Insider Sell: Karin Walker Sells 5,000 Shares of Prothena Corp PLC

On September 19, 2023, Karin Walker, the Chief Accounting Officer of Prothena Corp PLC (NASDAQ:PRTA), sold 5,000 shares of the company. This move is part of a series of transactions made by the insider over the past year, which have seen a total of 85,000 shares sold and no shares purchased.

Karin Walker has been with Prothena Corp PLC for several years, serving in her current role as Chief Accounting Officer. Her responsibilities include overseeing the company's financial reporting, internal controls, and compliance with regulatory standards. Her insider transactions provide valuable insights into the company's financial health and future prospects.

Prothena Corp PLC is a clinical-stage neuroscience company engaged in the discovery and development of novel therapies with the potential to fundamentally change the course of progressive, life-threatening diseases. The company's pipeline includes treatments for diseases such as Parkinson's and Alzheimer's.

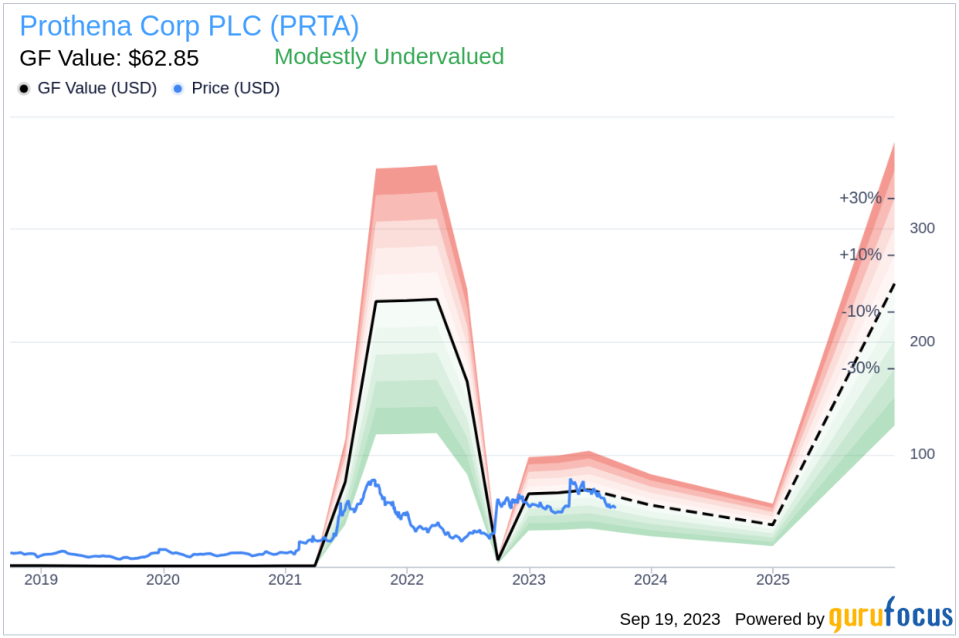

The insider's recent sell transaction raises questions about the company's current valuation and future prospects. On the day of the transaction, Prothena Corp PLC's shares were trading at $52.36, giving the company a market cap of $2.823 billion.

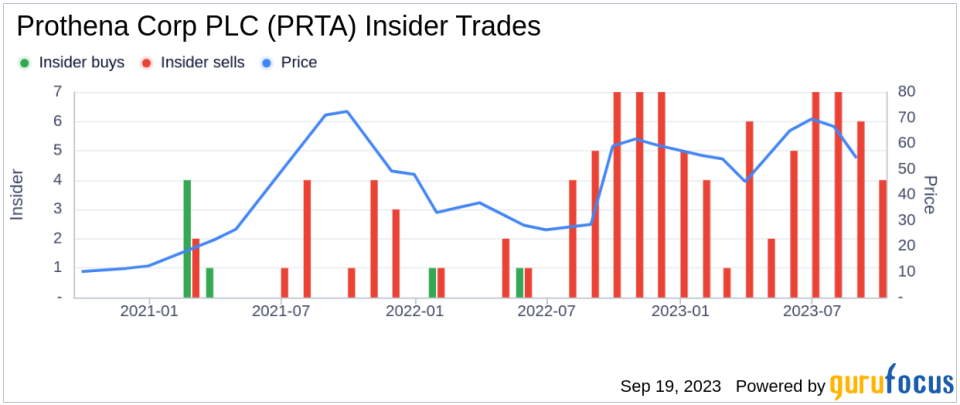

The insider transaction history for Prothena Corp PLC shows a trend of more sells than buys over the past year. There have been 67 insider sells and no insider buys. This could indicate that insiders believe the stock is currently overvalued, or it could simply reflect personal financial decisions by the insiders.

According to the GuruFocus Value, Prothena Corp PLC is currently modestly undervalued. The stock's price-to-GF-Value ratio is 0.83, with a GF Value of $62.85. The GF Value is an intrinsic value estimate that takes into account historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Despite the insider's recent sell transaction, the stock's modest undervaluation could present an opportunity for investors. However, the trend of insider sells over the past year suggests caution. Investors should carefully consider these factors and conduct their own research before making investment decisions.

As always, insider transactions should not be used in isolation to make investment decisions. Instead, they should be used as a starting point for further research into a company's financials, fundamentals, and market conditions.

This article first appeared on GuruFocus.