Insider Sell: Michael Arntz Sells 13,538 Shares of Smartsheet Inc

On October 2, 2023, Chief Revenue Officer Michael Arntz sold 13,538 shares of Smartsheet Inc (NYSE:SMAR). This move comes amidst a year where the insider has sold a total of 37,495 shares and purchased none.

Michael Arntz is a key figure at Smartsheet Inc, serving as the Chief Revenue Officer. His role involves overseeing the company's revenue generation strategies and ensuring the company's financial growth. His recent sell-off of shares may raise eyebrows among investors and market watchers.

Smartsheet Inc is a software company that provides a cloud-based platform for work execution, enabling teams and organizations to plan, capture, manage, automate, and report on work at scale. The company's platform, Smartsheet, includes various applications, such as grid, which is a spreadsheet-style application; card for a kanban-style experience; Gantt for project timelines; and calendar for event schedules.

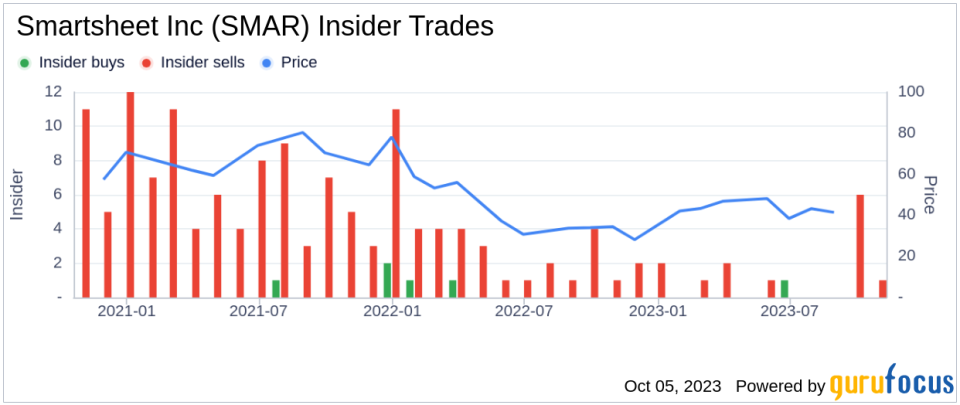

The insider's recent sell-off is part of a broader trend within Smartsheet Inc. Over the past year, there has been only one insider buy compared to 17 insider sells. This trend may suggest a lack of confidence among insiders about the company's future prospects.

Despite the insider's sell-off, Smartsheet Inc's stock price remains robust. On the day of the insider's recent sell, shares of Smartsheet Inc were trading for $40.79 apiece, giving the company a market cap of $5.455 billion.

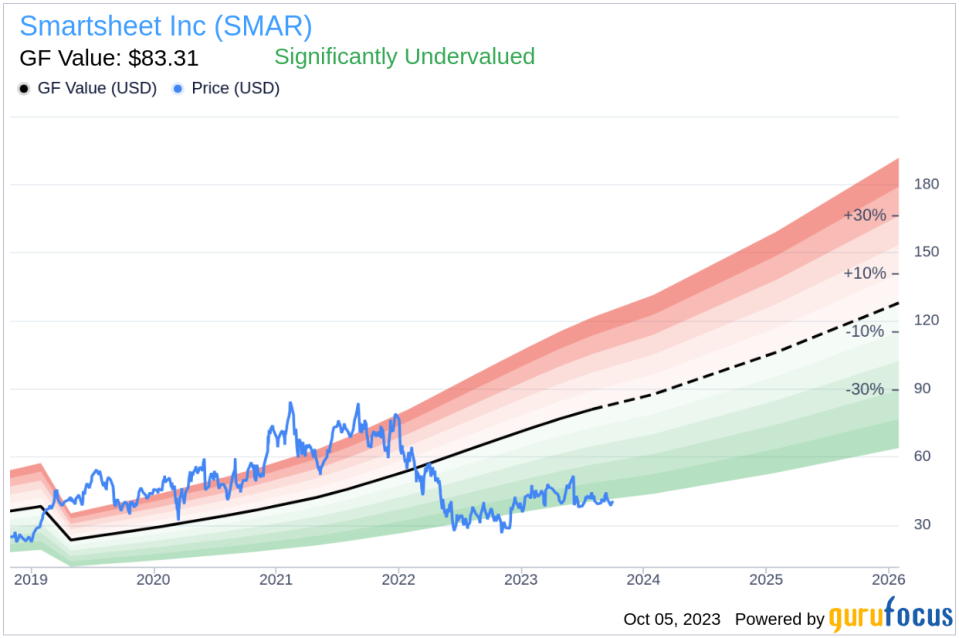

According to GuruFocus Value, Smartsheet Inc is significantly undervalued. With a price of $40.79 and a GuruFocus Value of $83.31, the stock has a price-to-GF-Value ratio of 0.49. This suggests that the stock is undervalued and could be a good buy for investors.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent sell-off may raise concerns, the stock's current valuation suggests that Smartsheet Inc could be a good buy for investors. However, investors should keep an eye on the insider's future transactions and the company's performance to make informed decisions.

This article first appeared on GuruFocus.