Insider Sell: Kendra Krugman Sells 2,000 Shares of Carter's Inc

On November 3, 2023, Kendra Krugman, EVP, Retail & Chief Merchandising Officer of Carter's Inc (NYSE:CRI), sold 2,000 shares of the company. This move comes amidst a year where the insider has sold a total of 2,000 shares and purchased none.

Kendra Krugman is a key figure in Carter's Inc, holding the position of EVP, Retail & Chief Merchandising Officer. Her role involves overseeing the retail and merchandising strategies of the company, ensuring that the company's products meet the needs and preferences of its customers.

Carter's Inc is a major player in the apparel industry, specializing in the production of children's clothing, gifts, and accessories. The company operates under two segments: Carter's and OshKosh. The Carter's brand provides apparel for children from newborn to seven years old, while the OshKosh brand offers clothing for children ages newborn to 12 years old.

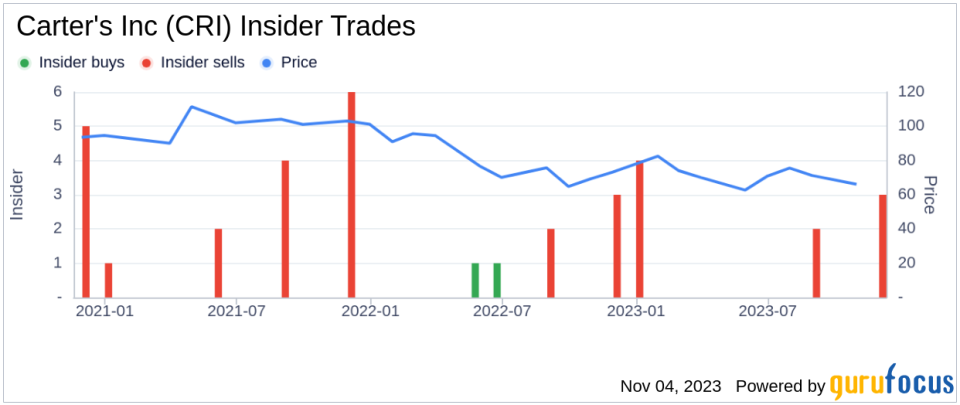

The insider's recent sell has raised some eyebrows, especially considering the insider trends for Carter's Inc. Over the past year, there have been 12 insider sells and no insider buys. This could potentially signal a bearish sentiment among the insiders of the company.

On the day of the insider's recent sell, shares of Carter's Inc were trading for $69.96 apiece, giving the stock a market cap of $2.589 billion. The price-earnings ratio stands at 12.83, which is lower than both the industry median of 16.43 and the companys historical median price-earnings ratio. This suggests that the stock is currently undervalued.

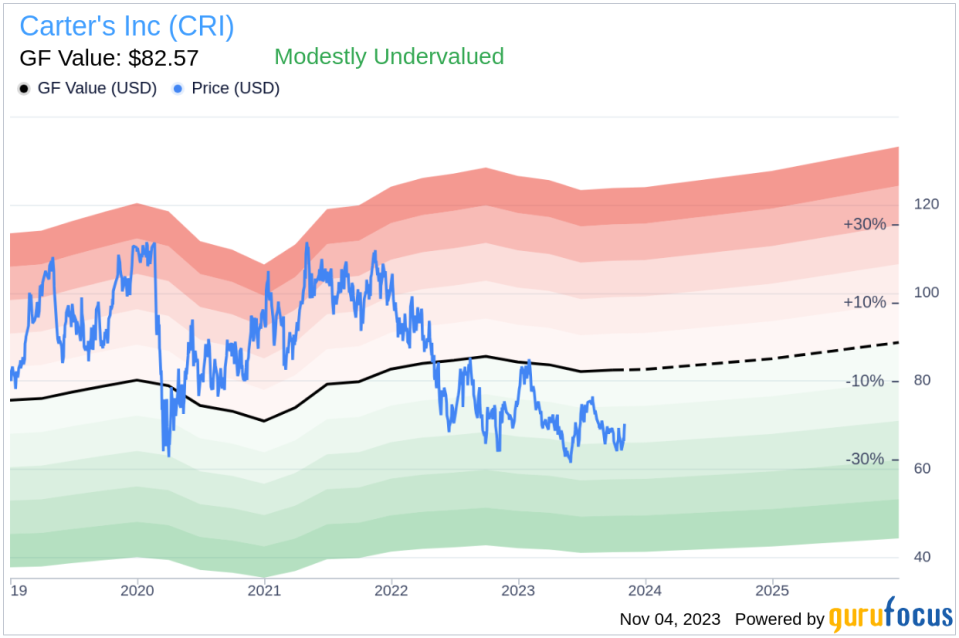

The GF Value of Carter's Inc is $82.57, resulting in a price-to-GF-Value ratio of 0.85. This indicates that the stock is modestly undervalued.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent sell by the insider could be a signal for investors to reassess their positions in Carter's Inc. Despite the stock being undervalued according to its GF Value, the lack of insider buys over the past year could be a cause for concern. Investors should keep a close eye on the insider trends and the company's performance in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.