Insider Sell: Laura Miele Sells 2,000 Shares of Electronic Arts Inc

On November 1, 2023, Laura Miele, the Chief Operating Officer (COO) of Electronic Arts Inc (NASDAQ:EA), sold 2,000 shares of the company. This recent transaction is part of a trend for the insider, who has sold a total of 17,000 shares over the past year and made no purchases.

Electronic Arts Inc is a leading global interactive entertainment software company. The company delivers games, content, and online services for Internet-connected consoles, personal computers, mobile phones, and tablets. It has a market cap of $35.107 billion.

The insider's recent sell comes at a time when the stock is trading at $123.64, giving the company a price-earnings ratio of 40.10. This is higher than the industry median of 19.02 and the companys historical median price-earnings ratio, suggesting that the stock is currently overvalued.

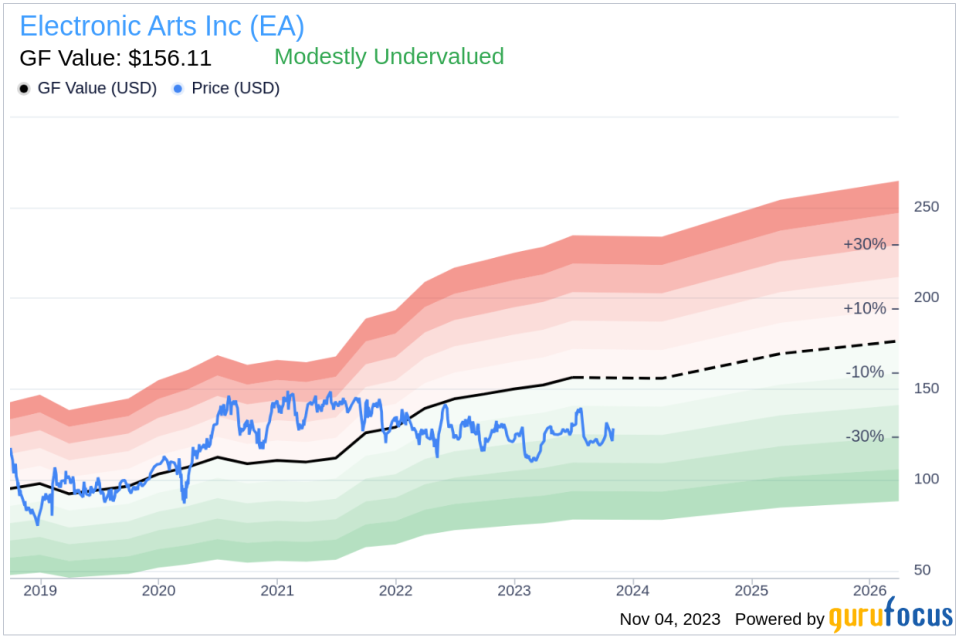

However, the GuruFocus Value of $156.11 indicates that the stock is modestly undervalued. The price-to-GF-Value ratio of 0.79 supports this assessment. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance.

Over the past year, there have been no insider buys at Electronic Arts Inc, while there have been 46 insider sells. This trend could suggest that insiders believe the stock is overvalued at current prices. However, the insider's sell should not be taken as a definitive sign of the company's future performance.

It's important to note that insider sells can occur for a variety of reasons, including personal financial needs or diversification strategies. Therefore, while the insider's sell is noteworthy, it should be considered as part of a broader analysis of the company's financial health and market conditions.

In conclusion, while the insider's recent sell of Electronic Arts Inc shares and the overall trend of insider sells over the past year may raise some concerns, the company's modest undervaluation according to the GF Value suggests potential for future growth. Investors should continue to monitor insider activity as part of their overall assessment of the company.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.