal or professional reasons that may not necessarily reflect a lack of confidence in the company.

On the day of Meaney's recent sale, Iron Mountain Inc's shares were trading at $62.44, giving the company a market cap of $18.36 billion. This valuation places the stock at a price-earnings ratio of 66.88, significantly higher than the industry median of 17.32 and above the company's historical median price-earnings ratio. Such a high price-earnings ratio could suggest that the stock is overvalued compared to its peers, potentially justifying insider selling.

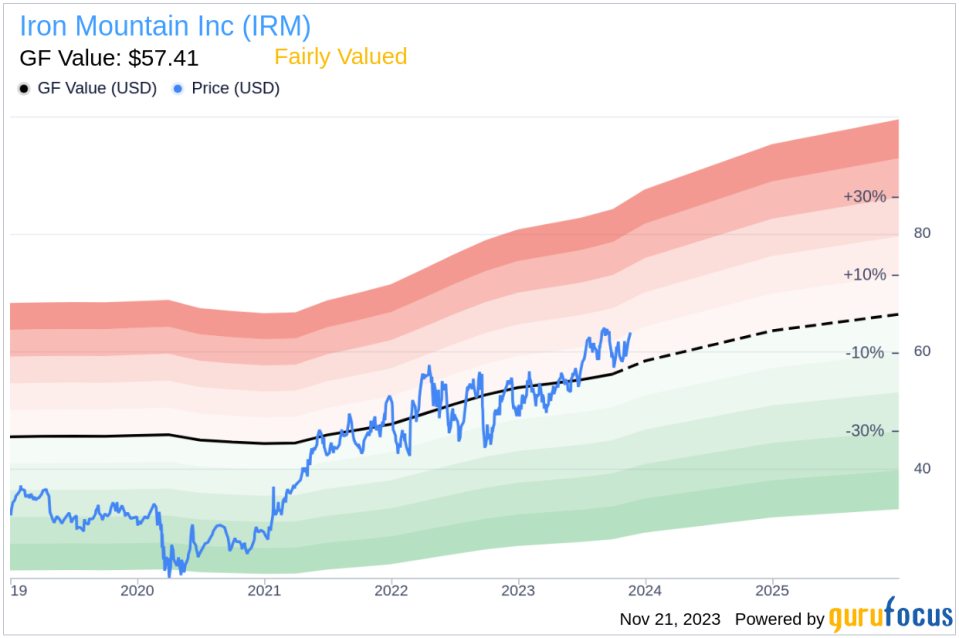

However, when considering the GuruFocus Value (GF Value) of $57.41, Iron Mountain Inc appears to be Fairly Valued with a price-to-GF-Value ratio of 1.09. The GF Value is a proprietary metric that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider trend image above illustrates the recent selling activity by insiders at Iron Mountain Inc. The absence of insider buys over the past year, coupled with the consistent selling, could be interpreted as a cautious signal by market observers.

The GF Value image provides a visual representation of Iron Mountain Inc's stock valuation in relation to its intrinsic value estimate. The stock's proximity to the GF Value suggests that it is not significantly over or undervalued, which may offer some reassurance to investors concerned about the insider selling trend.

Conclusion

William Meaney's recent insider sell of 21,014 shares of Iron Mountain Inc is part of a larger pattern of insider selling at the company. While the high price-earnings ratio might raise questions about the stock's valuation, the GF Value indicates that the stock is fairly valued. Investors should consider the insider selling trend in the context of the company's overall financial health and market position. As with any insider transaction, it is essential to look at the broader picture, including company performance, industry trends, and market conditions, before drawing conclusions about the potential impact on the stock price.

As Iron Mountain Inc continues to navigate the evolving landscape of information management, investors will be watching closely to see how the company's strategy and financial performance align with the insider activity. For now, the market will digest the implications of Meaney's sell-off and await further signals from the company's leadership team.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.