Insider Sell: Jennifer Rock of Zillow Group Inc Cashes Out 2,222 Shares

In a notable insider transaction, Jennifer Rock, the Chief Accounting Officer of Zillow Group Inc (NASDAQ:Z), sold 2,222 shares of the company on December 6, 2023. This move has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance.

Who is Jennifer Rock?

Jennifer Rock is a key figure at Zillow Group Inc, serving as the Chief Accounting Officer. Her role involves overseeing the financial reporting and compliance, ensuring the accuracy of financial statements, and maintaining the integrity of the company's accounting practices. Rock's position places her in a unique vantage point, with a comprehensive understanding of the company's financial intricacies and strategic direction.

Zillow Group Inc's Business Description

Zillow Group Inc is a leading digital real estate platform that revolutionized the way people buy, sell, rent, and finance homes. The company's portfolio includes Zillow, Trulia, StreetEasy, HotPads, and other prominent real estate and rental marketplaces. Zillow Group leverages technology to empower consumers with unparalleled data, inspiration, and knowledge around homes and connects them with the best local professionals who can help. The company's business model includes selling advertising and providing a suite of marketing software and technology solutions.

Analysis of Insider Buy/Sell and Relationship with Stock Price

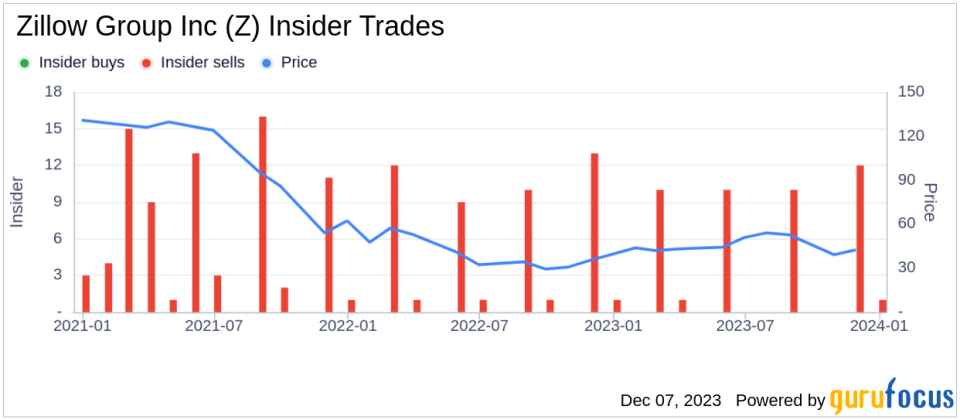

Insider transactions, particularly those involving high-ranking executives, can provide valuable insights into a company's prospects. Over the past year, Jennifer Rock has sold a total of 42,493 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in various ways. While it might raise concerns about the insider's confidence in the company's future, it is also common for executives to sell shares for personal financial planning, diversification, or liquidity reasons.

The broader insider transaction history for Zillow Group Inc shows a trend of more insider selling than buying over the past year, with 45 insider sells and no insider buys. This trend could suggest that insiders, on the whole, believe the stock's current price reflects its fair value or that they anticipate a potential downturn.

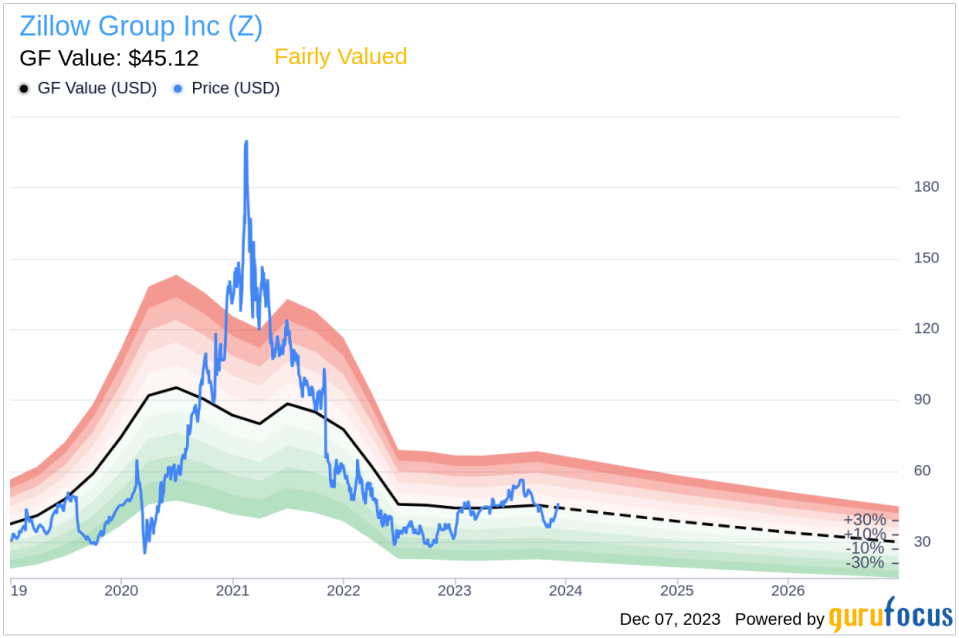

On the day of Rock's recent sale, Zillow Group Inc's shares were trading at $45.19, giving the company a market cap of $10.767 billion. This price point is particularly interesting when considering the GF Value.

The GF Value, an intrinsic value estimate from GuruFocus, suggests that Zillow Group Inc is Fairly Valued with a price-to-GF-Value ratio of 1. This assessment is based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The close alignment between the stock's trading price and the GF Value indicates that the market is pricing Zillow Group Inc's shares in a manner consistent with its historical and expected performance.

However, investors should consider that insider selling, when it occurs in isolation, is not always a definitive indicator of a stock's future movement. It is essential to look at the broader context, including market conditions, company performance, and sector trends. In the case of Zillow Group Inc, the real estate market is subject to cyclical fluctuations and regulatory changes, which could impact the company's performance and, consequently, its stock price.

Conclusion

Jennifer Rock's recent sale of 2,222 shares of Zillow Group Inc is a transaction that warrants attention, but it should be viewed as part of a larger mosaic of financial data. While the insider has been selling shares over the past year, the stock remains Fairly Valued according to the GF Value. Investors should continue to monitor insider activities, but also consider a wide range of factors, including market trends, company earnings, and sector-specific news, before making investment decisions.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential. A comprehensive analysis that includes financial metrics, industry position, and macroeconomic factors is crucial for making informed investment choices. For Zillow Group Inc, the alignment of its stock price with the GF Value suggests that the market has confidence in its valuation, but the insider selling trend may still be a point of consideration for current and potential shareholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.