Insider Sell: Monster Beverage Corp's President of EMEA Guy Carling Divests 34,553 Shares

In a notable insider transaction, Guy Carling, the President of EMEA for Monster Beverage Corp (NASDAQ:MNST), sold 34,553 shares of the company on December 14, 2023. This move has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Guy Carling of Monster Beverage Corp?

Guy Carling is a seasoned executive with a significant role at Monster Beverage Corp, overseeing the company's operations in the Europe, Middle East, and Africa (EMEA) region. His position puts him in charge of a critical segment of Monster Beverage's international market, which is vital for the company's global expansion strategy and revenue growth. Carling's decisions and actions are closely watched by investors, as they can have a substantial impact on the company's performance in these key markets.

Monster Beverage Corp's Business Description

Monster Beverage Corp is a global leader in the development, marketing, sales, and distribution of energy drink beverages and concentrates. Known for its flagship Monster Energy brand, the company has successfully expanded its product portfolio to include a variety of energy drinks, fruit juices, smoothies, iced teas, and other beverages. Monster Beverage Corp has built a strong brand presence and loyal customer base through strategic marketing and sponsorship deals, particularly within the extreme sports and gaming communities.

Analysis of Insider Buy/Sell and Relationship with Stock Price

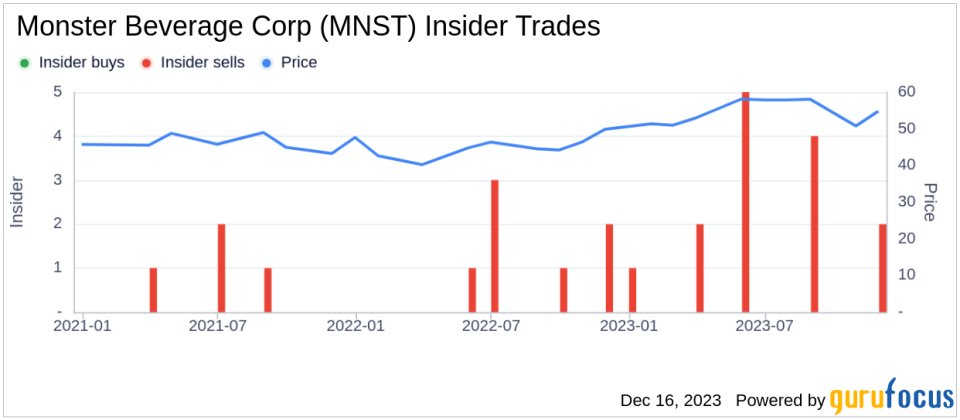

Insider transactions, particularly sales, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company's future prospects, it is also common for insiders to sell shares for personal financial planning or diversification reasons. In the case of Guy Carling, the insider has sold 115,144 shares over the past year without purchasing any shares. This pattern of selling could raise questions among investors about Carling's long-term outlook on the company.

However, it's important to consider the broader context of insider transactions at Monster Beverage Corp. Over the past year, there have been no insider buys and 14 insider sells. This trend suggests that while insiders are taking profits, they are not currently increasing their stakes in the company. This could be due to various reasons, including the stock's valuation or personal financial considerations.

On the day of Carling's recent sale, shares of Monster Beverage Corp were trading at $55.55, giving the company a market cap of $57.317 billion. The stock's price-earnings ratio of 37.10 is higher than both the industry median of 18.055 and the company's historical median, indicating a premium valuation compared to its peers and its own trading history.

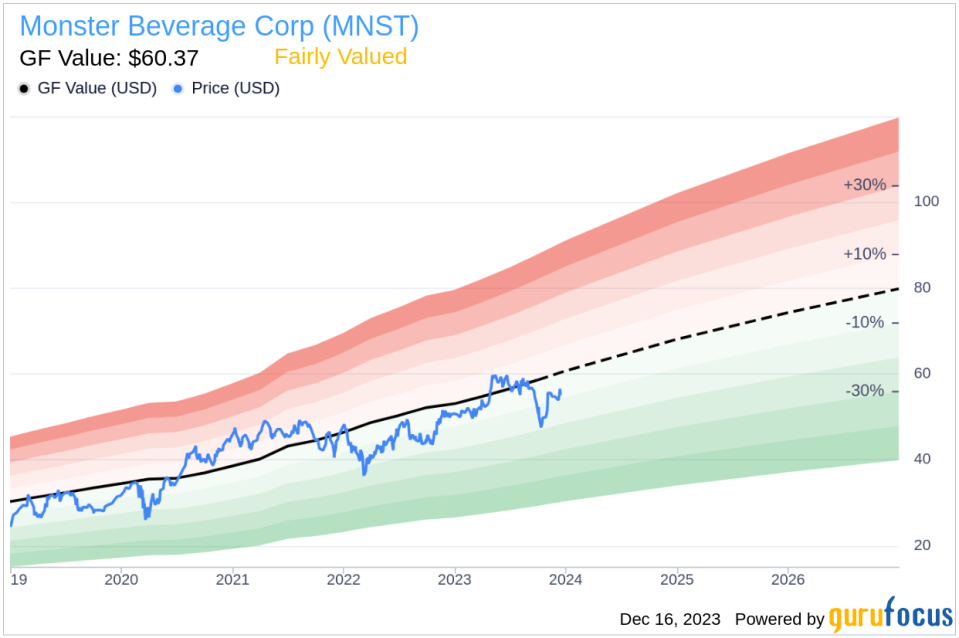

Despite the higher price-earnings ratio, Monster Beverage Corp's stock is considered Fairly Valued with a price-to-GF-Value ratio of 0.92, based on a GF Value of $60.37. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling pattern among Monster Beverage Corp's insiders. This consistent selling could be a signal for investors to monitor the company's performance and future growth prospects closely.

The GF Value image illustrates the stock's valuation in relation to its intrinsic value, suggesting that the current price is in line with what is considered fair value by GuruFocus's proprietary model.

Conclusion

While insider sales can be a red flag for potential investors, it is crucial to analyze these transactions within the broader context of the company's performance and valuation. Guy Carling's recent sale of 34,553 shares does not necessarily indicate a negative outlook for Monster Beverage Corp, especially when considering the stock's fair valuation based on the GF Value. Investors should continue to assess the company's financial health, market position, and growth prospects before making investment decisions. As always, insider trends and valuations are just pieces of the puzzle that should be combined with comprehensive research and analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.