Insider Sell: Kenneth Moelis Unloads Shares of Moelis & Co

In a notable move within the financial sector, Kenneth Moelis, the Chairman, CEO, and 10% Owner of Moelis & Co (NYSE:MC), has sold a significant number of shares in the company. On November 13, 2023, the insider executed a sale of 93,063 shares, a transaction that has caught the attention of investors and market analysts alike.

Who is Kenneth Moelis?

Kenneth Moelis is a prominent figure in the investment banking industry, having founded Moelis & Company in 2007. With a storied career that includes a tenure at UBS where he served as President of UBS Investment Bank, Moelis has established himself as a leading advisor on corporate finance matters, mergers and acquisitions, and risk management. His expertise and leadership have been instrumental in guiding Moelis & Company to its current position as a respected independent investment bank.

About Moelis & Co

Moelis & Co is a global independent investment bank that offers financial advisory services to a diverse client base, including corporations, governments, and financial sponsors. The company specializes in advising on strategic decisions such as mergers and acquisitions, recapitalizations and restructurings, and other corporate finance matters. With a team of experienced bankers, Moelis & Co prides itself on its entrepreneurial approach and its ability to deliver conflict-free advice to its clients.

Analysis of Insider Buy/Sell and Stock Price Relationship

The recent sale by Kenneth Moelis is part of a broader pattern of insider transactions at Moelis & Co. Over the past year, the insider has sold a total of 525,167 shares and has not made any purchases. This one-sided activity raises questions about the insider's confidence in the company's future prospects.

The insider trend image above reflects the absence of insider buys over the past year, juxtaposed against 16 insider sells within the same timeframe. This trend can sometimes indicate that insiders might believe the stock is fully valued or potentially overvalued, prompting them to lock in gains or reallocate their investments.

Valuation and Market Reaction

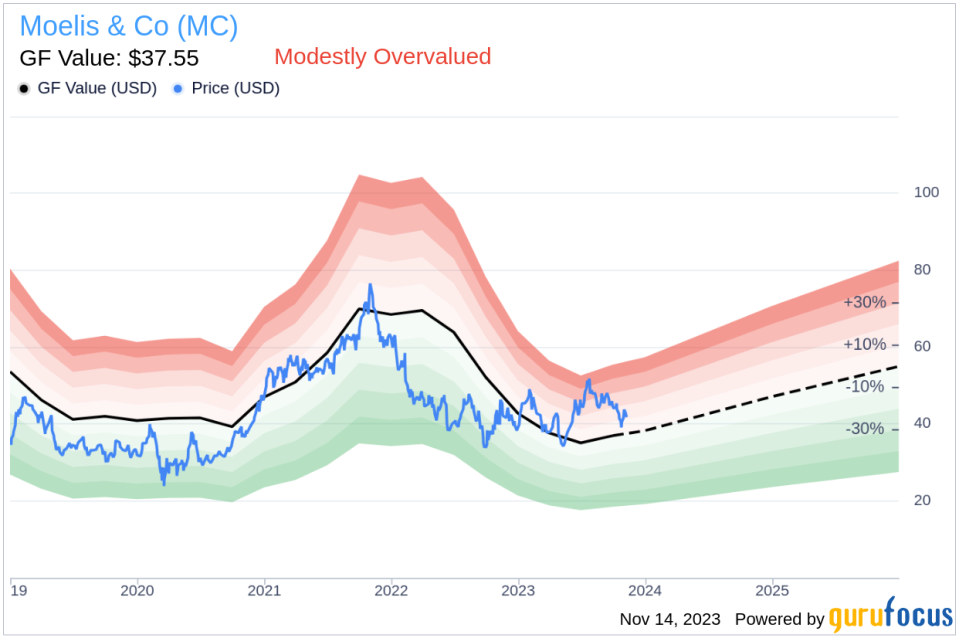

On the day of the insider's recent sale, shares of Moelis & Co were trading at $41.75, giving the company a market capitalization of $2.77 billion. This valuation places the stock's price-earnings ratio at an astonishingly high 9999.00, far exceeding the industry median of 18.48 and the company's historical median. Such a high price-earnings ratio could suggest that the stock is significantly overvalued, or it may be a result of an anomaly in reported earnings.With a price of $41.75 and a GuruFocus Value of $37.55, Moelis & Co has a price-to-GF-Value ratio of 1.11, indicating that the stock is modestly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio suggests that the market is pricing Moelis & Co shares above what might be considered a fair value, supporting the notion that the insider's decision to sell could be financially prudent.

Conclusion

The sale of shares by Kenneth Moelis is a significant event that warrants attention from current and potential investors. While insider selling is not always indicative of a company's health or future performance, the consistent pattern of sales and the absence of purchases by insiders at Moelis & Co may suggest a cautious outlook from those with intimate knowledge of the company. Additionally, the high price-earnings ratio and the modest overvaluation based on the GF Value could be seen as red flags for investors looking for value opportunities.Investors should consider these factors in the context of their investment strategy and risk tolerance. It is also important to look at the broader market conditions and the company's fundamentals before making any investment decisions. As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.