Insider Sell: Joshua Glover Sells 10,693 Shares of Ncino Inc

On November 3, 2023, President & Chief Revenue Officer Joshua Glover sold 10,693 shares of Ncino Inc (NASDAQ:NCNO). This move comes amidst a year where the insider has sold a total of 158,041 shares and purchased none.

Joshua Glover is a key figure at Ncino Inc, serving as the President and Chief Revenue Officer. His role involves overseeing the company's revenue generation strategies and operations, making him a significant player in the company's financial performance.

Ncino Inc is a pioneer in cloud banking. The company offers a bank operating system that accelerates digital transformation for financial institutions. Its platform enables financial institutions to increase transparency, efficiency, and profitability while ensuring regulatory compliance.

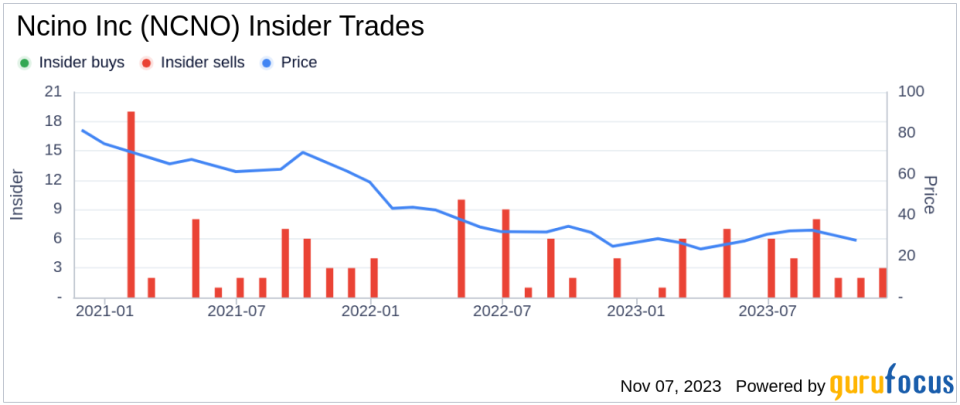

The insider's recent sell-off is part of a broader trend within Ncino Inc. Over the past year, there have been 39 insider sells and no insider buys. This could be indicative of the insider's sentiment towards the company's stock and its future prospects.

The relationship between insider trading and stock price is complex. While it's not uncommon for insiders to sell their shares, a high volume of sales over a short period can sometimes signal a lack of confidence in the company's future performance. However, it's also important to note that insiders may sell shares for reasons unrelated to the company's health, such as personal financial planning.

On the day of the insider's recent sell, Ncino Inc's shares were trading at $28.73, giving the company a market cap of $3.28 billion. Despite the insider's sell-off, the stock appears to be significantly undervalued based on its GuruFocus Value of $59.77.

The GF Value is an intrinsic value estimate developed by GuruFocus. It's calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts. With a price-to-GF-Value ratio of 0.48, Ncino Inc's stock is significantly undervalued.

In conclusion, while the insider's recent sell-off may raise some eyebrows, the stock's current valuation suggests that it could be a good opportunity for investors. As always, potential investors should conduct their own research and consider multiple factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.