Insider Sell: Joseph Lyon of Corcept Therapeutics Inc (CORT) Sells 5,000 Shares

Joseph Lyon, the Chief Accounting Officer of Corcept Therapeutics Inc, has recently made a significant stock transaction, selling 5,000 shares of the company on December 4, 2023. This move by an insider has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's financial health and future prospects.

Who is Joseph Lyon of Corcept Therapeutics Inc?

Joseph Lyon has been serving as the Chief Accounting Officer at Corcept Therapeutics Inc. His role within the company is crucial, overseeing the accounting operations and ensuring that financial statements are accurate and compliant with regulatory standards. Lyon's position gives him an intimate understanding of the company's financials, making his trading activities particularly noteworthy to investors.

Corcept Therapeutics Inc's Business Description

Corcept Therapeutics Inc is a pharmaceutical company focused on the discovery, development, and commercialization of drugs for the treatment of severe metabolic, oncologic, and psychiatric disorders. The company is known for its work on medications that modulate the effects of the hormone cortisol. Corcept's leading product, Korlym, is approved in the United States for the treatment of endogenous Cushing's syndrome. The company's pipeline also includes several other promising drug candidates in various stages of clinical development.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly sales, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company's future, it is also possible that insiders might sell shares for personal financial reasons that have no bearing on their outlook for the company. In the case of Joseph Lyon, the insider has sold 35,000 shares over the past year without purchasing any shares. This pattern of selling could raise questions among investors about the insider's long-term belief in the company's value.

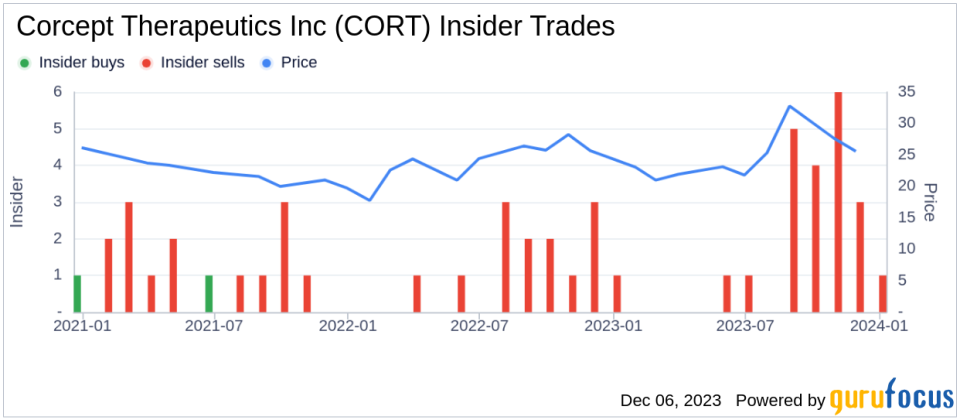

However, it is important to consider the broader context of insider transactions at Corcept Therapeutics Inc. Over the past year, there have been no insider buys and 23 insider sells. This trend suggests that insiders, on the whole, have been more inclined to sell their shares than to acquire more. While this could be a signal for investors to proceed with caution, it is also essential to analyze the company's stock performance and valuation metrics to gain a more comprehensive understanding.

On the day of Lyon's recent sale, Corcept Therapeutics Inc's shares were trading at $26, giving the company a market cap of $2.785 billion. The price-earnings ratio stood at 33.38, slightly higher than the industry median of 31.84 and above the company's historical median. This indicates that the stock was trading at a premium compared to its peers and its own historical valuation.

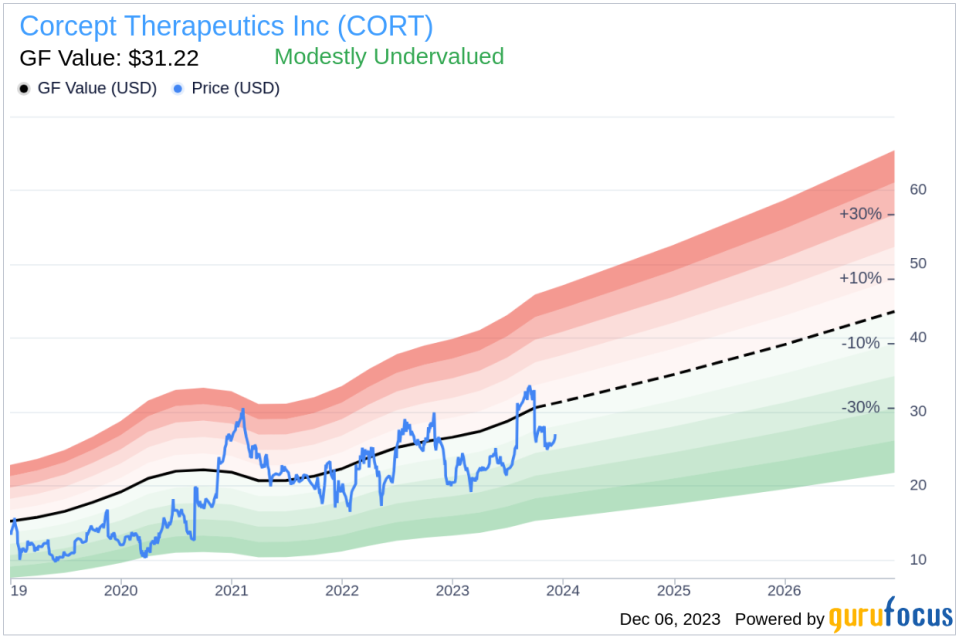

Despite this, the price-to-GF-Value ratio was 0.83, with a GF Value of $31.22, suggesting that the stock was modestly undervalued. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders at Corcept Therapeutics Inc. The absence of buys and the prevalence of sells could be a point of concern for potential investors.

The GF Value image further illustrates the stock's valuation status. Despite the insider selling trend, the stock appears to be trading below its intrinsic value according to GuruFocus's analysis.

Conclusion

Joseph Lyon's recent sale of 5,000 shares of Corcept Therapeutics Inc is a significant event that warrants attention. While the insider's selling activity over the past year may raise questions, it is crucial to consider the company's valuation and stock performance. The modestly undervalued status of the stock based on the GF Value, despite a higher than average price-earnings ratio, suggests that the company may still present a worthwhile opportunity for investors. As always, investors should conduct their own due diligence and consider the broader market context when interpreting insider transactions.

For those interested in following insider activities and understanding their potential impact on stock performance, staying informed through platforms like GuruFocus can provide valuable insights and aid in making informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.