Insider Sell: Isaac Zacharias Sells 4,000 Shares of ShockWave Medical Inc

On September 26, 2023, President and Chief Commercial Officer Isaac Zacharias sold 4,000 shares of ShockWave Medical Inc (NASDAQ:SWAV). This move comes amidst a year where the insider has sold a total of 52,000 shares and purchased none.

Isaac Zacharias is a key figure at ShockWave Medical Inc, serving as the President and Chief Commercial Officer. His role involves overseeing the commercial strategy and operations of the company, making his trading activities particularly noteworthy for investors.

ShockWave Medical Inc is a medical device company that focuses on developing and commercializing products intended to transform the way calcified cardiovascular disease is treated. The company aims to establish a new standard of care for medical device treatment of atherosclerotic cardiovascular disease through its differentiated and proprietary local delivery of sonic pressure waves for the treatment of calcified plaque.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. Let's delve into the details.

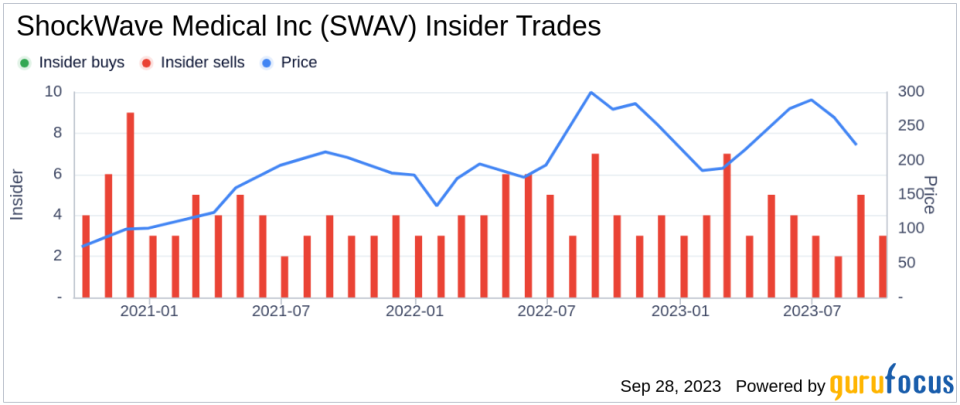

The insider transaction history for ShockWave Medical Inc shows a clear trend of selling over the past year, with 46 insider sells and no insider buys. This could be a potential red flag for investors, as it may indicate that those with intimate knowledge of the company are not confident in its future performance.

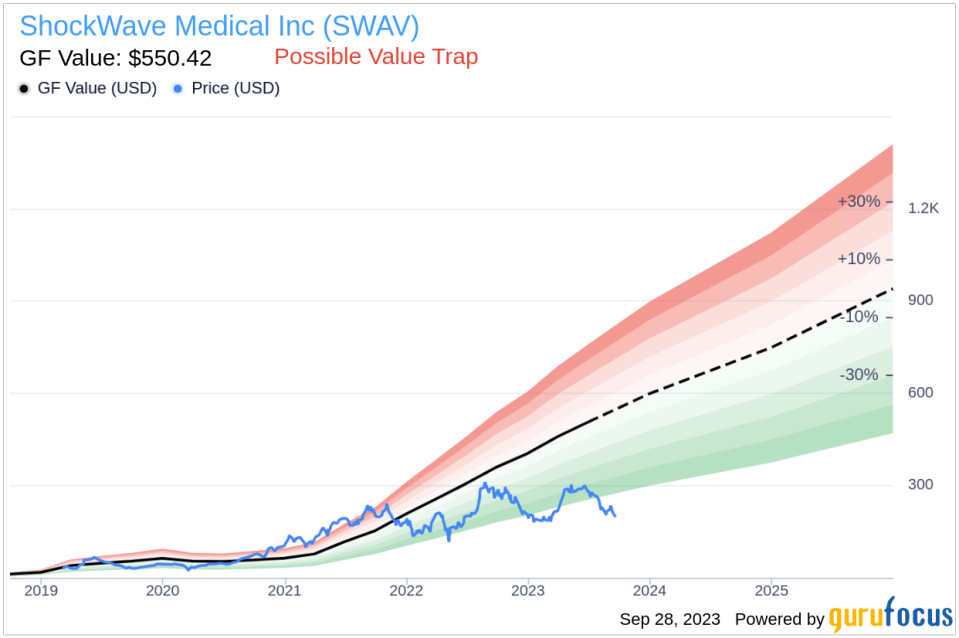

On the day of the insider's recent sell, shares of ShockWave Medical Inc were trading for $192.12, giving the company a market cap of $7.34 billion. This is a significant valuation, especially considering the company's price-earnings ratio of 31.10, which is higher than the industry median of 28.12.

However, according to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, the stock may be a possible value trap. With a price of $192.12 and a GuruFocus Value of $550.42, the stock has a price-to-GF-Value ratio of 0.35, suggesting that investors should think twice before investing.

In conclusion, the insider's recent sell-off, combined with the company's high valuation and potential value trap status, suggests that investors should approach ShockWave Medical Inc with caution. As always, it's crucial to conduct thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.