Insider Sell: Kforce Inc's COO David Kelly Sells 5,000 Shares

David Kelly, the Chief Operating Officer of Kforce Inc (NASDAQ:KFRC), has recently sold 5,000 shares of the company's stock, according to a Form 4 filed with the Securities and Exchange Commission. The transaction took place on December 12, 2023, and has caught the attention of investors and analysts alike, as insider activity can often provide valuable insights into a company's prospects.

Who is David Kelly of Kforce Inc?

David Kelly serves as the Chief Operating Officer of Kforce Inc, a key executive position within the company. His role involves overseeing the day-to-day administrative and operational functions, and his actions and decisions can significantly impact the company's performance and strategic direction. Kelly's insider transactions are closely monitored as they can reflect his confidence in the company's future and its current valuation.

Kforce Inc's Business Description

Kforce Inc is a professional staffing and solutions firm that specializes in the areas of technology and finance & accounting. The company provides its clients with highly skilled professionals well-versed in these fields, catering to the demand for specialized talent in a competitive job market. Kforce operates across various industries, offering both temporary staffing and permanent placement services, which positions it well to capitalize on the evolving workforce dynamics and the increasing reliance on flexible staffing solutions.

Analysis of Insider Buy/Sell and Relationship with Stock Price

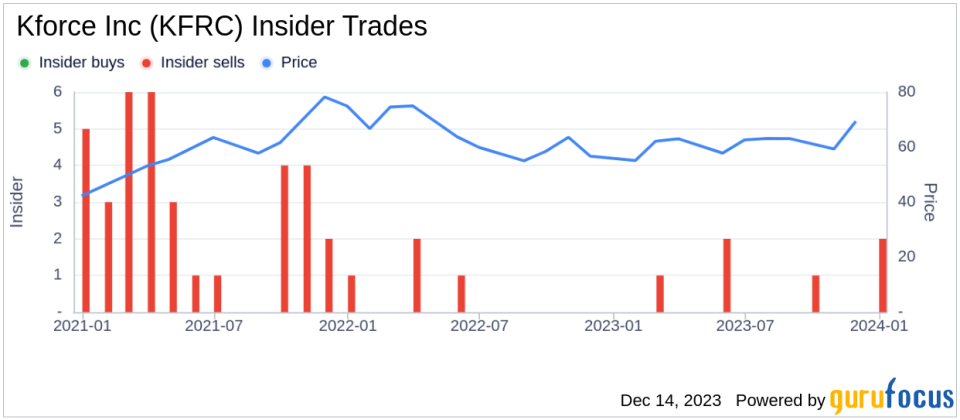

Insider transactions, particularly sales, can be interpreted in various ways. While a sale might indicate that the insider believes the stock is fully valued or overvalued, it could also be motivated by personal financial planning or diversification needs. In the case of David Kelly, the insider has sold 23,800 shares over the past year without purchasing any shares. This pattern of behavior could suggest that the insider sees limited upside potential or that they are taking profits after a period of stock appreciation.

On the day of the recent sale, Kforce Inc's shares were trading at $70, giving the company a market cap of $1.357 billion. This price level reflects a price-earnings ratio of 25.88, which is higher than both the industry median of 17.175 and Kforce Inc's historical median price-earnings ratio. Such a premium could imply that the market has high expectations for the company's future earnings growth.

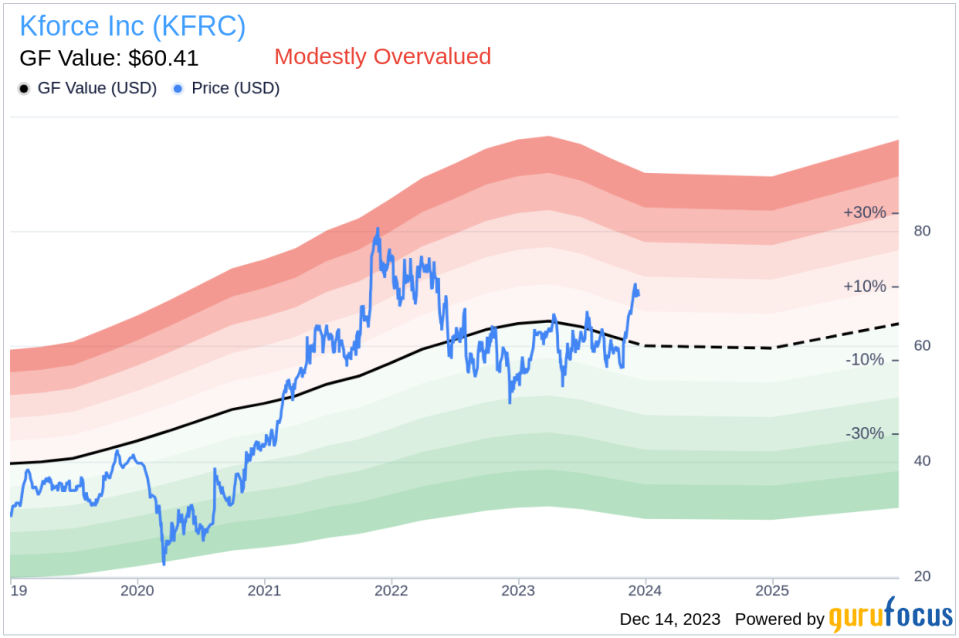

However, when considering the GuruFocus Value, which is calculated at $60.41, Kforce Inc appears to be modestly overvalued with a price-to-GF-Value ratio of 1.16. This suggests that the stock's current price exceeds its estimated intrinsic value, potentially supporting the insider's decision to sell at this time.

The GF Value is determined by considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. This comprehensive approach to valuation provides a benchmark for investors to gauge whether a stock is trading above or below its fair value.

The insider trend image above illustrates the recent history of insider transactions for Kforce Inc. The absence of insider buys over the past year, coupled with a handful of insider sells, may raise questions about the insiders' collective outlook on the stock's valuation and future performance.

The GF Value image provides a visual representation of Kforce Inc's stock price relative to its intrinsic value over time. The current price-to-GF-Value ratio above 1 indicates that the stock is trading at a premium to its GuruFocus-calculated intrinsic value, which could be a factor in the insider's decision to sell shares.

Conclusion

David Kelly's recent sale of 5,000 shares of Kforce Inc may be a signal to investors to reassess the stock's valuation. While insider sales are not always indicative of a stock's future direction, they can provide context, especially when they follow a pattern or occur at valuation levels that suggest the stock is overpriced. With Kforce Inc trading above its GF Value and at a higher price-earnings ratio than the industry median, investors should consider whether the current stock price fully reflects the company's growth prospects or if it has ventured into overvalued territory.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock. Investors should also consider the company's fundamentals, industry trends, and broader market conditions before making investment decisions. Keeping an eye on insider activity, however, can offer valuable insights and serve as an additional tool for those looking to fine-tune their investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.