Insider Sell: Keysight Technologies Inc's CEO Satish Dhanasekaran Unloads Shares

Keysight Technologies Inc (NYSE:KEYS), a leading technology company that delivers advanced design and validation solutions to help accelerate innovation to connect and secure the world, has recently witnessed a significant insider sell by its President and CEO, Satish Dhanasekaran. On November 27, 2023, the insider sold 7,275 shares of the company, a move that has caught the attention of investors and market analysts alike.

Who is Satish Dhanasekaran?

Satish Dhanasekaran is the President and CEO of Keysight Technologies Inc. He has been with the company for several years and has played a pivotal role in steering the company towards its current market position. Under his leadership, Keysight has continued to innovate and expand its product offerings, catering to a wide range of industries including communications, aerospace, defense, and semiconductor markets.

Keysight Technologies Inc's Business Description

Keysight Technologies Inc is a global company that operates in the electronic measurement industry. It provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries. The company's products are integral to the development and testing of the latest electronic products and systems. Its solutions go beyond measurement to provide simulation, automation, and analysis, which are critical for the design and optimization of high-performance and innovative products.

Analysis of Insider Buy/Sell and Relationship with Stock Price

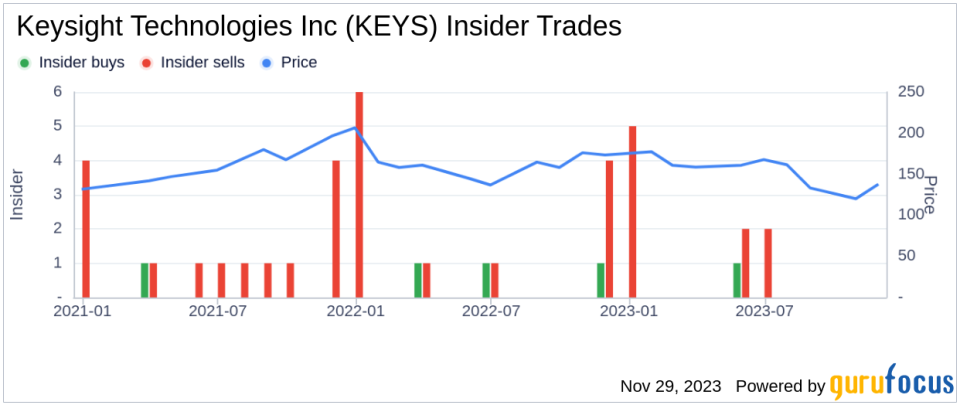

Insider transactions can provide valuable insights into a company's health and future prospects. Over the past year, Satish Dhanasekaran has sold a total of 15,661 shares and has not made any purchases. This pattern of selling without corresponding buys could signal a lack of confidence in the company's future prospects or simply a personal financial decision by the insider.

However, it is important to consider the broader context of insider transactions at Keysight Technologies Inc. Over the same period, there has been only 1 insider buy compared to 11 insider sells. This trend suggests that insiders, on the whole, are choosing to decrease their holdings in the company.

On the day of Dhanasekarans recent sell, shares of Keysight Technologies Inc were trading at $134.9, giving the company a market cap of $24.48 billion. The price-earnings ratio stood at 21.89, slightly lower than the industry median of 22.4 and also lower than the companys historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its peers and its own historical valuation.

When analyzing the impact of insider sells on the stock price, it's crucial to consider the volume of shares sold and the overall market conditions. A large sell-off by an insider could potentially lead to a decrease in stock price if the market perceives it as a lack of confidence. However, if the market cap of the company is large and the volume of shares sold by insiders is relatively small, the impact on the stock price may be minimal.

The insider trend image above provides a visual representation of the buying and selling patterns of insiders at Keysight Technologies Inc. The predominance of sells over buys could be a point of concern for potential investors.

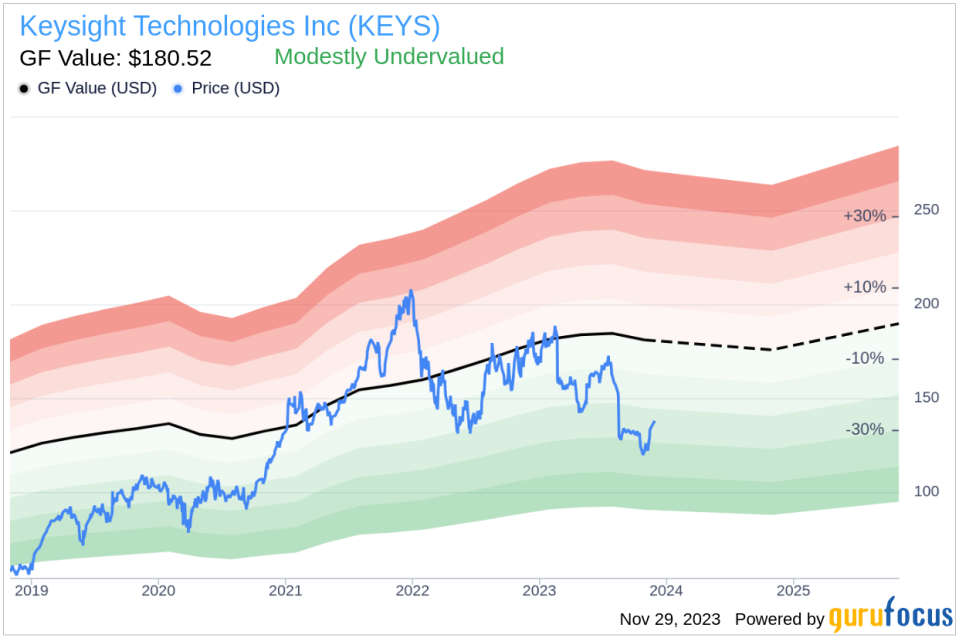

Valuation and GF Value

With a current price of $134.9 and a GuruFocus Value (GF Value) of $180.52, Keysight Technologies Inc has a price-to-GF-Value ratio of 0.75. This suggests that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The GF Value image above illustrates the stock's current valuation in relation to its estimated intrinsic value. The modest undervaluation could present an attractive entry point for investors who believe in the company's fundamentals and long-term growth prospects.

Conclusion

The recent insider sell by President and CEO Satish Dhanasekaran of Keysight Technologies Inc is a development that warrants attention. While insider sells can be influenced by various factors, the consistent pattern of insider selling at the company over the past year could be indicative of a cautious or bearish outlook by those closest to the company's operations.

However, the valuation metrics suggest that Keysight Technologies Inc may be undervalued at its current price, potentially offering a favorable opportunity for investors. As always, it is essential for investors to conduct their own due diligence and consider the broader market context when interpreting insider transactions and making investment decisions.

Investors should keep an eye on future insider transactions and other fundamental indicators to gauge the direction of Keysight Technologies Inc and to make informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.